Macroeconomic slack is such an easy, intuitive concept that only Economists and central bankers (same thing) could possibly mess it up. But mess it up they have. Spending years talking about a labor shortage, and getting the financial media to report this as fact, those at the Federal Reserve, in particular, pointed to this as proof QE and ZIRP had fulfilled the monetary policy mandates – both of them. A labor shortage would’ve meant full or maximum employment, the absolute best any economy can imagine. Given the huge economic hole the first Global Financial Crisis had created (How was it global, again? Why did this get so bad in 2008 of all years?), the inflationary pressures presumed from a sizable labor shortage would have been a welcome development. The end

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, continued jobless claims, Core CPI, CPI, currencies, Deflation, disinflation, economy, Featured, Federal Reserve/Monetary Policy, inflation, Initial Jobless Claims, jobless claims, labor shortage, macro slack, macroeconomic slack, Markets, newsletter, unemployment insurance, unemployment rate

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

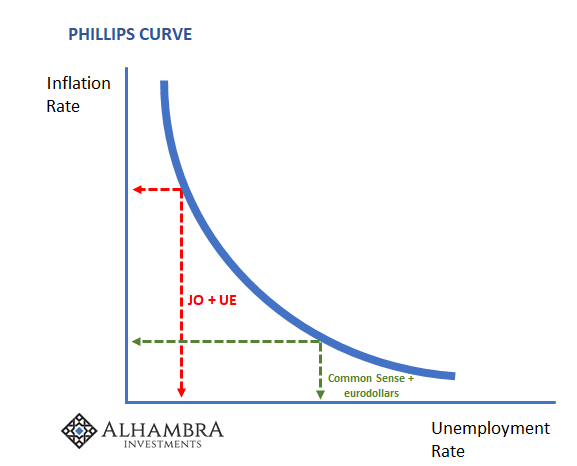

| Macroeconomic slack is such an easy, intuitive concept that only Economists and central bankers (same thing) could possibly mess it up. But mess it up they have. Spending years talking about a labor shortage, and getting the financial media to report this as fact, those at the Federal Reserve, in particular, pointed to this as proof QE and ZIRP had fulfilled the monetary policy mandates – both of them.

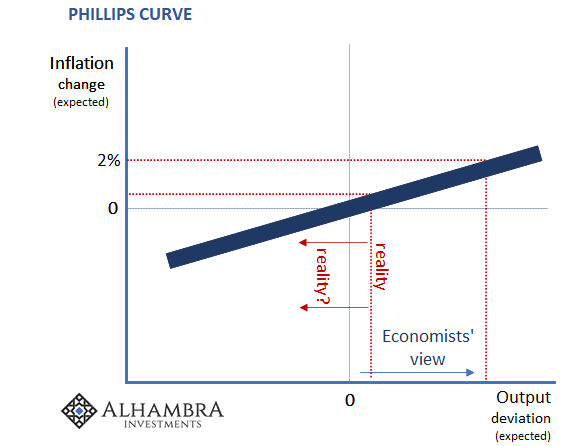

A labor shortage would’ve meant full or maximum employment, the absolute best any economy can imagine. Given the huge economic hole the first Global Financial Crisis had created (How was it global, again? Why did this get so bad in 2008 of all years?), the inflationary pressures presumed from a sizable labor shortage would have been a welcome development. The end of macro slack, meaning inflation as the definitive sign of full, complete recovery. |

|

| Employment to its maximum possible. An economy so good, companies would have to robustly compete for workers.

And it never once happened. No matter how many times whichever high Fed official talked like it was a foregone conclusion, it was obvious at those times they were either wrong or being disingenuous (managing sometimes to be both). There never was a labor shortage as you could tell by the fact wages weren’t rising too fast, let alone in any danger of skyrocketing. Instead, the media was filled with anecdotes about how businesses were being “forced” to “compete” for “scarce” labor using…piddly perks? Huh? Silly and stupid, no logic or rational analysis was behind any of this. It really deserved every last exclamation point in: LABOR SHORTAGE!!!! It was, of course, another key cog fitting out Inflation Hysteria #1. I wrote back in early July 2018 how it was never anything other than really desperate rationalizing:

As I’d written so many times, there never was any need to get creative to find workers. You want them, really want them because business is truly booming, you pay them. It really is that simple. At times when labor is easy to come by, because macro slack has made workers widely available since they are otherwise idle and waiting to find work, wages aren’t going to move much therefore deflationary, at the very least disinflationary, pressures predominate. During these same times, companies are stressed to avoid paying the workers they have. Thus, perks not pay. It’s not really about consumer prices. |

|

|

Long after the fact, well past the labor-shortage-that-never-was, even the screechers at the Federal Reserve admit that something wasn’t right about the whole thing. They’re still trying to figure these things out when, again, there’s no reason to complicate it. Macro slack. End of story. And it’s the same one behind what’s now Inflation Hysteria #2. Supposedly what didn’t happen two and three years ago will happen next year, next week, tomorrow. Some claim it’s already begun. Phooey. There’s nary a lick of inflationary pressures evident anywhere. |

|

| And, like everything else in these two periods, there’s even less of them here in #2 than what little had been uncovered during #1. So much less.

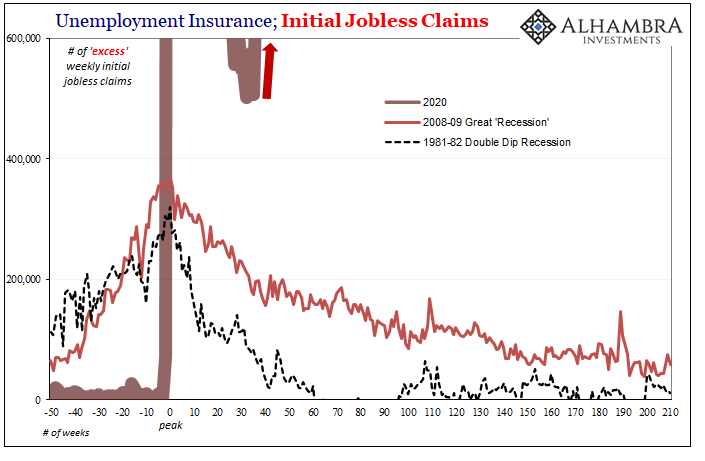

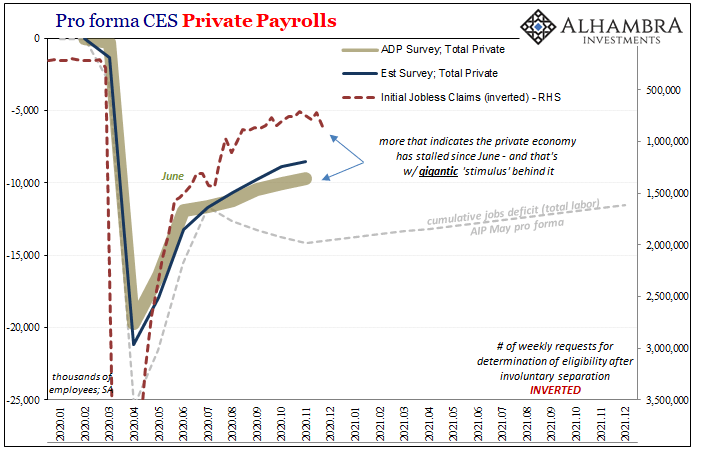

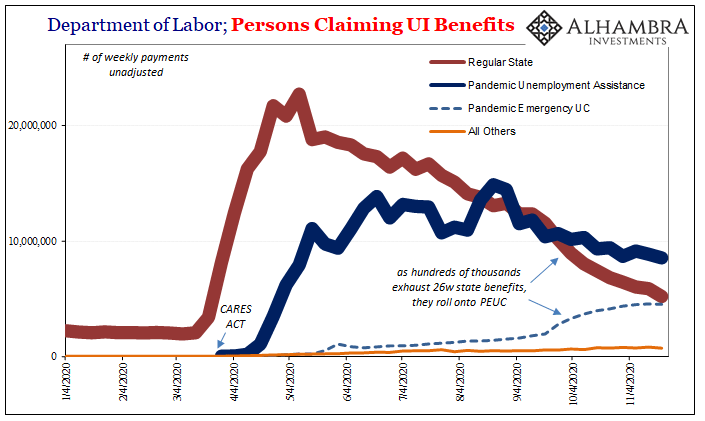

Let’s start with the key component to the deflationary evils: the labor market. Jobless claims – unlike fuzzy anecdotal tales of a labor shortage – haven’t steered us wrong. In 2020, especially since June, they’ve correctly identified what’s become a summer-autumn slowdown. Not just a slowing of the rebound, but done so in a way that makes it all but impossible to lead into inflationary excesses. Not when so much labor is involuntarily slacking off. According to the Department of Labor, initial jobless claims exploded higher last week, rising to 853,000 from what had been near a recent low of (revised) 716,000. The “excess” weekly claims are literally off the chart when they should be consistently, significantly dropping week after week. Huge slack. |

|

|

|

|

|

|

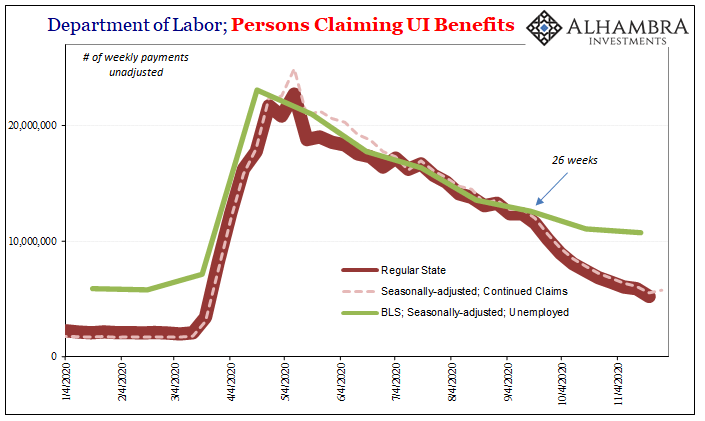

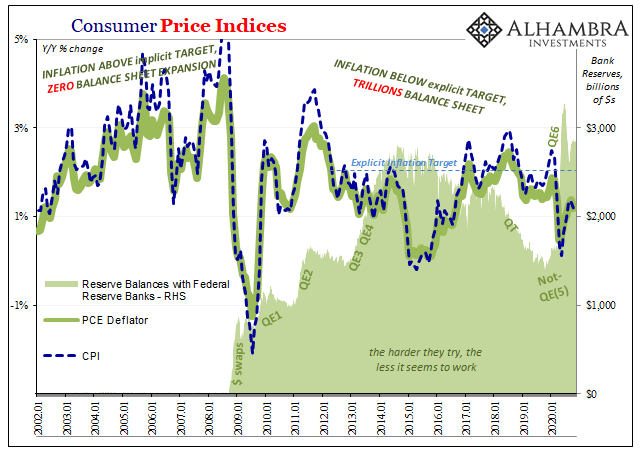

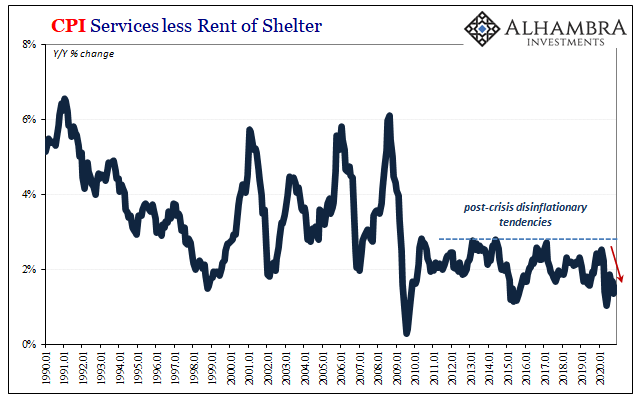

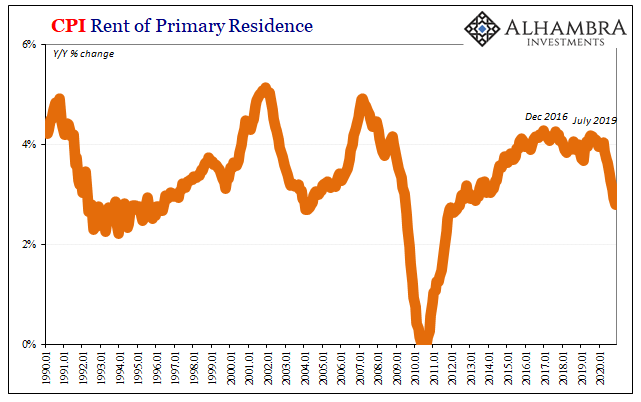

Even worse, more deflationary still, as you can see above a good chunk of those still unemployed have exhausted their regular state payments and are now dependent upon the federal politics of pandemic claims just to have anything coming in. The economy at a standstill, one that is described not by ridiculous mainstream media fiction but in one data series after another (after another), stalled out in a hole that for the labor market is significantly greater than its deepest point during the Great “Recession.” And that’s eight months into this latest recession, six months after reopening and supposedly recovery. Unsurprisingly, the various consumer price indices have joined the slowdown/stall-out chorus singing in dark tones about this very evident and destructive macro slack. |

|

| The US CPI, despite oil prices rising, its headline rate managed to decelerate a single bip during November 2020. Up just 1.17% year-over-year, it’s less than the 1.18% put up during October.

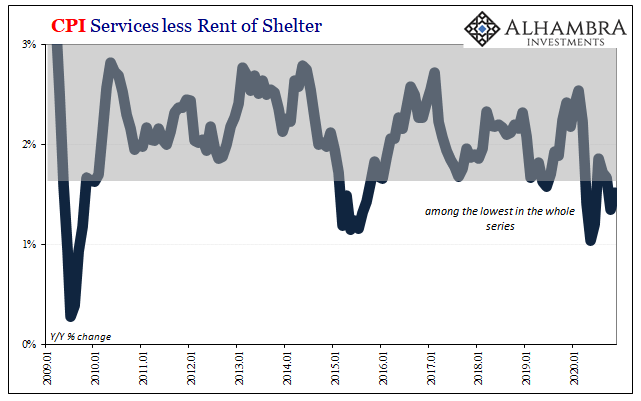

The core CPI rate was just 1.65% last month, four bips higher than October’s 1.61% but remaining among the lowest rates of the entire series history (and that goes for other “core” measure, like services less rent). |

|

|

|

| But that’s not what Inflation Hysteria #2 is really about. Like Inflation Hysteria #1, it’s all about tomorrow because there’s no data for tomorrow. You can make next week and next month into pretty much anything you like. What’s at issue is always how plausible your future scenario might ever be.

Thus, when Inflation Hysteria #1 turned to absurd anecdotal stories about a LABOR SHORTAGE!!!! which would, at some always distant forward point, lead to this inflationary recovery stuff you already knew it was bogus. If it had been anywhere close to a realistic chance, there’d have been some corroborating data supporting the unemployment rate setting up that accelerating trajectory. Now, as we’ve said all week, there isn’t even a fraction of it for Inflation Hysteria #2. Most of all a labor market still experiencing more – not less – slack and destructive tendencies. All the ungodly, massive, inflationary monetary and fiscal “stimulus” so far have done little to bend the summer slowdown back up in the “V” direction. Trillions of feds and Fed, nary a sniff of inflation. Only ongoing disinflation. More will suddenly work? So, Inflation Hysteria #1 leaned heavily on the LABOR SHORTAGE!!!! which didn’t exist. Inflation Hysteria #2, way short of even that, is constructed instead upon STIMULUS SHORTAGE!!!! before it can ever hope to get near a fake labor shortage which hadn’t done it back then. Good luck with that. |

|

Tags: continued jobless claims,Core CPI,CPI,currencies,Deflation,disinflation,economy,Featured,Federal Reserve/Monetary Policy,inflation,Initial Jobless Claims,jobless claims,labor shortage,macro slack,macroeconomic slack,Markets,newsletter,unemployment insurance,unemployment rate