It’s worth taking a look at a couple of extremes, and the putting each into wider context of inflation/deflation. As you no doubt surmise, only one is receiving much mainstream attention. The other continues to be overshadowed by…anything else. To begin with, the US Bureau of Labor Statistics reported today that US import prices were up on annual basis for the first time in some time. Rising in January 2021 by 0.9% year-over-year, this was actually the fastest increase in almost three and a half years; another one of these “highest in years” comparisons. Not only that, just looking at the index especially clear acceleration the past two months (December and January), it does seem to be indicative of all that price overheating everyone’s been talking about. Given

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, currencies, Deflation, Dollar, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, import prices, inflation, jobless claims, Labor market, macro slack, Markets, newsletter, PPI, producer prices, T-Bills, Unemployment

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| It’s worth taking a look at a couple of extremes, and the putting each into wider context of inflation/deflation. As you no doubt surmise, only one is receiving much mainstream attention. The other continues to be overshadowed by…anything else.

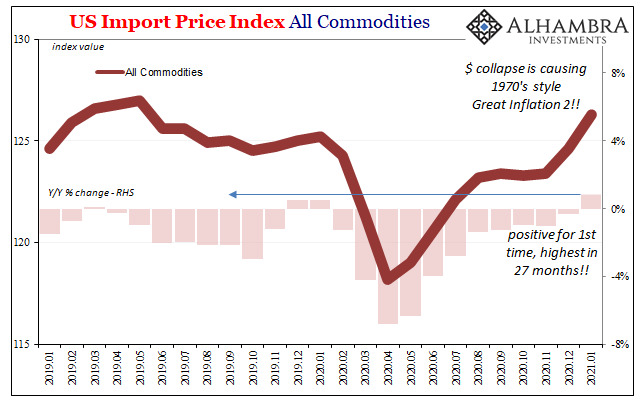

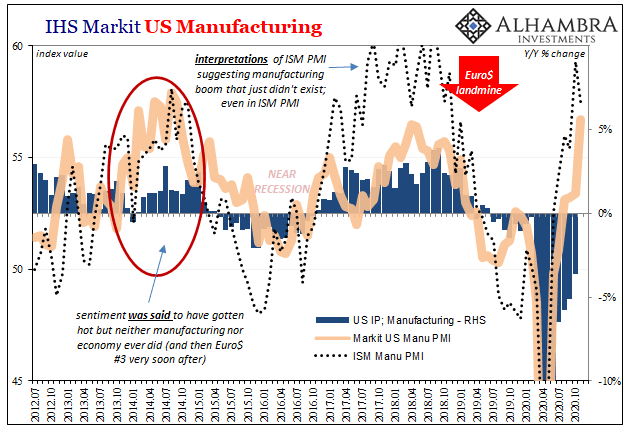

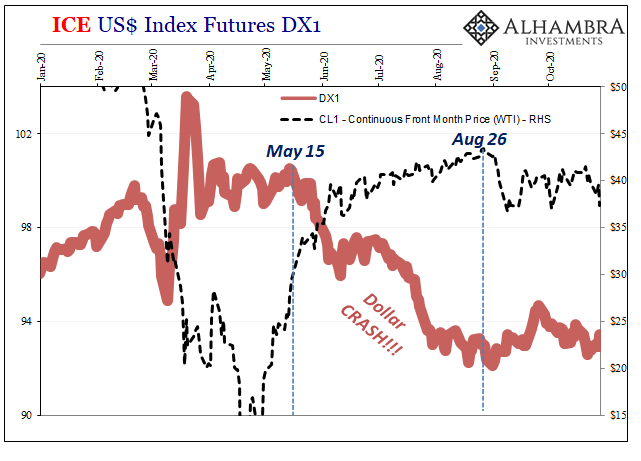

To begin with, the US Bureau of Labor Statistics reported today that US import prices were up on annual basis for the first time in some time. Rising in January 2021 by 0.9% year-over-year, this was actually the fastest increase in almost three and a half years; another one of these “highest in years” comparisons. Not only that, just looking at the index especially clear acceleration the past two months (December and January), it does seem to be indicative of all that price overheating everyone’s been talking about. Given enough time, has Jay’s flood finally started to come in? After all, import prices are linked to the dollar’s exchange value and global conditions, therefore if the long-predicted dollar crash is showing up it’s going to be costing Americans even more destructive inflation pain. |

US Import Price Index All Commedities, 2019-2021 |

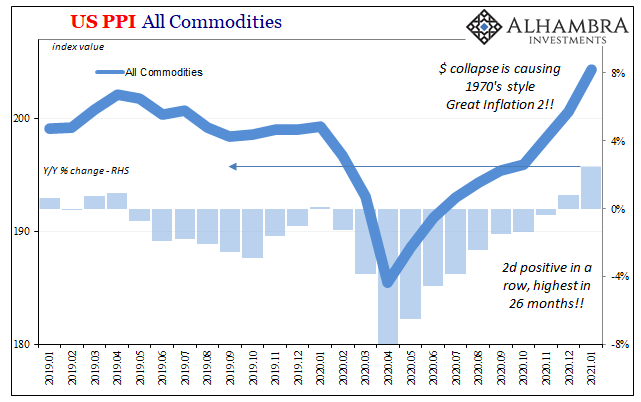

| Hardly alone, appearing to corroborate the overheating alarm the BLS reported earlier in the week that producer prices have accelerated, too, also during these past few months. Like import prices, the PPI is up on annual basis and at the quickest pace in 26 months.

Here comes the seventies! |

US PPI All Commodities 2019-2021 |

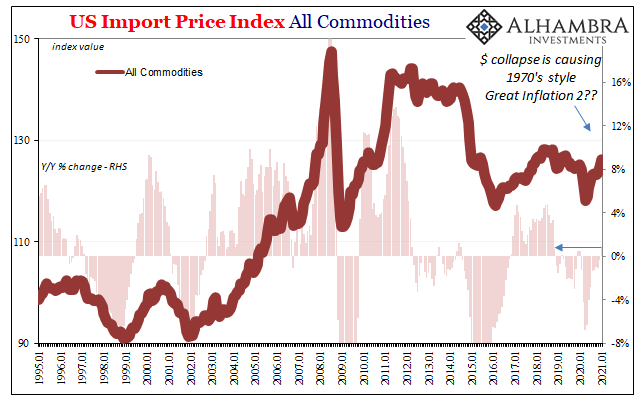

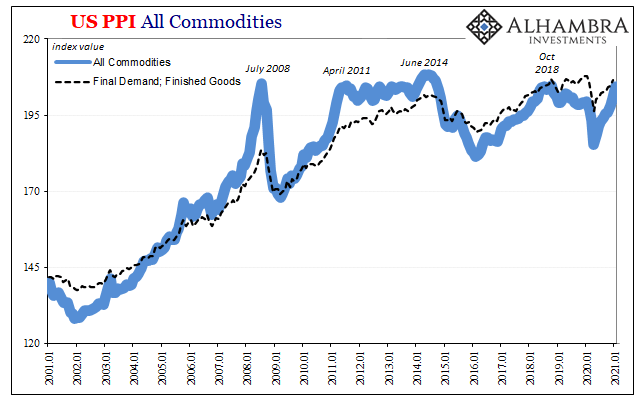

| However, being higher than at any time during 2019-20 isn’t quite the comparison it’s made out to be. In fact, while produce and import prices are rebounding with commodity prices, in particular, that supply squeeze hasn’t really had all that much impact beyond turning several years of minuses into small pluses.

Yes, small. Context matters: |

US Import Price Index All Commedities, 1995-2021 |

US PPI All Commodities 2001-2021 |

|

| And if this is the start of something big in the inflationary direction, why hasn’t it been so much bigger?

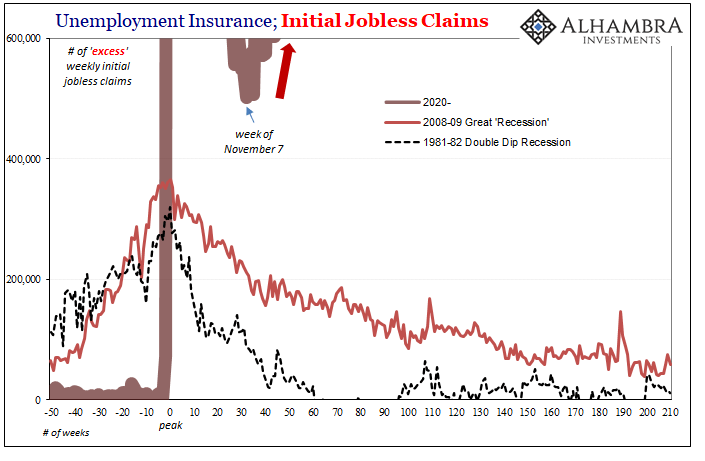

The reason in all likelihood is over at the opposing side where things continue to be actually huge. Inflation is talked about like it’s some massive monster already rearing its ugly head, while deflationary forces continue be, in reality as opposed to conjecture, truly mind boggling. The labor market is still imperiled; the Department of Labor reported today on yet another rise in weekly jobless claims filings. Revising the tally from two weeks ago substantially higher, last week’s total beat it anyway at truly monstrous 863,000. |

Unemployment Insurance, Initial Jobless Claims, 1981-2020 |

| As a reminder, there had never been a single week so much as 700,000 before last year.

As of the latest data, this makes 48 straight weeks at substantially greater than all prior record levels. More concerning still is the trajectory; going back to the first week in November, jobless claims have been trending upward again now stretching into a third month. Not only is it consistent with the decline in payrolls over the prior two (the same December and January as producer and import prices accelerating), it’s perfectly consistent with a labor market which has stopped improving at a level of dysfunction and contraction commensurate with nothing else since the Great Depression. Why does the first week in November sound so familiar? That had been the Presidential and Congressional elections, followed the next week by vaccines. |

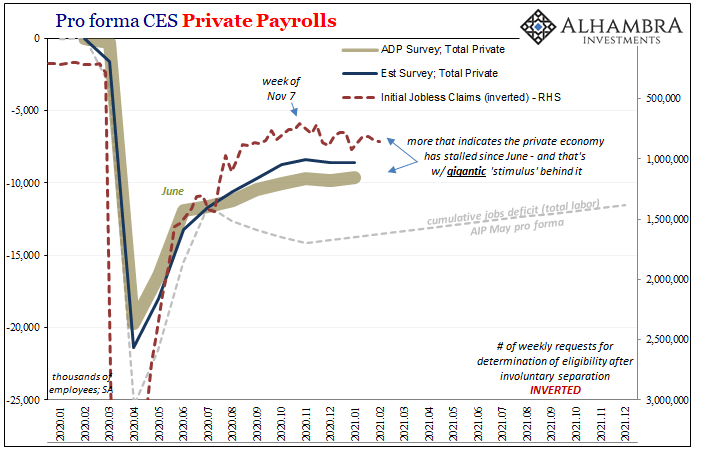

Pro forma CES Private Payrolls, 2020-2021 |

| Both of those were supposedly hugely positive and staunchly reflationary (if not full-blown inflationary, if commentary surrounding short-run PPI and import prices is to be believed).

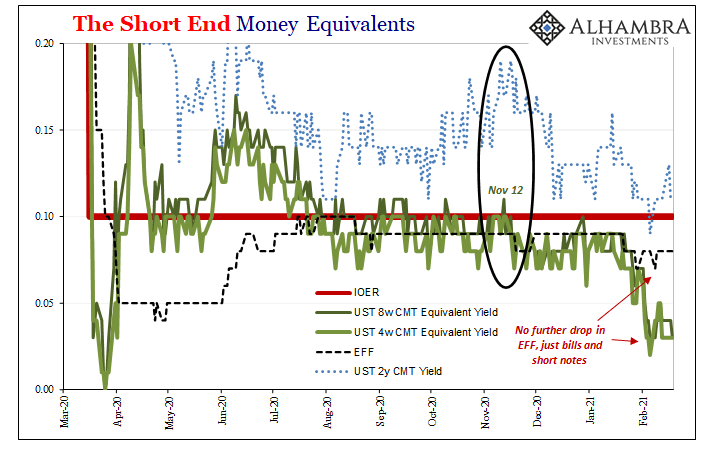

But to those paying attention in a money, collateral, repo sense, early November instead comes back for vastly different reasons, as right when T-bill rates began moving noticeably lower. Not early January when bill supply became more of an issue, that’s when the move accelerated, but right at that same time as jobless claims and therefore the perceived underlying economy and monetary risks as I described them here. Combined, import like producer prices together with jobless claims (and payroll data) both suggest those prices must be rebounding on supply squeeze factors alone, thus leaving overheated only the inflation talk that in the economy continues to be superseded by deflationary pressures that aren’t actually getting any better. Uncle Sam may have been able to buy a few months of retail sales, but Treasury still can’t lead a jobs recovery – just as its bills price. And that’s really all that matters, or has mattered for the last thirteen years (see: PPI, Import Prices during that entire period). |

The Short End Money Equivalents, 2020-2021 |

Tags: Bonds,currencies,Deflation,dollar,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,import prices,inflation,jobless claims,Labor Market,macro slack,Markets,newsletter,PPI,producer prices,T-Bills,Unemployment