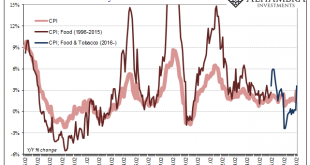

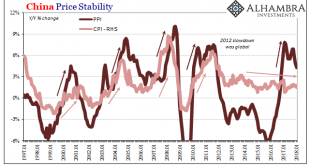

By far, the easiest to answer for today’s inflation/boom trifecta is China’s CPI. At 2.9% in February 2018, that’s the closest it has come to the government’s definition of price stability (3%) since October 2013. That, in the mainstream, demands the description “hot” if not “sizzling” even though it still undershoots. The primary reason behind the seeming acceleration was a more intense move in food prices. Rising...

Read More »China Going Boom

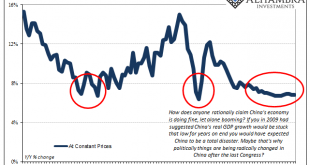

For a very long time, they tried it “our” way. It isn’t working out so well for them any longer, so in one sense you can’t blame them for seeking answers elsewhere. It was a good run while it lasted. The big problem is that what “it” was wasn’t ever our way. Not really. The Chinese for decades followed not a free market paradigm but an orthodox Economics one. This is no trivial difference, as the latter is far more...

Read More »Bi-Weekly Economic Review: One Down, Three To Go

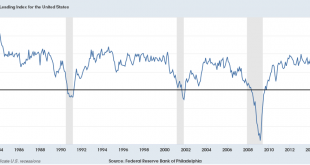

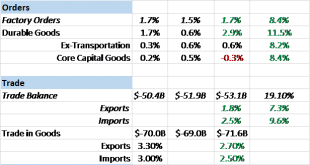

Economic Reports Economic Growth & Investment We pay particular attention to broad based indicators of growth. The Chicago Fed National Activity Index and the Conference Board’s Leading Economic Indicators are examples. We watch them because we are mostly interested in identifying inflection points in the broad economy and aren’t as interested in the details. Why? Because, while bear markets do happen outside of...

Read More »China: Inflation? Not Even Reflation

The conventional interpretation of “reflation” in the second half of 2016 was that it was simply the opening act, the first step in the long-awaiting global recovery. That is what reflation technically means as distinct from recovery; something falls off, and to get back on track first there has to be acceleration to make up that lost difference. There was, to me anyway, a lot of Japan in it, even still if “globally...

Read More »Ein giftiger Cocktail für die Börsen

Unter Investoren herrscht Nervosität, die Stimmung bleibt fragil. Foto: iStock Der Schock hat gesessen. Seit Ende Januar haben die Aktienmärkte – gemessen am US-Leitindex S&P 500 – zeitweise mehr als 10 Prozent verloren und sind damit offiziell in eine Korrektur gefallen. Seither herrscht unter Investoren Nervosität. Die Börsen haben sich etwas erholt, doch die Stimmung bleibt fragil. Fondsmanager, die noch vor wenigen Wochen überaus optimistisch waren, sind in Deckung gegangen, wie...

Read More »Bi-Weekly Economic Review

Economic Reports Economic Growth & Income Personal income for December was better than expected at up 0.4% on the month and 4.11% year over year. Wages and salaries were up 0.5%. Unfortunately, that rate of rise is not even up to the lower end of the range we’ve seen in past expansions when 5% income growth was a precursor to recession. Still, it is, sadly, about average for this expansion. Two items in this...

Read More »Die Schweiz und die Inflation

Luzern, 30. Januar 1974: Der deutsche Oppositionspolitiker Franz Josef Strauss (CSU) fordert im voll besetzten Kunstsaal harte Massnahmen gegen die Inflation. Foto: Keystone Seit die Weltwirtschaft brummt, spricht man wieder von Inflation. Es ist jedoch unwahrscheinlich, dass es bald zu einer eigentlichen Inflationsphase kommen wird. Ein historischer Rückblick auf die Geschichte der Inflation in der Schweiz zeigt dies klar. Die erste Inflationsperiode fand im Ersten Weltkrieg (1914–1918)...

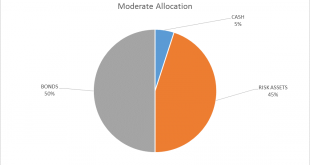

Read More »Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in...

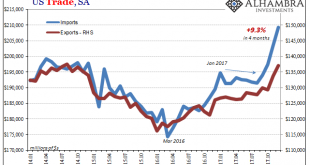

Read More »US Imports: A Little Inflation For Yellen, A Little More Bastiat

US imports rocketed higher once again in December, according to just-released estimates from the Census Bureau. Since August 2017, the US economy has been adding foreign goods at an impressive pace. Year-over-year (SA), imports are up just 10.4% (only 9% unadjusted) but 9.3% was in just those last four months. For most of 2017, imports were flat and even lower. The question is, obviously, what has changed? Did the boom...

Read More »The Historical Warnings of Money

It’s interesting, to me anyway, that an image of the Roman goddess Juno remains to this day on the logo of the Bank of England. There are many stories about her role as it relates to money, but what cannot be denied is that the very word itself came to us from her temple. The Latin moneta was derived from the word monere, a verb meaning to warn. Moneta was Juno’s surname. One fable has it where the goddess’s sacred...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org