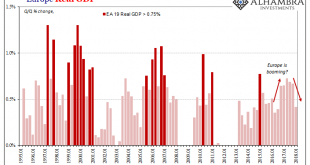

The primary example of globally synchronized growth has been Europe. Nowhere has more hope been attached to shifting fortunes. The Continent, buoyed by the persistence of central bankers like Mario Draghi, has not just accelerated it is actually booming. Or so they say. Last September, politicians were lining up to confidently declare as much, often deploying that specific word. When Jean-Claude Juncker gave his annual...

Read More »Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth

The yield on the 10 year Treasury note briefly surpassed the supposedly important 3% barrier and then….nothing. So, maybe, contrary to all the commentary that placed such importance on that level, it was just another line on a chart and the bond bear market fear mongering told us a lot about the commentators and not a lot about the market or the economy. As I said last month, despite the recent run up in rates, the...

Read More »Transitory’s Japanese Cousin

Thomas Hoenig was President of the Federal Reserve’s Kansas City branch for two decades. He left that post in 2011 to become Vice Chairman of the FDIC. Before that, Mr. Hoenig as a voting member of the FOMC in 2010 cast the lone dissenting vote in each of the eight policy meetings that year (meaning he was against QE2, too). This makes him, apparently, the hawk of all hawks. In January 2011, in his capacity as still...

Read More »Bi-Weekly Economic Review: Interest Rates Make Their Move

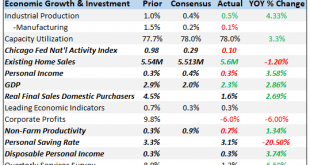

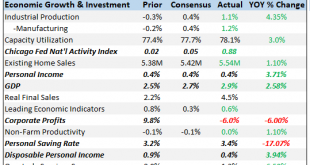

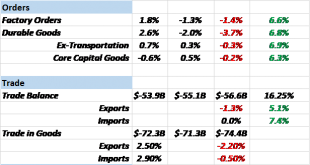

How quickly things change in these markets. In the report two weeks ago, the markets reflected a pretty obvious slowing in the global economy. In the course of two weeks, what seemed obvious has been quickly reversed. The 10-year yield moved up a quick 20 basis points in just a week, a rise in nominal growth expectations that was mostly about inflation fears. The economic news over the last two weeks does not appear to...

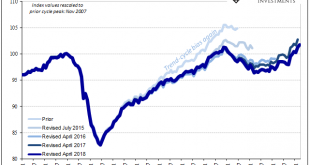

Read More »Why The Last One Still Matters (IP Revisions)

Beginning with its very first issue in May 1915, the Federal Reserve’s Bulletin was the place to find a growing body of statistics on US economic performance. Four years later, monthly data was being put together on the physical volumes of trade. From these, in 1922, the precursor to what we know today as Industrial Production was formed. The index and its components have changed considerably over its near century of...

Read More »Die Normalisierung des Frankens und die Inflation

Der Aussenhandel ist laut IWF nicht verantwortlich für die tiefen Inflationsraten in den entwickelten Ländern: Blick in ein Labor am Actelion-Hauptsitz in Allschwil, Foto: Gaëtan Bally (Keystone) Letzte Woche hat der Euro erstmals seit dem 15. Januar 2015 wieder 1.20 Franken gekostet. Damit endet zumindest vorerst die Phase der starken Überbewertung der Schweizer Währung. Als Grund für die Bekämpfung des zu teuren Frankens mit Negativzinsen und Devisenkäufen hat die Schweizerische...

Read More »The Retail Sales Shortage

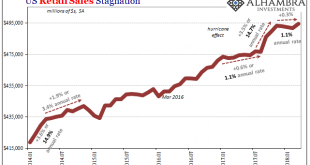

Retail sales rose (seasonally adjusted) in March 2018 for the first time in four months. Related to last year’s big hurricanes and the distortions they produced, retail sales had surged in the three months following their immediate aftermath and now appear to be mean reverting toward what looks like the same weak pre-storm baseline. Exactly how far (or fast) won’t be known until subsequent months. US Retail Sales, Jan...

Read More »Bi-Weekly Economic Review: Investing Is Not A Game of Perfect

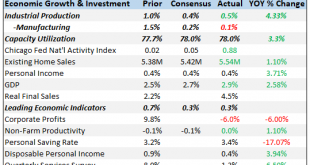

The market volatility this year has been blamed on a lot of factors. The initial selloff was blamed on a hotter than expected wage number in the January employment report that supposedly sparked concerns about inflation – although a similar number this month wasn’t mentioned as a cause of last Friday’s selling. The unwinding of the short volatility trade exacerbated the situation and voila, 12% came off the market in a...

Read More »Three Months Now of After-Harvey Retail Sales; or, The Boom Narrative Goes Boom

If indeed this inflation hysteria has passed, its peak was surely late January. Even the stock market liquidations that showed up at that time were classified under that narrative. The economy was so good, it was bad; the Fed would be forced by rapid economic acceleration to speed themselves up before that acceleration got out of hand in uncontrolled consumer price gains. On February 1, the Atlanta Fed’s GDPNow...

Read More »Bi-Weekly Economic Review: The New Normal Continues

There has been a lot of talk about the economic impact of the recent tax reform. All of it, including the analyses that include lots of fancy math, amounts to nothing more than speculation, usually informed by little more than the political bias of the analyst. I am guilty of that too to some degree but I don’t let my personal political views dictate how I view the economy for purposes of investing. I am, to put it...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org