Click to see the video. I had the privilege to be on CNBC’s Trading Block show to discuss how the market is positioned for the UK referendum. The markets are strongly anticipating the UK to vote to stay in the EU, even though polls remain very tight. Given that leveraged participants and speculators have rallied sterling more than nine cents from last week’s lows. This makes us wary of the risk that...

Read More »FX Daily, June 22: Markets Consolidate as Table is Set for Referendum

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The Financial Times poll of polls has it at 45%-44% in favor of Brexit. However, the betting markets appear to be telling a...

Read More »Great Graphic: UK Referendum–Turnout it Key

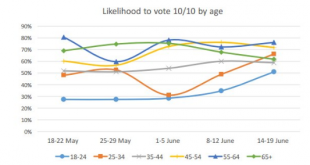

Summary Younger voters are more supportive of the EU. There has been an increase in the intention of younger cohorts to vote. There has been a decline in the intention of some older cohorts to vote. We showed that younger age cohorts in the UK are more inclined to vote to stay in the EU than their elders. However, some suggested that this consideration is blunted by the fact that the younger people are less...

Read More »FX Daily, June 21: CHF Strongest Currency Again

Swiss Franc The Swiss Franc was the strongest currency. The euro fell from 1.0877 to 1.0808. Two fundamental reasons: Speculator anticipate that German investors buy Swiss francs in response to the court decision in favor of the OMT (see below) The German ZEW (see below) that was better than expected. We know that CHF acts as a proxy for the German economy via strong trade ties and the tradition that German...

Read More »European Politics Beyond the UK Referendum

Sterling is hovering around seven cents above last week’s lows as many short-term participants better position themselves for the UK to vote to say in the EU, even though many opinion polls show a statistical dead heat. The German Constitutional Court dismissed claims that the ECB’s Outright Market Transactions does not violate the German Constitution. Italy’s run-off for local elections was held over the past...

Read More »Great Graphic: Age and Brexit

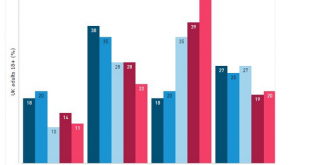

The betting and events markets have shifted more decisively than the polls in favor of the UK to remain in the EU. Sterling extended its rally from $1.4010 last Thursday to nearly $1.4785 today, as the market participants adjust positions. What is particular striking is that the asymmetrical perceptions of the personal impact of a vote to leave the EU. The Great Graphic here was posted on Business Insider,...

Read More »FX Daily, June 20: Brexit not the main Swiss Franc Driver

On the Swiss Franc Recently I enumerated the different drivers for the continuing strength of the franc. Most commentators mentioned Brexit fears, but I insisted on the low rate and yield environment in the United States after the last Non-Farm Payroll report and the FOMC. Today’s jump in sterling after changed Brexit bets confirmed my view. This anticipation of an Anti-Brexit vote was not followed by a franc decline...

Read More »If Sterling has Not Peaked, It has Come Pretty Close

Summary Today’s sterling rally is the largest since 2008. The rally began with the murder of UK MP Cox. Risk-reward favors a near-term pullback. Sterling is recording its daily advance since 2008 today. It is up about 2.3%. The ostensible driver is the weekend polls suggesting that, as we suspected the murder of the UK MP acting as a catalyst of sorts for public opinion. The odds makers in the betting houses...

Read More »Bullard’s New Paradigm and the Federal Reserve

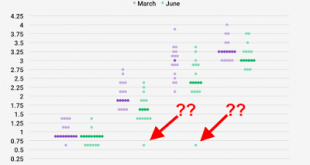

Summary There is much to like in Bullard’s new paradigm. The problem is that it does not reflect the Federal Reserve’s view or approach. Policy emanates from the Fed’s leadership, but be confused by the noise. The dot plot the recent FOMC meeting was curious. We noted right away that inexplicably there was one official that apparently anticipated one hike this year and then no hikes in 2017 or 2018. There was...

Read More »FX Weekly Preview: It is All about Europe

Major data this week: German Constitutional Court ruling on OMT. UK referendum. EMU flash PMI. ECB TLTRO II launch. Yellen testifies before Congress, RBI Rajan to step down in early Sept. The Chair of the Federal Reserve testifies before Congress on Tuesday and Wednesday. Given the recent FOMC meeting and Yellen’s press conference, it is unlikely new ground will be broken. It is difficult for the market to price out...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org