Swiss Franc The Euro has risen by 0.27% to 1.0999 EUR/CHF and USD/CHF, May 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A setback in commodities and technology are roiling equity markets today. The inability of US equities to sustain yesterday’s rally provided an initial headwind to trading in the Asia Pacific region today. Hong Kong and South Korea markets were closed for holidays, but most of the...

Read More »FX Daily, May 13: Long Lost Bond Vigilantes Sighted, Gives Dollar Fillip

Swiss Franc The Euro has fallen by 0.15% to 1.0957 EUR/CHF and USD/CHF, May 13(see more posts on Business, EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is as if the bond vigilantes were pushed too far. US inflation is accelerating more than expected, and it cannot all be attributed to the base effect, and the Federal Reserve, to many investors, is tone-deaf. With powerful fiscal stimulus, nominal growth above 10%, and the...

Read More »FX Daily, May 11: Stocks Slide but Little Demand for Safe Havens

Swiss Franc The Euro has risen by 0.37% to 1.0969 EUR/CHF and USD/CHF, May 11(see more posts on Business, EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The sell-off in US shares yesterday has triggered sharp global losses today, and there is no flight into fixed income as benchmark yields are higher across the board. Nor is the dollar serving as much as a safe haven. It is mostly softer against the major currencies. Japan and...

Read More »The Dollar and the Fed

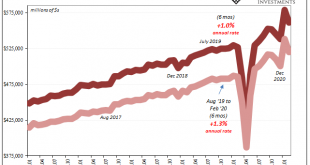

One of the stark developments since the initial shock of the pandemic has been the aggressiveness of the US monetary and fiscal response. This was also true in dealing with the Great Financial Crisis. The divergence then and now had shaped the investment climate. On a per-capita basis, the pandemic struck the US harder than in most other high-income countries, and some see the wide disparity of income and wealth as a contributing factor. In any event, the vaccine...

Read More »FX Daily, April 29: US GDP: The V

Swiss Franc The Euro has risen by 0.05% to 1.1031 EUR/CHF and USD/CHF, April 29 Source: markets.ft.com - Click to enlarge FX Rates Overview: The market’s initial reaction to the Federal Reserve statement and the press conference was that it was dovish: the 10-year yield slipped, and the dollar was sold to new lows. In fact, the two countries that appear to be ahead of the curve among high-income countries, Canada and Norway, saw their currencies rally to new...

Read More »Weekly Market Pulse: The Market Did What??!!

One of the most common complaints I hear about the markets is that they are “divorced from reality”, that they aren’t acting as the current economic data would seem to dictate. I’ve been in this business for 30 years and I think I first heard that in year one. Or maybe even before I decided to lose my mind and start managing other people’s money. Because, of course, it has always been this way. Economic data represents the past while markets look to the future. And...

Read More »Weekly Market Pulse: Nothing To See Here. No, Really. Nothing.

The answer to the question, “What should I do to my portfolio today (this week, this month)? is almost always nothing. Humans, and especially portfolio managers, have a hard time believing that doing nothing is the right response….to anything…or nothing. We are programmed to believe that success comes from doing things, not not doing things. And so, often we look at markets on a day to day or week to week basis and think something of significance happened and we...

Read More »Rechecking On Bill And His Newfound Followers

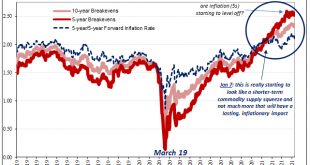

The benchmark 10-year US Treasury has obtained some bids. Not long ago the certain harbinger of bond rout doom, the long end maybe has joined the rest of the world in its global pause if somewhat later than it had begun elsewhere (including, importantly, its own TIPS real yield backyard). Even nearer-in inflation expectations have rounded off at their current top. Perhaps no more than a short-term rest before each rising again, then again with the rest of the...

Read More »FX Daily, March 30: US Yields Push Higher, Lifting the Greenback Especially Against the Euro and Yen

Swiss Franc The Euro has risen by 0.02% to 1.1047 EUR/CHF and USD/CHF, March 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US 10-year yield is at new highs since January 2020, pressing above 1.77% and helping pull up global yields today. European benchmarks yields are up 4-5 bp, and the Antipodean yields jump 8-9 bp. The impact on equities has been minor, and the talk is still about the unwinding of...

Read More »Spending Here, Production There, and What Autos Have To Do With It

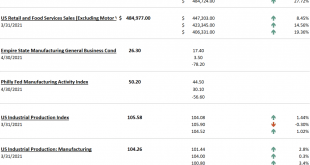

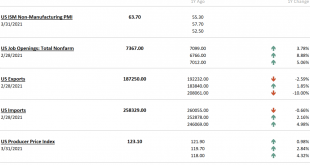

While the global inflation picture remains fixed at firmly normal (as in, disinflationary), US retail sales by contrast have been highly abnormal. You’d think given that, the consumer price part of the economic equation would, well, equate eventually price-wise. Consumers are spending, prices should be heading upward at a noticeable rate. To begin with, consumer spending – as pictured by the Census Bureau – was obviously boosted during January by the previous...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org