Swiss Franc The Euro has fallen by 0.13% to 1.0619 EUR/CHF and USD/CHF, February 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is one overriding driver today, and that is the incorporation of CAT scan diagnoses of the virus in Hubei, ground-zero. This follows the arrival of WHO officials into China a couple days ago. Not only have the cases jumped, but so did the number of deaths. It plays on fears that China’s figures are not reliable. But it is not just China. Indonesia is reporting no case, for example, which seems to many observers as incredulous. Investors have responded by taking a little risk off the table. The Shanghai Composite’s seven-day rally came to an end, and most equity markets in

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, Currency Movement, Featured, inflation, Mexico, newsletter, trade, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

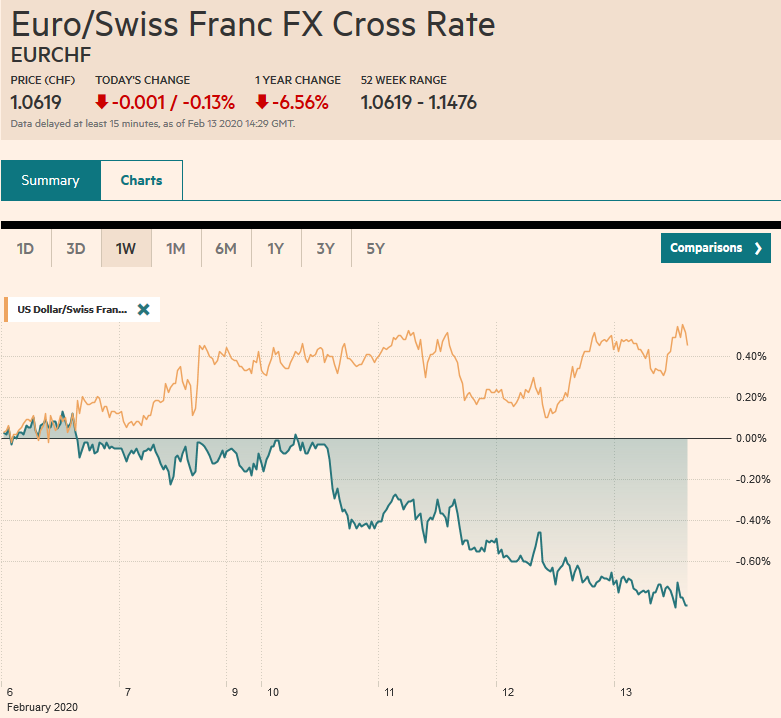

Swiss FrancThe Euro has fallen by 0.13% to 1.0619 |

EUR/CHF and USD/CHF, February 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

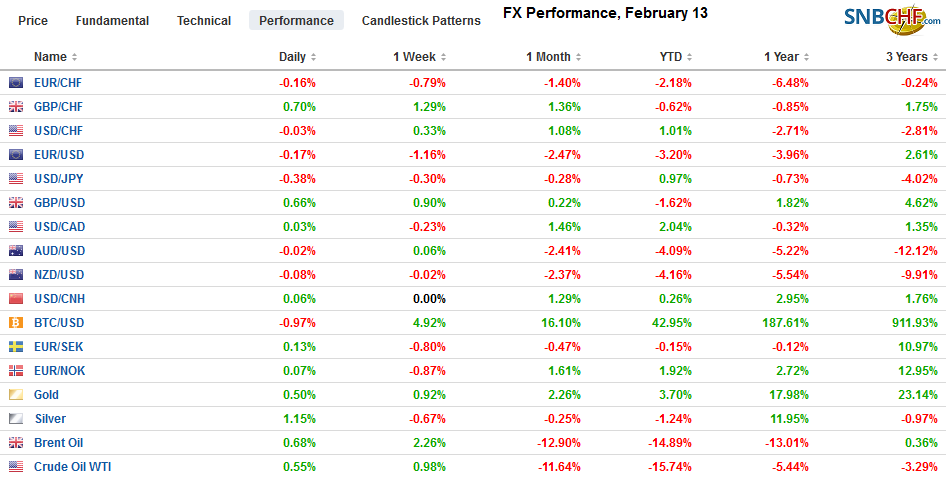

FX RatesOverview: There is one overriding driver today, and that is the incorporation of CAT scan diagnoses of the virus in Hubei, ground-zero. This follows the arrival of WHO officials into China a couple days ago. Not only have the cases jumped, but so did the number of deaths. It plays on fears that China’s figures are not reliable. But it is not just China. Indonesia is reporting no case, for example, which seems to many observers as incredulous. Investors have responded by taking a little risk off the table. The Shanghai Composite’s seven-day rally came to an end, and most equity markets in the region fell. Australia and Taiwan were exceptions. Europe’s Dow Jones Stoxx 600 is ending its three-day advance. It is off by about 0.5% in late morning turnover. US shares are trading lower, and the S&P 500 is poised to give back yesterday, nearly 0.65% gain. Bonds are picking up the safe-haven bid, and yields are 2-5 bp lower, and the US 10-year Treasury yield is back below 1.60%. The dollar is back at the fulcrum, with the dollar bloc and Scandis under pressure, while the other currencies are steady to higher led by the Japanese yen and Swiss franc. The floating, freely accessible emerging market currencies are mostly lower, though the Hungarian forint is a notable exception. Stronger than expected inflation (4.7% vs. 4.0% CPI) has helped the forint stabilize after falling to record lows against the euro yesterday. Gold is about $10 higher, recovering most of the losses seen in recent days. March WTI, which had approached $52 on follow-through buying after the gains in the US yesterday, has reversed and is back below $51. |

FX Performance, February 13 |

Asia Pacific

Hubei apparently did not have enough of the virus testing kits and used CAT scans, but did not include the results into the numbers and earlier today. WHO officials arrived in the country two days ago may have been behind the adjustment. This generated 15k new cases and fatalities nearly doubled. President Xi has replaced the Communist Party heads in Hubei and Wuhan and the Director of Hong Kong and Macau Affairs. The closure of businesses and schools, and the broader economic disruption, will continue into next month and, in some cases, even April. Meanwhile, the death of the young doctor who was first chastised for reporting the virus (Li Wenliang) has spurred a larger movement pushing for free speech. A contradiction has crystallized between the need for objective factual information to prevent contagion and the state’s censorship.

S&P affirmed Australia’s AAA rating with a stable outlook. However, it warned the virus will dampen growth by an estimated 50 bp to 1.7%. The market’s forecasts last month were also for 2.2%, and new surveys are likely to show it too has been shaved.

Once again, the JPY110 area has proved difficult for the greenback to sustain gains above. The dollar has slipped back to almost JPY109.60, to approach the week’s low (seen Monday near JPY109.55). It may take a break of JPY109.40 to indicate the market may be giving up on the JPY110 level for now. The Australian dollar initially sold-off by around 0.5% to approach $0.6700 before recovering to new session highs near $0.6640. An A$1.1 bln option at $0.6710 that expires today may have been defended, and there is another option for A$650 mln at $0.6750 that also rolls off today. The dollar edged higher for a second session against the Chinese yuan. Near CNY6.9830, the greenback remains well below the high above CNY7.0 seen at the start of the week.

Europe

The EU did not change its GDP forecasts for the eurozone. It stands at 1.2% for both this year and next. The median forecast in the Bloomberg survey among private economists is for 1% growth this year and 1.3% in 2021.

As had been tipped, UK Prime Minister Johnson made modest adjustments in the cabinet. The core team remains in place. The Secretary for Northern Ireland, McVey, the housing secretary, and business secretary Leadsom were replaced, as was Villiers, the environment secretary and Morgan, the culture secretary. Cox, the attorney general, and transport minister Freeman are out. It is difficult to out the significance immediately, and the market reaction was minimal.

The euro has steadied after falling through the 2019 lows yesterday but has been unable to resurface above $1.09. It has been confined to about a quarter of a cent above $1.0865. The next chart point on the downside is an old gap from around the French election in April 2017 found between roughly $1.0740 and $1.0825. Sterling found support just below $1.2950 but has not been above $1.30 since last Thursday. The intraday technicals warn that the market may try again. Meanwhile, the Swiss franc continues to rise against the euro. It has risen through the high seen on the UK referendum vote in June 2016 and now is at its highest level since Q3 15. This puts the euro near CHF1.0620. The SNB’s sight deposits will be reported next week and are likely to show that authorities are intervening to slow the franc’s ascent over the apparent objections of the US Treasury. The OECD’s model of PPP has the franc as the most overvalued currency (16.2%) and the euro the most undervalued (-28.5%).

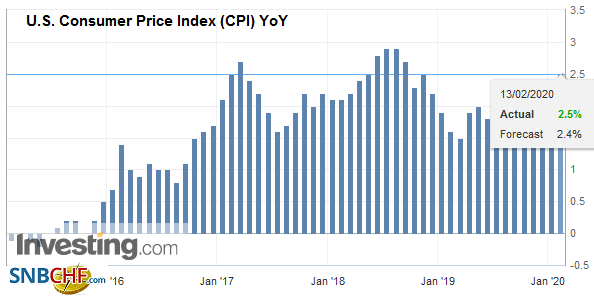

AmericaThere are two highlights from North America today. The US reports January CPI and Mexico’s central bank anticipated to cut its official rate by 25 bp to 7.0%. The headline and core CPI are forecast to rise by 0.2% on the month. Owing to the divergent performance in January 2019, the year-over-year headline rate will likely tick up to 2.5% from 2.3%, while the core rate may slip to 2.2% or maybe even 2.1%, depending rounding. For methodological reasons, the personal consumption deflator, which the Fed targets (though it talks about the core rate), runs lower (~1.6%). Inflation expectations, as measured by the 10-year breakeven (the difference between an inflation-linked note and conventional note yields) has fallen about 10 bp since the end of last year to around 1.67%. The five-year-five-year forward metric is virtually unchanged since the start of the year. |

U.S. Consumer Price Index (CPI) YoY, January 2020(see more posts on U.S. Consumer Price Index, ) Source: investing.com - Click to enlarge |

Mexico offers among the highest real and nominal yields in the investment universe. In this yield-hungry world, it attracts the world’s short-term capital flows and underpins the peso, which continues to be among the strongest currencies in the world. Several other large emerging market countries have brought policy rates to around their inflation levels. Consider Brazil. Its Selic rate stands at 4.15%. January CPI (IPCA) rose almost 4.2% year-over-year. Yesterday’s disappointing December retail sales dragged the real to new all-time lows. If the central bank is on hold, as it has signaled, then the currency may have to bear a greater burden. The cost of the gradual Banxico rate cuts is, arguably, the strengthening of the peso and aggravating the economic weakness.

The 2.4% rally in March light sweet crude oil yesterday, the most since January 3. Most narratives seemed to attribute the bounce to increasing confidence that the virus was near a peak. The rally is all the more impressive because the EIA estimated oil inventories jumped by more than twice the 3.4 mln barrels expected. It was even more than the 6 mln barrel build estimated by the API. The EIA, regarded as the more accurate estimate, was the most in two and a half months. The rally is also impressive given the cut in demand growth by OPEC (slashed this year’s growth in demand by about a quarter or 440k barrels per day in here in the first quarter. It estimated that if the cartel continues to produce the 28.88 million bpd, there would be more nearly 600k bpd in excess. But unlike investors, who appear to be looking for only a short-term impact from the coronavirus, OPEC reduced its projection for 2020 demand growth by 230k bpd to just under a million. That said, demand growth is still projected to be faster than last year. Separately, a reported although there was no official decision, many Russian oil producers were inclined to participate with OPEC in cutting output further in H1 20. and extending existing cuts until the end of the year.

Most critics of the US-China trade agreement argue it did not go far enough. However, many think that proscribed Chinese purchases are not realistic, and it sets the stage for another crisis when the targets are not met. Bloomberg reports that API told Washington policymakers that trying to achieve the $52.4 bln increase in US energy shipments to China by the end of next year would be disruptive. It estimates that China would have to buy an additional 1 mln bpd and 500k bpd of refined products. Plus, China would have to buy about two tankers a week of liquified natural gas. API warned the US does not have the productive capacity and/or shipping infrastructure to deliver without straining the system, which is expressed as higher prices.

The risk is that too much of a good thing is not limited to energy. Some think that that agriculture target is also unrealistic. Bloomberg quotes President Trump from last month’s signing ceremony: “So our people agreed to $20 [billion], and I said, ‘No, make it $50 billion. What difference does it make? Make it $50 billion,” Trump said. “They say, ‘Sir, our farmers can’t produce that much.’ I said, ‘I love our farmers. Let them tell me they can’t do it.’ And I said, ‘Tell them to go out and buy a larger tractor. Buy a little more land.”

The rally in oil prices yesterday may have helped the Canadian dollar recover. Yesterday was the first time this month that the US dollar did not trade above CAD1.33. It fell to about CAD1.3235, a little above this month’s low (~CAD1.3225). However, the risk-off mood and the retreat in oil prices has stemmed the Loonie’s recovery. Look for initial resistance in the CAD1.3280-CAD1.3290 area. The US dollar’s three-day fall against the peso is being tested today. In the first three sessions this week, the dollar slipped by about 0.75% and is giving back about a third of it today. So far, it has held below MXN18.70, but the week’s high, set Monday, was near MXN18.83. A 25 bp rate cut will not significantly alter the carry-trade calculations. A 50 bp cut today that surprises investors may see a quick retreat, but we suspect that given nominal and real rates, even then the carry-trade will remain attractive.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,Currency Movement,Featured,inflation,Mexico,newsletter,Trade