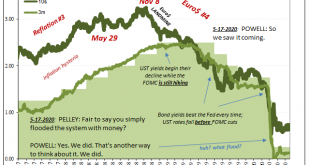

The Federal Reserve has become more aggressive again, after several years of acting docile. As you can see on this chart of the Fed’s balance sheet, it has very rapidly expanded from a baseline from (prior to) 2015 through 2018, of about $4.4 trillion. After which, it had attempted to taper, getting down to $3.8 trillion last summer. Then it was obliged to reverse itself well before responding to the COVID lockdown. Since then, its balance sheet has gone vertical....

Read More »Why The FOMC Just Embraced The Stock Bubble (and anything else remotely sounding inflationary)

The job, as Jay Powell currently sees it, means building up the S&P 500 as sky high as it can go. The FOMC used to pay lip service to valuations, but now everything is different. He’ll signal to all those fund managers by QE raising bank reserves, leading them on in what they all want to believe is “money printing” (that isn’t). This provides the financial services industry with the rationalization those working within it desperately want for them to do what they...

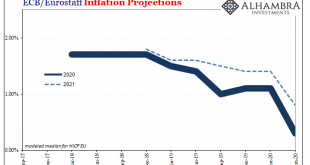

Read More »ECB Doubles Its QE; Or, The More Central Banks Do The Worse You Know It Will Be

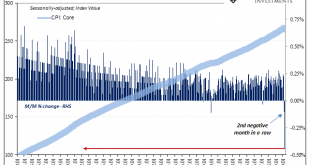

A perpetual motion machine is impossible, but what about a perpetual inflation machine? This is supposed to be the printing press and central banks are, they like to say, putting it to good and heavy use. But never the inflation by which to confirm it. So round and round we go. The printing press necessary to bring about consumer price acceleration, only the lack of consumer price acceleration dictates the need for more of the printing press. It never ends. If you...

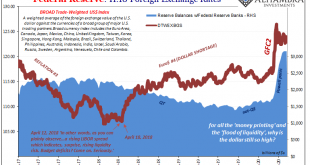

Read More »No Flight To Recognize Shortage

If there’s been one small measure of progress, and a needed one, it has been the mainstream finally pushing commentary into the right category. Back in ’08, during the worst of GFC1 you’d hear it all described as “flight to safety.” That, however, didn’t correctly connote the real nature of what was behind the global economy’s dramatic wreckage. Flight to safety, whether Treasuries or dollars, wasn’t it. Back in March, while “it” was very obvious, even the New...

Read More »Open Letter to Crispin Odey

Crispin Odey I am writing in response to the comments you made in a letter to investors yesterday, which were widely reported. You have set the gold community afire, with claims that are not new and not true. So I shall attempt to douse the flames. As everyone knows, President Roosevelt outlawed the ownership of gold in 1933. Although gold was legalized in 1975, fears linger today that the governments may repeat this heinous act. There is no reason for this fear. In...

Read More »So Much Bond Bull

Count me among the bond vigilantes. On the issue of supply I yield (pun intended) to no one. The US government is the brokest entity humanity has ever conceived – and that was before March 2020. There will be a time, if nothing is done, where this will matter a great deal. That time isn’t today nor is it tomorrow or anytime soon because it’s the demand side which is so confusing and misdirected. Realizing this is true does not cancel your vigilantism. For two years...

Read More »A Big One For The Big “D”

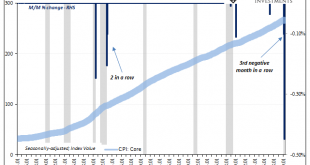

From a monetary policy perspective, smooth is what you are aiming for. What central bankers want in this age of expectations management is for a little bit of steady inflation. Why not zero? Because, they decided, policymakers need some margin of error. Since there is no money in monetary policy, it takes time for oblique “stimulus” signals to feed into the psychology of markets and the economy. Thus, a little steady inflation as insurance against the real evil....

Read More »Everyone Knows The Gov’t Wants A ‘Controlled’ Weimar

There are two parts behind the inflation mongering. The first, noted yesterday, is the Fed’s balance sheet, particularly its supposedly monetary remainder called bank reserves. The central bank is busy doing something, a whole bunch of something, therefore how can it possibly turn out to be anything other than inflationary? The answer: the Federal Reserve is not a central bank, not really. What it “prints” are, as Emil Kalinowski likes to call them, the equivalent...

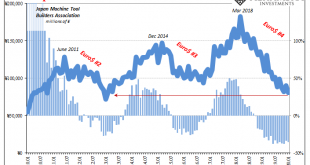

Read More »What Happens When Central Banks Buy Stocks (ETFs)? Well, We Already Know

Can we please dispense with all notions that monetary policy works? Specifically balance sheet expansion via any scale asset purchase programs. Nowhere has that been more apparent than Japan. Go back and reread all the promised benefits from BoJ’s Big Bang QQE that were confidently written in 2013. The biggest bazooka ever conceived has fallen short in every conceivable way. Starting with the fact QQE remains ongoing approaching its seventh birthday. Over here in...

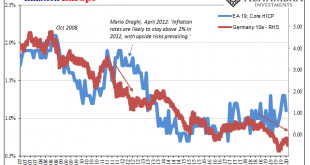

Read More »Schaetze To That

When Mario Draghi sat down for his scheduled press conference on April 4, 2012, it was a key moment and he knew it. The ECB had finished up the second of its “massive” LTRO auctions only weeks before. Draghi was still relatively new to the job, having taken over for Jean-Claude Trichet the prior November amidst substantial turmoil. The non-standard “flood of liquidity” was an about-face from his predecessor (who had been raising rates in 2011 before the wheels...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org