The primary example of globally synchronized growth has been Europe. Nowhere has more hope been attached to shifting fortunes. The Continent, buoyed by the persistence of central bankers like Mario Draghi, has not just accelerated it is actually booming. Or so they say. Last September, politicians were lining up to confidently declare as much, often deploying that specific word. When Jean-Claude Juncker gave his annual state of the union speech on Wednesday [September 13, 2017] last week, Europe’s booming economy was near the top of his list. Ten years since the crisis struck, “Europe’s economy is finally bouncing back,” the European commission president told MEPs. Detailing the economic resurgence, but also

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, bank reserves, boom, currencies, ECB, economy, Europe, Eurozone Gross Domestic Product, Featured, Federal Reserve/Monetary Policy, GDP, HICP, inflation, inflation hysteria, Jean-Claude Juncker, lsap, Mario Draghi, Markets, Money, newsletter, QE, real GDP

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The primary example of globally synchronized growth has been Europe. Nowhere has more hope been attached to shifting fortunes. The Continent, buoyed by the persistence of central bankers like Mario Draghi, has not just accelerated it is actually booming. Or so they say.

Last September, politicians were lining up to confidently declare as much, often deploying that specific word.

When Jean-Claude Juncker gave his annual state of the union speech on Wednesday [September 13, 2017] last week, Europe’s booming economy was near the top of his list. Ten years since the crisis struck, “Europe’s economy is finally bouncing back,” the European commission president told MEPs. Detailing the economic resurgence, but also referring to the EU’s newfound unity after Britain’s vote to leave, Juncker declared: “the wind is back in Europe’s sails”.

| A huge part of inflation hysteria was the aftermath of hurricanes Harvey and Irma boosting economic stats in the US, but even more than that it could be traced to these kinds of glowing assessments about the European economy. After all, more than any other place in the world (outside of, of course, Japan) Europe has for a very, very long time represented the true dark side. It’s tendency toward continued weakness was more pronounced than anywhere else.

Therefore, to finally break out would really mean something. If it was true. |

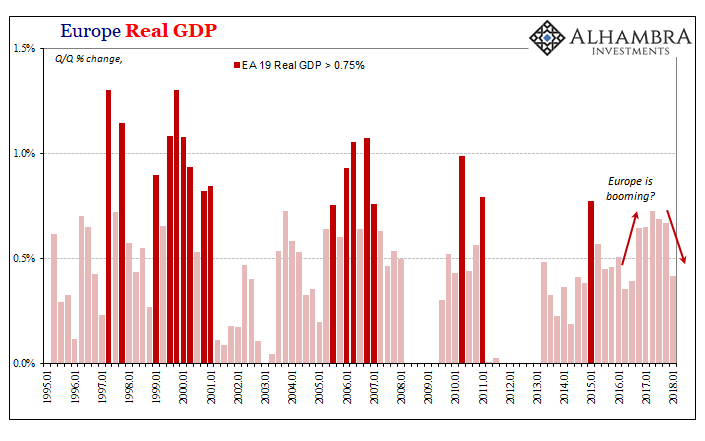

Europe Real Gross Domestic Product, Jan 1995 - May 2018(see more posts on Eurozone Gross Domestic Product, ) |

| Even at that apparent apex last year, Real GDP never really did manage all that much acceleration. Quarterly growth didn’t once break above 0.75% (Q/Q quarterly rather than annual rate), a rate that used to be common. It was more the promise of acceleration, the extrapolation of 2017’s small increase into something better that tempted the hysteria. |

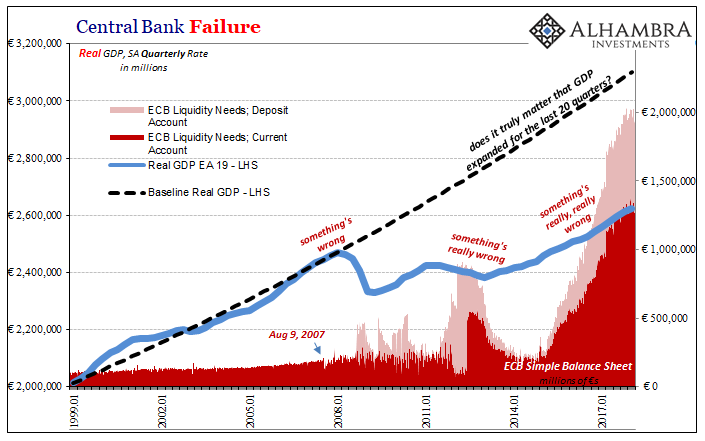

Central Bank Failure, Jan 1999 - May 2018 |

| Q4 2017 GDP disappointed when it didn’t do that, and then last week Eurostat reported Real GDP only gained a paltry 0.42% in Q1 2018. It was more like the bad days of the last downturn and nothing like Juncker’s bravado, a gut punch to markets perhaps growing a little too fond of the confidence.

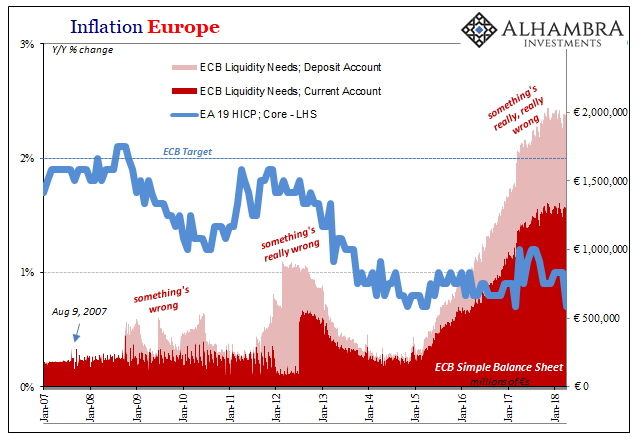

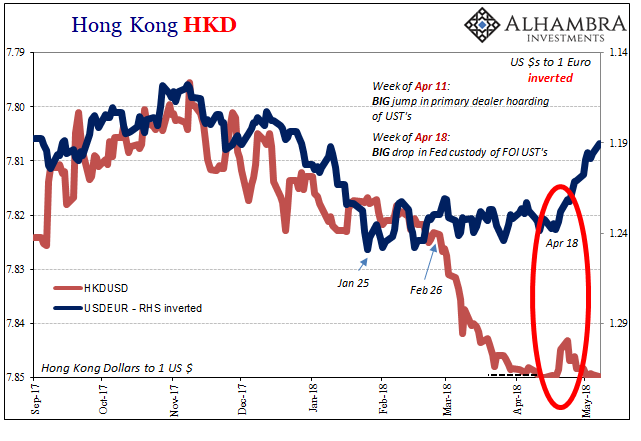

Is it any wonder, then, that the euro has started to turn so decisively? Where the promise of globally synchronized growth was perhaps the most realistic (which still wasn’t all that much), the disappointment of 2018 can’t be overstated in analyzing risk perceptions where they matter most – balance sheet capacity. The bad economic news was compounded by a further deceleration of inflation. The HICP rate for the EA was just 1.2% year-over-year in April 2018. More concerning for Mario Draghi, the so-called core rate, which removes food, energy, tobacco, and alcohol prices, collapsed. Partially due to some base effects, it tied a record low last month. |

Inflation Europe, Jan 2007 - May 2018 |

The GDP and HICP data are largely complimentary, meaning that they confirm the continued weak state of Europe’s economy no matter what politicians might say otherwise. Acceleration is not now indicated in any part. Mario Draghi’s prior comments are proving a critical distinction:

His statement was, importantly, a blatant contradiction. For markets, they were apparently willing to overlook it in the promise that maybe the first part would come true despite the second part. As more time passes, however, the second part stands out as to what is really going on – they have no idea what they are doing and have no good idea what the economy will do as a consequence. This time was supposed to be different, except more and more it looks like it really isn’t. The hysteria starts to dissolve as it always does, leaving behind repercussions played out in risk perceptions. |

Hong Kong HKD, Sep 2017 - May 2018 |

On January 27, just before the first wave of liquidations struck, The New York Times perhaps rang the bell for the top if not in markets than at least in terms of the absurdity of the narrative.

A decade after the world descended into a devastating economic crisis, a key marker of revival has finally been achieved. Every major economy on earth is expanding at once, a synchronous wave of growth that is creating jobs, lifting fortunes and tempering fears of popular discontent.

It instead only fits the convention that asserts time is dispositive. At some point, no matter what ugliness, an economy will just grow. If it’s not in recession, it can never be held from a boom. The longer it goes without, they believe, the more likely it has to happen.

Time is definitive on this matter, alright, just not in that way. The longer we go without actual growth, the more it is proved that economies can be held in some other worse state maybe permanently. Growth should be a given as everyone believes, but if it’s not then we have to actually determine what it is that is holding everything back (orthodox guessing doesn’t help). Frustratingly, the answers are all over the charts I posted above. Nobody is willing to see it because of the bedazzlement of QE and the slick presentations of Draghi. Doesn’t matter he admits he has no idea, he sounds good.

Europe is booming, except it’s not and increasingly it appears as if it never will; at least until something more than the mainstream mood changes. As if we needed more empirical proof, bank reserves don’t matter one bit. When the world finally understands that crucial distinction, then, maybe, we’ve got something.

Tags: bank reserves,boom,currencies,ECB,economy,Europe,Eurozone Gross Domestic Product,Featured,Federal Reserve/Monetary Policy,GDP,hicp,inflation,inflation hysteria,Jean-Claude Juncker,lsap,Mario Draghi,Markets,money,newsletter,QE,real GDP