The basic idea behind the Quantity Theory of Money could be stated as: too much money supply is chasing too little goods supply, so prices rise. We have debunked this from several angles. For example, we can use a technique that every first year student in physics is expected to know. Dimensional analysis looks at the units on both sides of an equation. Money supply is a quantity, a stocks, i.e. dollars or tons in the gold standard. Goods supply is a quantity per year, a flows, i.e. tons / year. You cannot compare tons to tons / year. The attempt is meaningless. We have noted that if a bank sells a Treasury bond, it is not going to spend the cash on a big bender in Vegas. And we discussed the fact that a dollar is not consumed in the transaction, unlike the

Topics:

Keith Weiner considers the following as important: 6a.) Keith Weiner on Monetary Metals, 6a) Gold & Bitcoin, Basic Reports, falling interest, falling rates, Featured, inflation, Interest Rate, newsletter, rising interest, rising rates

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The basic idea behind the Quantity Theory of Money could be stated as: too much money supply is chasing too little goods supply, so prices rise. We have debunked this from several angles. For example, we can use a technique that every first year student in physics is expected to know. Dimensional analysis looks at the units on both sides of an equation.

Money supply is a quantity, a stocks, i.e. dollars or tons in the gold standard. Goods supply is a quantity per year, a flows, i.e. tons / year. You cannot compare tons to tons / year. The attempt is meaningless.

We have noted that if a bank sells a Treasury bond, it is not going to spend the cash on a big bender in Vegas. And we discussed the fact that a dollar is not consumed in the transaction, unlike the hamburger for which it is exchanged. At any given quantity of dollars, that dollar which bought the burger could be used again and again, at an accelerating pace, to buy more and more goods, driving prices up to infinity. We would add that when a burger—or anything—is bought, we cannot just assume that the price will go up. We need to know if the buyer took the seller’s offer price, or if the seller took the buyer’s bid price.

The Meaning, Nature, and Consequences of Leverage

Today, we want to look at the quantity of dollars in a different way. We would like to show in clearer concepts, why rising quantity does not necessarily mean rising prices. We will begin by stating our thesis.

An increase in the quantity of dollars is an increase in leverage.

In an irredeemable currency, an increase in debt goes along with an increase in the quantity of what people miscall money. The relationship is not one-to-one, and is affected by many variables including reserves required by regulation. But there is a positive correlation—and a causal relationship.

This tells us exactly nothing about what will happen to prices. If businesses borrow to increase their rate of buying of commodities and to increase their buffer of work-in-progress in between each stage of the manufacturing process, then prices will rise. Not because the quantity of dollars increased, but because the rate of buying increased to feed commodity hoarding at a faster pace. This describes the economy after WWII through 1981, but especially the 1970’s.

If businesses borrow to increase their capacity to produce, then the prices of their products will fall (though government-mandated useless ingredients might increase at close to a matching rate). This describes the economy since 1981.

Net Present Value

OK, businesses increased their leverage, and hence debt. So what happens next? It depends on the direction of interest rates. To see why, let’s revisit the concept of Net Present Value (NPV). When a business incurs debt, it must make payments. Typically those payments stretch out over years or a decade or more.

Each of those payments has a present value, which is the face value discounted for the amount of time. It is discounted by the market rate of interest. If the interest rate is 10%, then a $500 payment due one year from today, has a present value of $500 less the 10% discount, or $450. NPV is the sum of the present value all future payments.

The higher the interest rate, the lower the NPV. And the lower the interest rate, the higher the NPV. At 0% interest, NPV is just the sum of the face values of the payments (thus, a perpetuity has an infinite NPV).

Rising Interest Rates

So if a business increases its debt and then interest rises, then its burden of debt falls. That’s because once the debt is incurred, the payment does not change but the discount increases. A greater discount on future payments equals a lower present value.

If a business borrowed in the 1970’s, it borrowed to finance a warehouse full of commodities. The NPV of its debt dropped, while the market price of its finished goods was increasing. This business is sitting pretty, breathing easy, cake walking, tricking its hat, doubling its eagle, and generally enjoying every cliché coined to describe when things are going well, and one need not worry or expend too much effort. It was a lazy business environment.

In this case, the business will bid up the price of its raw materials happily, knowing that by the time it brings its products to market, the prices will have risen even further. Cash was trash, and commodities in the warehouse were good as gold (not quite).

Falling Interest Rates

But that is not the world we live in, today. Since 1981, we have had a falling interest rate. Which means a rising NPV of debt. The business debtor does not have a warehouse full of commodities that are going up. It has an asset such as factory or restaurant that produces goods, but it has little pricing power. Prices are soft, and margins are compressing.

It has a tough row to hoe, a hard slog, a Sisyphean task, or use whatever expression you like.

If it can run leaner, reducing its inventory to have on hand the stuff it will need just in the nick of time, it will do so, to free up the cash.

It is reluctantly buying its inputs, always seeking ways to do more with less. It is aggressively selling its finished products, which pushed down the bid price.

In this environment, inventory is crap (sorry) no business wants to carry, much less big buffers of raw materials. This stuff is depreciating, falling, and a burden to finance. Cash is king (though definitely not gold).

The above discussion is not based on quantity analysis. We will have more to say about this, but our method is based on looking at the economy as being many pieces in motion. We seek to understand the dynamics of the system. And we consider multiple different processes, asking which is moving faster than the others, and which is changing its rate more than the others.

Market Report

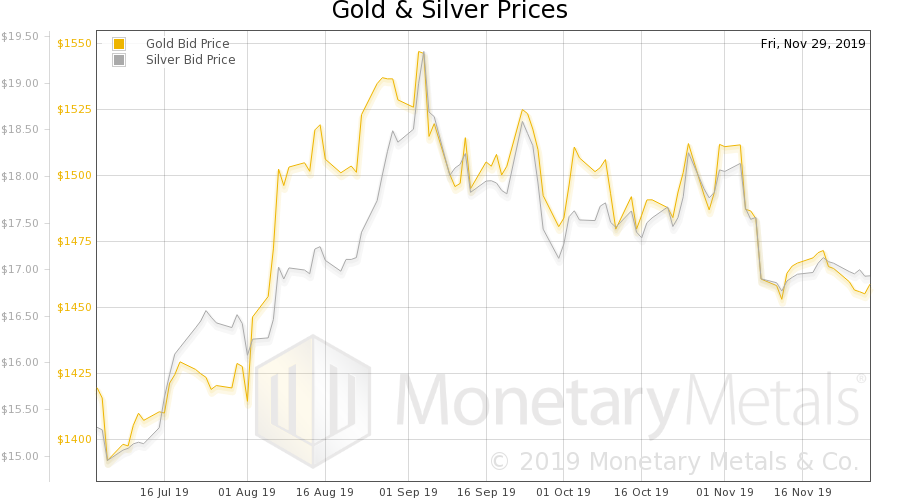

The price of gold was up enough to buy a bottle of Two Buck Chuck wine, and the price of silver was up enough to buy a wooden nickel (well, not enough to buy a real nickel nickel).

Having just seen (OK participated in) a bit of a Twitter storm about the gold price suppression conspiracy theory, we wanted to add a bit more to all the things we have already said (e.g. Keith’s Thoughtful Disagreement with Ted Butler).

We observed a series of arguments made, in which each was quickly abandoned for the next. We think of it as pivoting. The arguer seems not to care which argument is believed, or even if one argument he makes contradicts one he previously made. He’s just looking for whatever works, and will abandon whatever isn’t working at the drop of a tweet.

A prominent gold bug posted a link to the article about Poland asking for 100 tons of its gold to be shipped from London to Warsaw. The article says:

“…central banks usually seek to diversify the places where their gold resources are stored, also in order to limit geopolitical risk, the consequence of which could be, for example, loss of access or limitation of free disposal of gold resources kept abroad.

Due to the significant increase in our gold resources and taking into account the practice of other central banks, the Management Board of the NBP decided to transfer half of the current gold resources (about 100 tonnes) to the treasury of the NBP.”

Despite this statement, the gold bug of course spun it as a “worldwide run on gold vaults.” So Keith retweeted with the added comment:

“A transfer of gold from one storage vault to another is not a ‘run’.”

A run on the bank is when depositors are demanding to withdraw their money. But the bank has only got a limited amount of cash. The rest of its assets are long term, such as bonds. If enough depositors demand withdrawals, the bank will fail to pay and be taken down into receivership and liquidation. If this is happening to multiple banks, then the price of bonds crashes, as they are all desperate to sell bonds to raise cash to meet redemptions.

A warehouse is not a bank. The concept of a run is inapplicable to a gold vaults. Well, let’s just say that saying this sparked a firestorm!

The first argument thrown back was: the gold in the vaults in London is “leveraged”. This appears to mean the Bank of England either lent out Poland’s gold in breach of its contract, and/or that it conducts a fractional reserve banking operation with gold it holds in storage. Other folks helpfully clarified that the gold in London has been fraudulently sold 100 times over, which they can get away with because few people demand to take delivery.

We see here two problems. One, the term leveraged has a very approximate, fuzzy meaning. That is a feature, not a bug. We will get back to that. The other is that these folks casually assert without evidence that there is a simple, obvious, and flagrant fraud occurring. In order for this to be true, thousands of employees, auditors, and regulators would have had to be complicit over decades. And stay silent. We suggest that financial fraud is not like Fight Club.

While we are sure that there are cases of simple fraud, we do not believe that it is endemic in the Western World.

Others attempted to prove that gold is suppressed by posting links to articles about bank traders being caught spoofing. Spoofing is like a kid sneaking a Snickers Bar into his jacket, compared to suppressing the price of gold from its supposed real value of $50,000 to $1,500 for decades being more like a mobster gunning down people eating at Umberto’s. We assume that at the murder trial, the judge would not allow evidence presented that someone stole $0.10 worth of candy.

This is also a case of the Motte and Bailey Fallacy.

Next the argument for naked-shorting on COMEX came out. Answered with the Ted Butler article.

Next someone asserted that the COMEX gold contract is “cash settled.” And therefore, just like GLD, it “absorbs demand” for gold that would otherwise go to gold itself. Aside from being yet another allegation of outright fraud, it’s a frivolous argument. Many buyers cannot buy physical gold for one reason or another. Indeed, we seriously doubt that anyone who wants gold for reasons of either total distrust of the banking system and/or prepping for the end of the world owns GLD in lieu of gold.

In any case, the holder of a COMEX gold future has the right, but not the obligation, to stand for delivery of 100oz gold. But there’s a catch. He needs to have $150,000 in cash in the account. So most do not stand for delivery. But this is no argument for price suppression. And not even a case that the contract is inherently “cash settled.”

Finally, someone argued that suppressing the price of gold props up the dollar. Without debunking this here (we debunked it here), we want to make an observation. Conspiracy theorists always use fuzzy language. They traffic in vague claims. If they clearly denoted a specific allegation, then it would be easy to debunk. So they resort to an obscuring fog.

And that is also why they pivot from one argument to the next. Thus the gold bug tweeted about Poland’s repatriation—as if this would cause the price to rise. They just want arguments for why the price would rise.

One person skipped over the ideas and jumped straight into feelings. “You are a mole”, he blurted, upset because I seemed to be saying that the Polish gold move would not affect the price.

Folks, beware sloppy use of words and concepts, arguments that evolve from one idea to another, and goal-seeking for reasons that the gold price will go up. It’s hazardous to your wealth.

Gold and Silver PricesLet’s look at the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

Gold to Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio went sideways. |

Gold to Silver Ratio(see more posts on gold silver ratio, ) |

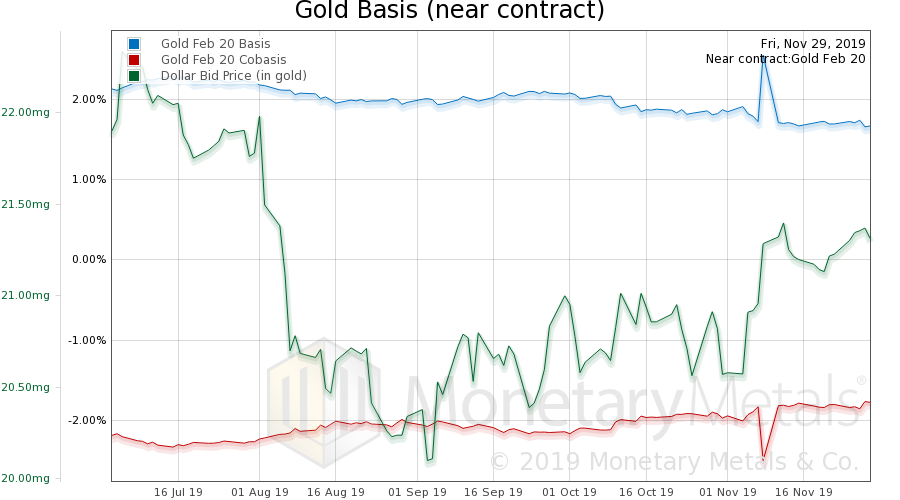

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. Scarcity (i.e. cobasis) rose slightly, while price rose also The Monetary Metals Gold Fundamental Price, was down another $3 this week, to $1, 454 |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

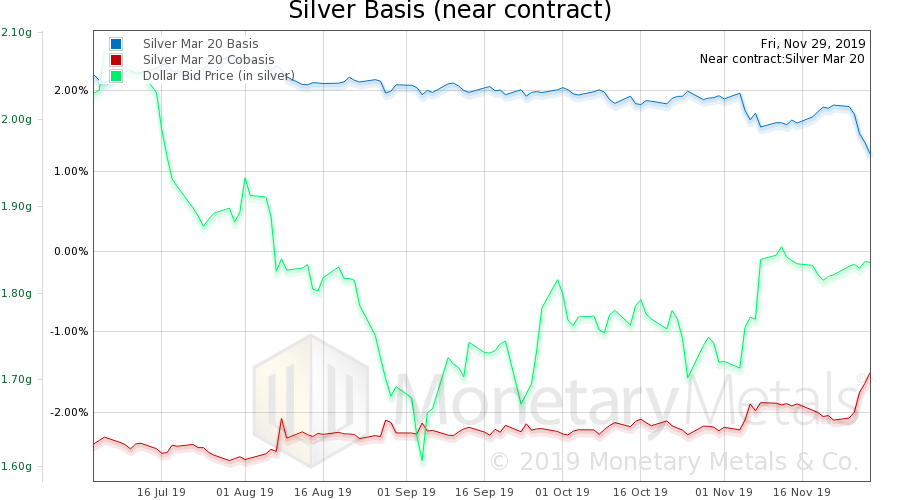

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. In silver, scarcity rose much more sharply than in gold. So it’s no surprise that the Monetary Metals Silver Fundamental Price shot up 58 cents, to $16.71. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2019 Monetary Metals

Tags: Basic Reports,falling interest,falling rates,Featured,inflation,Interest Rate,newsletter,rising interest,rising rates