Last week was only four days due to the President’s day holiday but it was eventful. The big news of the week was the spike in interest rates, which according to the press reports I read, “came out of nowhere”. In other words, the writers couldn’t find an obvious cause for a 14 basis point rise in the 10 year Treasury note yield so they just chalked it up to mystery. Of course, anyone who’s been paying attention knows that rates have been rising for almost a year –...

Read More »Two Seemingly Opposite Ends Of The Inflation Debate Come Together

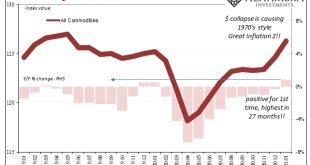

It’s worth taking a look at a couple of extremes, and the putting each into wider context of inflation/deflation. As you no doubt surmise, only one is receiving much mainstream attention. The other continues to be overshadowed by…anything else. To begin with, the US Bureau of Labor Statistics reported today that US import prices were up on annual basis for the first time in some time. Rising in January 2021 by 0.9% year-over-year, this was actually the fastest...

Read More »FX Daily, February 17: Follow-Through Dollar Buying after Yesterday’s Reversal Tests the Bears

Swiss Franc The Euro has risen by 0.03% to 1.0802 EUR/CHF and USD/CHF, February 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After reversing higher yesterday, the US dollar sees follow-through gains today, leaving the euro around a cent lower from yesterday’s highs. Sterling’s surge is also being tempered. Most emerging market currencies are lower as well. The jump in bond yields has stalled, but only...

Read More »The Endangered Inflationary Species: Gazelles

Nevada is, by all accounts and accountants, in rough shape. Very rough shape. An economy overly dependent upon a single industry, tourism, in this case, is a disaster waiting to happen should anything happen to that industry. Pandemic restrictions, for instance. Nevadans cannot afford the government spending they “have” without a gaming industry attracting visitors at full throttle. Desperate, the state’s governor Steve Sisolak announced last week that officials...

Read More »FX Daily, February 10: China’s Expansion Does not Prevent Deflation

Swiss Franc The Euro has fallen by 0.13% to 1.0796 EUR/CHF and USD/CHF, February 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Despite a soft close in US indices yesterday, global shares are on the march again today. Led by China and Hong Kong, most large markets in the Asia Pacific region advanced today. Officials gave approval for a new game from Tencent, which helped lift the Hang Seng. Europe’s Dow...

Read More »Even The People ‘Printing’ The ‘Money’ Aren’t Seeing It

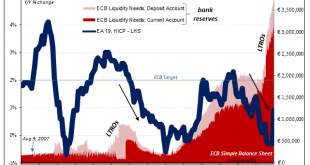

Everyone in Europe has long forgotten about what was going on there before COVID. First, an economy that had been stuck two years within a deflationary downturn central bankers like Italy’s new recycled top guy Mario Draghi clumsily mistook for an inflationary takeoff. Both the inflation puzzle and ultimately a pre-pandemic recession have taken a back seat to everything corona. Whereas Draghi spent those years howling for inflationary conditions that were nowhere in...

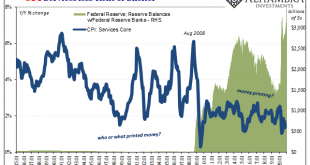

Read More »If the Fed’s Not In Consumer Prices, Then How About Producer Prices?

It’s not just that there isn’t much inflation evident in consumer prices. Rather, it’s a pretty big deal given the deluge of so much “money printing” this year, begun three-quarters of a year before, that consumer prices are increasing at some of the slowest rates in the data. Trillions in bank reserves, sure, but actual money can only be missing. U.S. CPI Services Core Fed, Jan 1985 - -2020 - Click to enlarge U.S. CPI Services Core percentile, Jan 2009 - 2020...

Read More »They’ve Gone Too Far (or have they?)

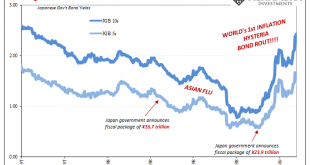

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months. The JGB 10-year yield had dropped to a low of just 77.2 bps during the depths of 1998’s Asian Financial Crisis (or “flu”, so noted for its regional contagious dollar...

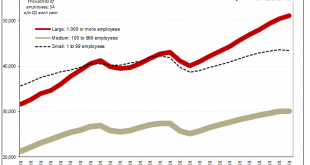

Read More »Inflation Hysteria #2 (Slack-edotes)

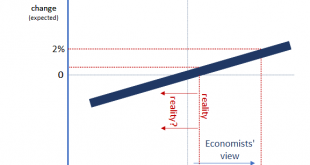

Macroeconomic slack is such an easy, intuitive concept that only Economists and central bankers (same thing) could possibly mess it up. But mess it up they have. Spending years talking about a labor shortage, and getting the financial media to report this as fact, those at the Federal Reserve, in particular, pointed to this as proof QE and ZIRP had fulfilled the monetary policy mandates – both of them. A labor shortage would’ve meant full or maximum employment, the...

Read More »Inflation Hysteria #2 (WTI)

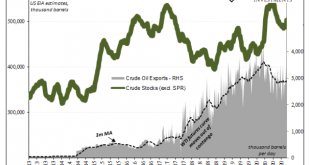

Sticking with our recent theme, a big part of what Inflation Hysteria #1 (2017-18) also had going for it was loosened restrictions for US oil producers. Seriously. Legacy of the 1970’s experience depending too much on OPEC, subject to embargoes, American oil companies had been prohibited for decades from exporting oil. Not that it would have mattered before 2014, the country never producing near enough to have ever done so. Export limitations removed, shale boom...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org