Summary Impact of Brexit will take some time to be seen, but the U.K. is already losing influence. U.S. employment data is not sufficient to get the Fed to hike this month. Pressure continues to build on the BOJ to act. There have been two developments that are shaping investment climate. The first was the dramatic rally in equity markets last week, with many recovering nearly all that was lost on the Brexit...

Read More »Weekly speculative Positions: Bulls and Bears Saw Speculative Opportunity in Euros

In the sessions before and after the UK referendum speculators in the currency futures did three things. First, they generally reduced exposure.This means gross longs and short positions were reduced. Of the 16 gross speculative currency futures positions we track, 12 fell. Euro: Speculators were divided Second, speculators were divided about what to do with the euro. The bulls added 20.9k contracts to their gross long...

Read More »FX Weekly Review: June 27 – July 01: Swiss Franc Strength Reversed

Swiss Franc Currency Index The Swiss franc (-0.3%) and the yen (-0.5%) were the worst performers as so-called “safe haven” buying was reversed during the week after Brexit. But the Swiss Franc index is still stronger in the last month. Via Financial Times. Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance. On a three years interval, the Swiss...

Read More »Why the Fed Will Talk Down the Dollar

The Only Move for the Fed is Talking Down the Dollar The Fed has no more maneuvers other than to jawbone the dollar lower. Because for a variety of reasons a strong dollar, in the current market environment, is akin to tighter monetary policy. The Eccles Building US dollar index over the past 2 years And right now, in the wake of Brexit, tighter monetary policy is clearly not an option. Plus, a stronger dollar (by...

Read More »FX Daily, July 01: Markets Head Quietly into the Weekend

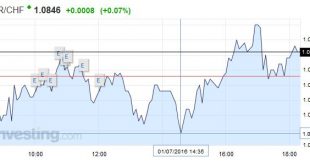

EUR/CHF stronger in Brexit week The EUR/CHF finished the week after Brexit with slight improvement of 0.18% (see the FX performance table below). The scare mongering by the Swiss media was misplaced. The euro even recovered from a dip after BoE governor Carney’s comments on Thursday. We do not see strong SNB interventions at this elevated price level. We judged that the interventions happened below 1.08. Click to...

Read More »FX Daily, June 30: Calm Continues, but Rot Below the Surface

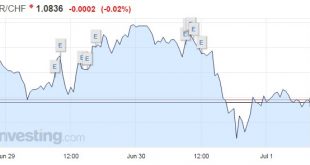

Swiss Franc During the weak the Swiss Franc lost momentum. It could regain speed only on June 30. The stronger Franc was initiated by remarks by BoE governor Carney. Sterling stayed on the defensive on Friday after unambiguously dovish comments from the Bank of England abruptly ended a tentative recovery in the currency, while the euro wobbled on speculation of more stimulus in Europe. Still trying to get over...

Read More »Great Graphic: What are UK Equities Doing?

Summary Domestic-oriented UK companies have been marked down. The outperformance by UK’s global companies is a negative view of sterling. The drop in interest rates is in anticipation of a recession and easier BOE policy. Some observers argue the media and some economists are exaggerating the impact of the UK vote a week ago. They talk about the petition for a second referendum. They about Scotland vetoing the...

Read More »FX Daily, June 29: Fragile Calm Ahead of Quarter-End

FX Rates No fundamental development can compare with the UK decision to leave the EU. It has set off a chain reaction whose outcome is still far from clear. Sterling is firm, alongside most of the major and emerging market currencies today. Sterling narrowly edged above yesterday’s highs to reach almost $1.3425 before encountering selling pressure. Click to enlarge. Equity fund managers may find themselves over...

Read More »FX Daily, June 28: Markets Stabilize on Turn Around Tuesday

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday’s; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today. Turnaround Tuesday after such dramatic price action over the last two sessions has the feel of the proverbial dead cat bounce. Brexit There has...

Read More »How Exceptional are Conditions?

Summary If conditions are exceptional, isn’t BOJ intervention more likely? If conditions are exceptional, the ban on European government supporting banks might not be valid. Italy is leading the charge in Europe. How exceptional are market developments? Much rests on the answer. If these are extraordinary circumstances, then Japanese intervention becomes more likely. Of course, Japanese policymakers have been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org