“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” What the heck did John Maynard Keynes mean by saying this? Overturning the existing basis of society?! Let’s begin by stating something that is both obvious and unpopular. We are living in days that could be called the end of an epoch. The signs are everywhere, and becoming more blatant. Wealth Inequality The Left focuses on wealth inequality, because they see one of the signs. The falling interest rate seemingly benefits those who own assets (it does not actually benefit anyone), particularly

Topics:

Keith Weiner considers the following as important: 6a.) Keith Weiner on Monetary Metals, 6a) Gold & Bitcoin, Basic Reports, capital consumption, dollar price, Featured, gold basis, Gold co-basis, gold price, gold silver ratio, inflation, Keynes, newsletter, seed corn, silver basis, Silver co-basis, silver price, speculation

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

What the heck did John Maynard Keynes mean by saying this? Overturning the existing basis of society?! Let’s begin by stating something that is both obvious and unpopular. We are living in days that could be called the end of an epoch. The signs are everywhere, and becoming more blatant.

Wealth Inequality

The Left focuses on wealth inequality, because they see one of the signs. The falling interest rate seemingly benefits those who own assets (it does not actually benefit anyone), particularly those who finance assets with dirt-cheap credit. And it harms wage-earners, by incentivizing businesses to borrow cheap to buy capital goods to replace labor.

The Right typically denies this plain fact, because they want to head the Left off at the pass. They want to foreclose on the Left’s policy: which is to impose a wealth tax. Newsflash for the Left: if you think wage earners get a bad deal now, wait ‘til you see what it’s like as you strip-mine the capital from the investors and corporations! It takes capital to pay a wage.

Anyways, the Right do not want a wealth tax, so they deny the observation. We are all for the right to keep wealth that one earns by producing and selling something valued by the market. However, increasingly today the rich are profiteering on the Fed’s destructive interest rate trend.

The Party Line vs. Private Parties

We propose a new principle: look at the contrast between how a group behaves when the spotlight is shining and the camera is rolling, vs. when they are just among themselves. Publicly, the Right says that there’s no rising wealth inequality—or if there is then it is a good thing. I have written about when Dick Fisher was asked about the Fed’s wealth effect. Let’s just say he thought it is a jolly good thing.

In such private gatherings, you can see three phases of the phenomenon. One, inevitably someone asserts the exact opposite of the public position. Two, no one seems surprised. Three, no one debates it. It is actually accepted in that group.

In public, the Fishers are giving the party line. No rising wealth inequality under their watches at the Fed. No, of course not. But in that room full of one-percenters…

It is not just the Left who know there is a problem. The broad liberty movement, including even the Tea Party—far more than us few Austrian School economists and the gold community—can see that there is something wrong. They decry the insane monetary policy of the Federal Reserve, and the insane fiscal policy of the government. And many of them are prepping for a possible coming Dark Age.

Inflation

One theory for what Keynes meant is: inflation. He did say “debauch the currency”. Everyone assumes that a rising quantity of dollars will cause a rising price level. And what else could debauch mean?

But that’s not it. And anyways inflation makes a weak argument for change. As we just noted, the one percenters are perfectly happy if consumer prices are rising at 2%, because their assets are rising much faster than that. The wage-earners care only about the relative rate, between how fast their wages are rising and how fast prices are rising. The same for pensioners on a fixed income. And the welfare class cares only that the free food keeps flowing.

People care about rising consumer prices—but not that much. They love to complain, but then they go back to watching the game and drinking their beer.

In our era, we do not have rapidly-rising prices, except in markets that are the most distorted by nonmonetary government interference. Such as health care (though not elective procedures such as Lasik, nor veterinary care).

The general price level is not rising fast enough to “overturn the basis of society”. We defy anyone to assert that it is (other than something is going to break, with the pricing of health care and a university education).

Why Does No One See It?

Finally, we must note that Keynes said “not one man in a million is able to diagnose.” Does that remotely sound like inflation? Everyone understands inflation, and everyone talks about it—even to the point of overstating it. Many people even think that the official consumer price index is a lie, that prices are really rising much faster.

Either Keynes was really stupid, or he thought that the people are really stupid (which would make him really stupid for thinking it).

We don’t think he was stupid. He was an (evil) genius. He did not mean rising prices. We submit for your consideration that he meant something else. Something far more destructive, and far more subtle.

We have quoted Upton Sinclair before:

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

Speculation and Euthanasia

There are two problems with explaining to wealthy people how our monetary system is driving us into the abyss. One, they are trading, and their portfolios are going up in dollar terms and purchasing power. That is, their “salary” depends on them knowing how to operate within this system, but not on identifying its fatal flaw. They substitute speculation for savings and investment—and the system rewards this behavior.

Two, they resent being told that they are participating in a destructive scheme. They may feel that they are being accused of committing evil.

We want to allay this concern right now. The Fed should get all the blame for plunging us into this game, where saving is impossible and people are forced to turn to speculation as a surrogate. We certainly do not blame anyone for trading, speculating, and making capital gains.

Where we draw the line is when people defend speculation as being equivalent to investing, when they normalize it. In investing, one finances new production and one’s profit comes from part of the income earned by that new production. In speculation, one’s profit comes from the next speculator’s capital. They may seem to generate the same outcome, but economically they are opposites.

We understand why people want to see their actions as being good, not just profitable but morally good. In a free market, of course to profit is to do good—there is no other way to profit. We understand why no one wants to hear “sure, you made a buck, but the world is poorer for it.” Or “it’s just a zero-sum game, and your gain is someone else’s loss.”

We can only respond by saying two things. One, it’s true. Deal with it. And two, there is little choice in the endgame of the Fed’s game. That’s how it works.

We don’t expect anyone to forego making a profit if he can. But we do hope that people of good conscience acknowledge what it is. And oppose it.

“Speculation is the process of conversion of one party’s wealth into another’s income, to be spent.” – Keith Weiner

It should be clear why we are nearing the end of an epoch. Prices have been rising for a long time, and could keep rising for an even longer time. But conversion of capital to income, to spend, is like eating the seed corn. That cannot last forever. Sooner or later, you run out. And then real misery begins.

It should be clear that Keynes was right. We think he was a genius (though evil), and one of the smartest guys in the room. He did not mean rising prices will “overturn society.” He meant the falling interest rate, which he said would commit “euthanasia of the rentier”—kill the saver. That is happening now. With each rise in asset prices, the yield drops.

And the primary reason why “not one man in a million is able to diagnose” it is that everyone loves a bull market. They’re too busy getting others’ capital as their income.

Market ReportThe price of gold was all but unchanged, but the price of silver dropped another 46 copper pennies. We came across an article showing pictures of something we have described: sculptures made from parts taken from farm tractors. How much of this is capital destruction, and how much is upcycling parts from tractors that are used up, we will never know. Here is a picture Keith took. |

|

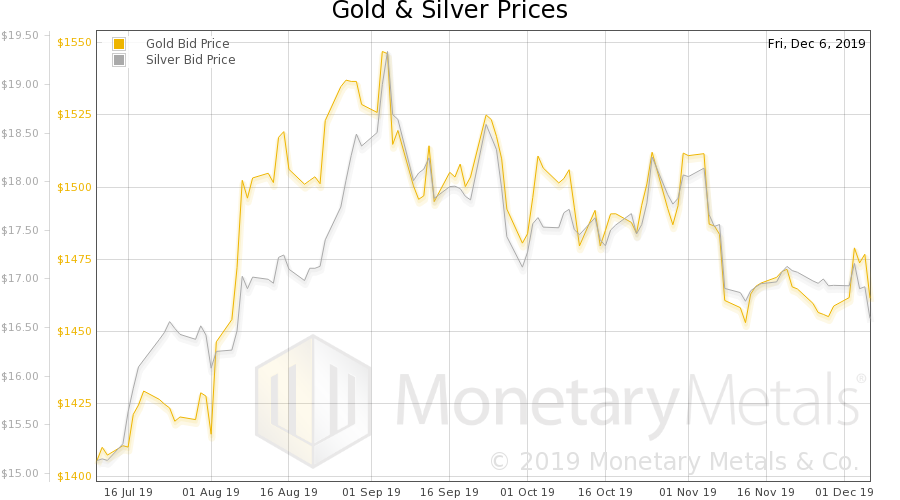

Gold and Silver PricesLet’s look at the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

Gold to Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio went up. |

Gold to Silver Ratio(see more posts on gold silver ratio, ) |

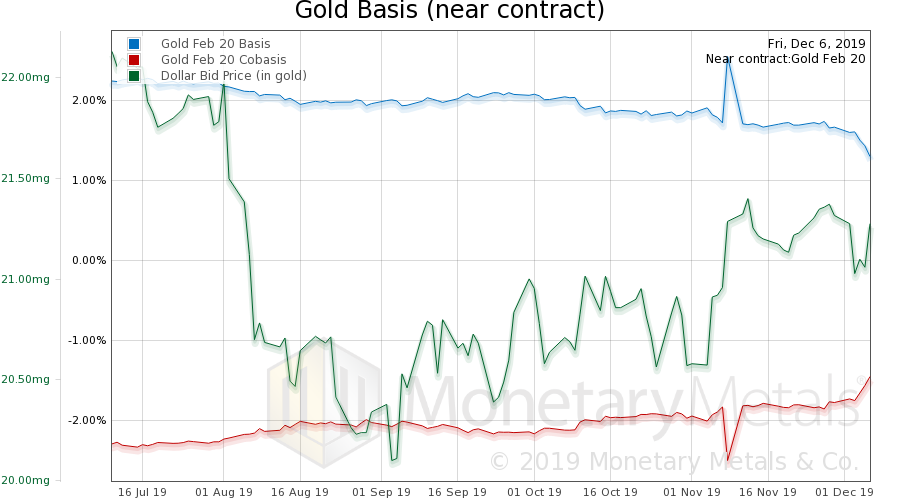

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. There’s that rising scarcity (i.e. cobasis) moving up again. The Monetary Metals Gold Fundamental Price, was up $13 this week, to $1, 467. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

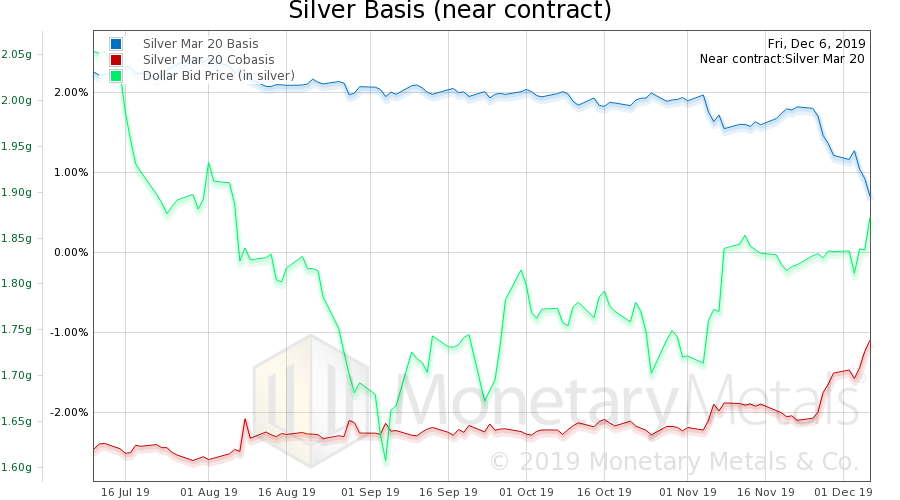

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. We see the same thing in silver. Except, in silver the market price dropped while scarcity increased. The Monetary Metals Silver Fundamental Price stayed level at $16.71. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2019 Monetary Metals

Tags: Basic Reports,capital consumption,dollar price,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,inflation,Keynes,newsletter,seed corn,silver basis,Silver co-basis,silver price,speculation