Sterling In the days ahead of the murder of Jo Cox, a UK member of parliament, apparently for her support for remaining in the EU, speculators in the futures market scooped up sterling. They added 25.4k sterling contracts to lift the gross long position to 61.7k contracts. This is the second largest long speculative position after the mid-March holdings of 62.9k long contracts. In the previous CFTC reporting...

Read More »FX Review Week till June 17: Jo Cox’s death supports Sterling, negative for CHF

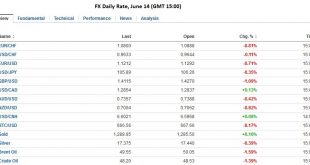

EUR/CHF The EUR/CHF was finished nearly without change after it had fallen to 1.0775 on Thursday. The rise of GBP and EUR on Thursday can be explained with speculation that the death of Jo Cox will help the anti-Brexit camp. We reported that FX speculators bought Sterling with two hands. FX Rates June 13 to June 17, 2016 click to enlarge USD/CHF Speculators have finally positioned themselves long CHF against...

Read More »FX Daily, June 17: Martyrdom of Cox Acts as Catharsis

The assassination of Jo Cox, a member of the UK parliament is a personal and political tragedy. Her needless death provided an inflection point. The suspension of the referendum campaigns and a steady stream of reports and speeches has the emotionalism of contest freeze. Investors quickly understood that the Cox’s death injected a new unknown into the forces that seemed to build toward a decision to leave the EU....

Read More »How Germany Could Upset Europe before UK Referendum

The assassination of the Jo Cox has broken the powerful momentum in the markets. Investors recognize that the tragedy potentially injects a new element into consideration for the outcome of next week’s referendum. The campaigns will be resume over the weekend, and new polls will be available. Investors will place more weight on polls conducted after the assassination. The UK referendum is the big event next week. ...

Read More »FX Daily, June 16: Markets are Anxious, Yen Soars

FX Rates The US dollar is higher against the major currencies but the Japanese yen and the New Zealand dollar. The dollar fell to new two-year lows against the yen to JPY103.55 before bouncing in the European morning back to JPY104.40. The Kiwi was helped by better than expected Q1 GDP. The euro and sterling are within yesterday’s ranges. The euro has been able to resurface above $1.13 since Monday. Bids have...

Read More »Macro Thinking: FOMC, USD, and EU

The Federal Reserve modified its stance yesterday without changing rates. It is not just about how fast the Fed sees itself normalizing monetary policy but also where the level of the equilibrium rate. The FOMC statement, but especially the officials’ forecasts (dot plots) effective unwound the impact of the earlier Fed talk of the likely appropriateness of a rate hike this summer. Although the Fed did not rule out a...

Read More »FX Daily, June 15: Key Data and FOMC

Swiss Franc The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar. Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduced the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again. FOMC The FOMC meeting later today,...

Read More »Fed Softens Stance Slightly

The Federal Reserve anticipated a more gradual tightening path going forward. This weighed on the dollar and lifted equities. August Fed funds futures implies less of a chance of a hike next month. It is now consistent with an 8% chance of a hike, which is less than half the probability assigned at the end of last week.The immediate reaction was driven by the Fed’s dot plots. Although the median continues to...

Read More »Kuroda and the BOJ

Following today’s FOMC meeting, the central banks of Japan, Switzerland, and the UK meet tomorrow. The SNB will keep its powder dry to be able to respond to the results of the UK referendum if needed. The Bank of England is also on hold. The outlook for the BOJ is more in dispute. The strength of the yen and deflationary pressures encourage some to look for Governor Kuroda to ease policy. In fact, a little more than...

Read More »FX Daily, June 14: Capital Markets Remain at UK Referendum’s Mercy

“The Swiss Franc was the strongest performer, EUR/CHF has fallen to 1.08 by 0.8%”. A spate of opinion polls showing a tilt toward Brexit, and the leading UK newspaper urging the Leave vote on the front page, keep the global capital markets on edge. Equities are lower, though of note ahead of the MSCI decision first thing Wednesday in Asia, Chinese shares eked out a small gain. Core bond yields are 4-5 bp lower, which...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org