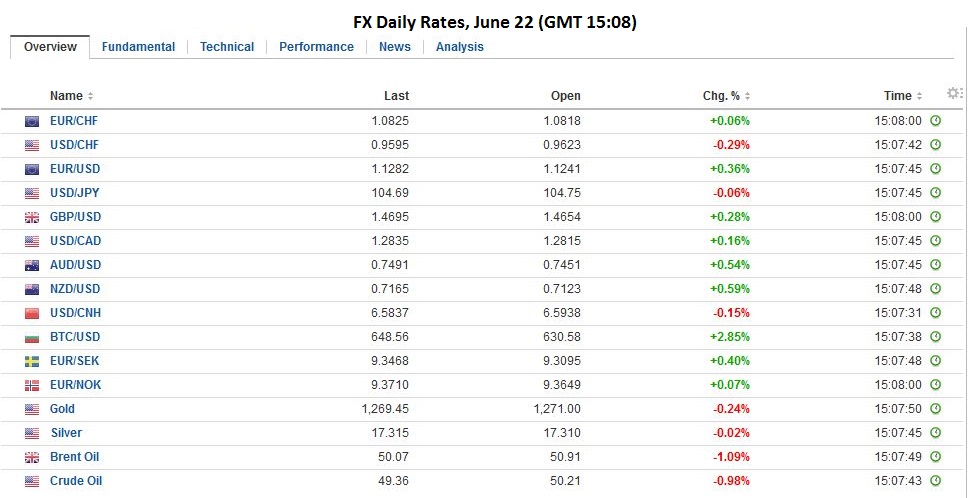

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The Financial Times poll of polls has it at 45%-44% in favor of Brexit. However, the betting markets appear to be telling a different story. Indicative prices suggest an 80% chance of a victory for the remain camp. The odds-makers have reportedly seen a strong shift toward the remain camp since June 14. The events market, PredictIt, also has seen the shift toward remain. A week ago, one had to “bet” 47 cents to get a if Brexit won. Now it costs 26 cents. Avg Probability of BREXIT Implied from Betting Odds FX Rates In the foreign exchange market, sterling is holding onto most of the gains it scored in the rush from .4010 on June 16 to nearly .4785 yesterday. The upside momentum has faded, and a consolidative tone has emerged. We would expect to see some more profit-taking on the idea that the new positions have been long sterling.

Topics:

Marc Chandler considers the following as important: Brexit, Chairman Fischer, Draghi, EUR, Featured, FX Daily, FX Trends, GBP, Janet Yellen, JPY, new paradigm, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Draghi did not promise new initiatives. Instead, he was referring to the fact that the impact of its current measures has not been fully felt. And how could they be? The corporate bond buying program just got underway. The second round of Targeted Long-Term Repo Operations get launched tomorrow. The ECB continues to expand its balance sheet by 80 bln euros a month.

If there is one currency that appears not to have been told about the shift toward the UK remaining in the EU is the Japanese yen. The dollar remains in its trough against the yen. Despite the outside session (engulfing pattern in candlesticks), there has been no follow through dollar buying. It now looks like yesterday’s punch through JPY105 exhausted the move. Now the greenback is struggling to get back above JPY104.60. If a risk-on follows a UK decision to remain in the EU, the yen looks rich.

The dollar-bloc currencies are firm. The Australian dollar continues to transverse a $0.7450-$0.7500 range. The New Zealand dollar is consolidating near yesterday’s highs, which were the best levels for the Kiwi since last June. The Canadian dollar is sidelined in a tight range. News that the API estimate showed a 5.2 mln barrel draw down of US crude inventories helping buoy oil prices may be helping to underpin the Loonie. The official DOE estimate will be reported in the NY morning. A 1.3 mln barrel draw was expected before the API estimate.

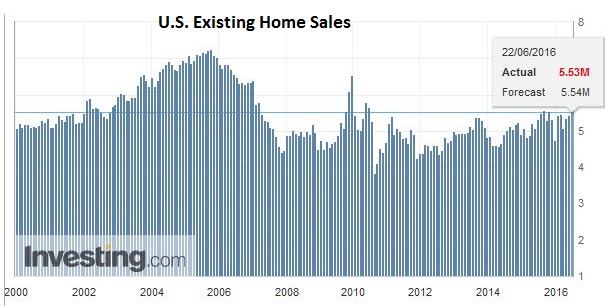

United StatesThe US also reports May existing home sales. Another small increase is expected; around April’s 1.7% rate. It is not a market-mover. Canada reports April retail sales. A healthy recovery from the 1.0% drop in March is expected. |

|

| Yellen faces questions today by the House Financial Service Committee. We do not see substantive differences between what Yellen said yesterday and her other recent remarks. |

The bar to a July hike does not appear to have changed. We see it as three-fold: stable global financial markets, a strong recovery in the pace of job growth (and ideally more wage pressure) and continued firm consumption. Vice Chairman Fischer also speaks today. He is participating in a panel at Sweden’s Riskbank conference. We continue to find it helpful to focus on the comments by the Fed’s leadership. This point is all the more important, given St.Louis Fed’s Bullard’s lone adoption of a “new paradigm”, which impact the median dot plot projections.