Full liquidity returns to the markets gradually in the coming days, and the week ahead culminates with the US December employment report. The highlights include the service and composite PMI readings, and December eurozone and China’s CPI. The UK reports December PMIs, November GDP, and industrial output figures. While the economic reports may pose some headline risk, the course of events suggests investors will look past the data. How the economies perform in Q1 20 is more important than Q4 data. The bar is understood to be high for action by the Federal Reserve or the ECB, at least in the first part of the year. Moreover, geopolitical risks have exploded to start the new year. The tension between the US and Iran is escalating. David Gardner warned of an all-out

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, David Gardner, Featured, Geopolitics, inflation, jobs, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Full liquidity returns to the markets gradually in the coming days, and the week ahead culminates with the US December employment report. The highlights include the service and composite PMI readings, and December eurozone and China’s CPI. The UK reports December PMIs, November GDP, and industrial output figures.

While the economic reports may pose some headline risk, the course of events suggests investors will look past the data. How the economies perform in Q1 20 is more important than Q4 data. The bar is understood to be high for action by the Federal Reserve or the ECB, at least in the first part of the year.

Moreover, geopolitical risks have exploded to start the new year. The tension between the US and Iran is escalating. David Gardner warned of an all-out war between the two in the Financial Times, but this does not seem like the most likely scenario. However, an asymmetrical response by Iran is still a reasonable expectation. At the same time, North Korea is again threatening to resume its nuclear weapons testing, and Turkish forces are moving into Libya. That said, markets often exaggerate the impact of geopolitical events on the monetary policy and the price of capital in its many forms.

The PBOC’s required reserve reduction, effective Monday, will likely lead to a lower Loan Prime Rate, which is based on funding costs reported by 18 banks on the 20th of each month. The move effectively steals whatever thunder the high-frequency data carries.

In the UK, last month’s election is one of those before and after moments. Weakness can be dismissed as uncertainty over Brexit, and the question becomes will the lifting of the uncertainty boost economic activity. Besides, Prime Minister Johnson’s campaign promises of increased government spending may take some pressure off monetary policy.

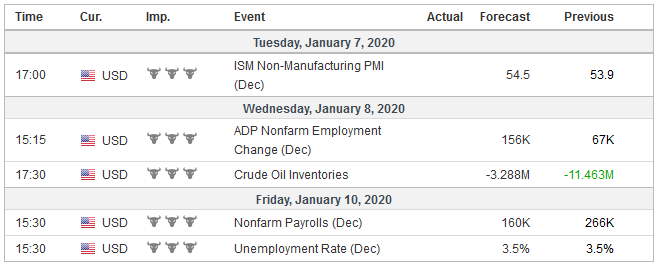

United StatesStill, we expect the data to underscore a few of our thematic points to the extent that a single high-frequency report can. First, while acknowledging that the 266k increase in US November non-farm payrolls was the strongest since January 2019, the underlying trend of this volatile series is slowing. The average through November has been 180k, while the average in the first eleven months of 2018 was 223k. The median forecast in the Bloomberg survey calls for a 156k increase in private-sector job growth would be the weakest in five months. Average hourly earnings rose by 0.4% last December. This will make for a tough comparison on a year-over-year basis. Due to rounding, a 0.3%-0.4% increase last month is needed to keep the year-over-year rate at 3.1%. While some observers seem to see this as the necessary fuel for consumption, inflation eats a chunk away (November CPI and the PCE deflator were 2.1% and 1.5% higher year-over-year). The base effect is part of what underlines another thematic point. The US and eurozone are likely to experience an inflation scare. It will likely be evident in the initial estimate of last month’s CPI in the eurozone. Consider that in November and December 2018 and January 2019, the headline measure of prices fell (by 0.6%, 0.0%, and 1.0%, respectively). The effect has already been seen already–with the November pace accelerating to 1.0% in November from 0.7% in October. The price of Brent rose 5.7% last month, and the euro appreciated by about 1.7%, and the net effect may also serve to lift the headline pace. The 0.3% increase in the median forecast in the Bloomberg survey would raise the year over-over-rate to 1.3%. The US had a similar experience. Consumer prices on a month-over-month basis were unchanged in November, December 2018 and January 2019. The 0.3% rise in November’s CPI lifted the year-over-year rate to 2.1%, the highest of the year, from 1.8% in October. The December report is not until January 14. The PCE deflator tells a similar story. Over the Nov-Jan period, the monthly PCE deflator was net-net unchanged, but it was delivered a little differently. The deflator was up 0.1% in November 2018 and was flat in December, before falling by 0.1% in January 2019. |

Economic Events: United States, Week January 6 |

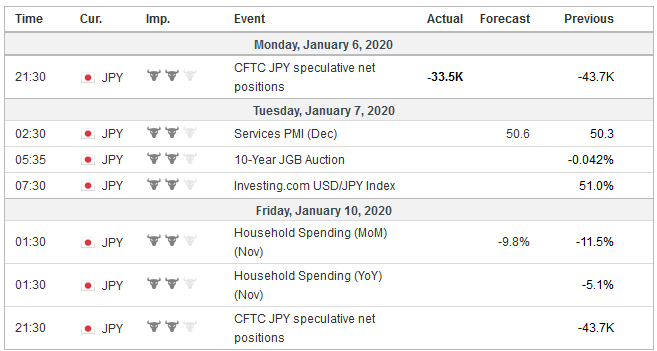

ChinaThird, we are skeptical of claims that the US-China trade agreement lifts uncertainties that were hampering the world’s largest economies. China’s manufacturing PMI was unchanged at 50.2, barely above the 50 boom/bust level. It had spent the May through October period below the threshold. The Caixin manufacturing PMI, which emphasizes smaller businesses, fell in December to 51.5, the lowest in the Q4 19 from 51.8. Caixin is expected to report a decline in the services component at the start of the new week, which would ensure that the composite pulls back from the nearly two-year high reached in November. Moreover, to the extent that China’s economy and many countries in the region have shown signs of gaining traction, it appears less related to trade and more linked to other measures. These include the use of fiscal and monetary policy, coupled with lower currencies, and importantly, the apparent bottoming of the semiconductor industry. We note that manufacturing PMI of South Korea, Taiwan, and Thailand moved back above 50 in December. Indonesia, where the manufacturing PMI remained below 50, it did rise for the third consecutive month and at 49.5, stands at a five-month high. Malaysia’s manufacturing PMI made it back to 50 as it increased for the fourth straight month in December, and it is the first time not in contraction territory since September 2018. |

Economic Events: China, Week January 6 - Click to enlarge |

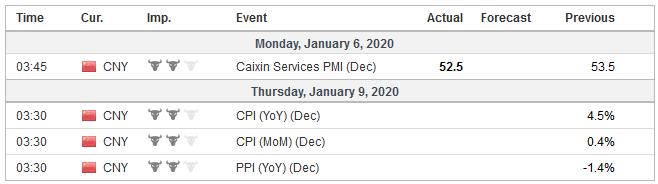

JapanJapan returns from its extended holiday and will report is final December PMI readings. Japan is a regional laggard. The preliminary estimates showed now improvement in manufacturing (48.8 vs. 48.9) and a small increase in the service PMI to 50.6 from 50.3. The composite was unchanged at 49.8, as it remained below 50 throughout Q4. Separately, and the data is not yet available, but we are skeptical of the extent that the UK election and the Tories securing a majority lifts the uncertainty for investors. While the divorce is now uncontested, the issue in some way remains what it always has been: what will be the trade relationship between the two? And that question will hang over investors this year. There remains a substantial risk that a return to WTO standards, which has been regarded as a hard Brexit, and that is understood to be broadly and acutely disruptive. Moreover, with the US, including UK goods in its retaliatory tariffs for the illegal Airbus subsidies, the chances of a quick trade deal with the US seem a stretch, and China’s apparent freeze of the Shanghai-London equity link raises questions about that relationship as well. |

Economic Events: Japan, Week January 6 |

India’s manufacturing PMI rose for the second consecutive month, and at 52.7 matches the high since February. When the composite is reported on Monday, it could test the year’s high set in July just below 54.0.

A fourth thematic point is that Beijing appears to be bouncing between two policy attractors–growth and deleveraging. It seems to have moved toward the growth pole, but this does not mean that it will not accept rising business and financial failures, in a seemingly controlled fashion, even if the algorithm does not appear evident. The cut in required reserves, replacing the one-year deposit rate as a benchmark with the Loan Prime Rate, allowing local governments to begin drawing from 2020 budget late last year, large tariff cuts, consistently point in the same direction.

The fact that headline CPI jumped to 4.5% in November, its highest level in seven years spooked investors and observers, but the PBOC seemingly looked through it and undoubtedly will the December CPI when it is released late next week. The problem is clear, and it is disinflation. The core CPI slowed to 1.4%, the lowest since March 2016. Pork prices appear to be peaking, and headline CPI can start to normalize toward the end of Q1 20. Producer prices have been falling on a year-over-year basis since July though the pace of decline may be moderating. It still down 1.4% in November.

Tags: #USD,China,David Gardner,Featured,Geopolitics,inflation,jobs,newsletter