Oil prices reached their highest level in eleven months in the middle of last week. The front-month futures contract did not post a key reversal on June 9, but the continuation contract did. Since reaching almost $51.70 then, prices have pushed lower, with lower highs and lower lows. As this Great Graphic created on Bloomberg shows, a trendline drawn off the mid-February cyclical low, and hitting the early and...

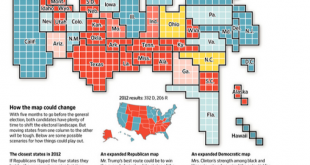

Read More »US Election Infographic

This infographic was in the Wall Street Journal on the US election. It is important to remember that the US does not elect the President by direct popular vote. This makes the national polls a bit misleading. There are 538 electoral college votes. To be elected a candidate must secure a majority or 270 electoral college votes. Obama received 332 elector votes and Romney 206. The WSJ cites four major...

Read More »FX Daily, June 13: Brexit Dominates

Swiss Franc Chandler is a bit puzzled about the Swiss Franc, that got stronger despite speculators being short CHF. We see weaker oil prices and weaker China as major reason, why sight deposits are falling and speculators are long the dollar. See the Dukascopy Video FX Rates The risk that the UK votes to leave the EU next week is the dominant force in the capital markets. It is a continuation of what was seen at...

Read More »Democratic Deficit: Is the UK Referendum the Tip of the Iceberg?

One of the most profound criticisms of the EU that it remains, even at this late date, primarily an elite project. The democratic deficit has grown, according to the latest Pew Research multi-country poll. The Pew Research survey covered ten countries that represent 80% of the EU28 population and 82% of the region’s GDP. The poll surveyed nearly 10.5k people between April 4 and May 12. It found that 2/3 of the both...

Read More »FX Weekly Preview: Four Central Bank Meetings and More

A couple of weeks ago, the four central banks that meet in the coming days were thought to be a big deal. Numerous Federal Reserve officials were preparing the market for a summer hike. Risks of a new downturn in Japan spurred speculation that BOJ would ease policy. On the other hand, the neither the Bank of England nor the Swiss National Bank were expected to move ahead of the UK referendum on June 23. Besides...

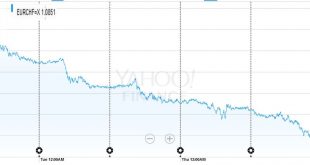

Read More »FX Weekly Review: June 06 – June 10: EUR/CHF Down 2%

EUR/CHF The SNB has about 280 billion CHF in euro. Hence the loss of 2% in the EUR/CHF rate will cost the SNB around 14 billion Swiss francs.We explained that the main reason for the stronger CHF was the bad Non Farm Payrolls Report in the United States. FX Rates June 06 to June 10, 2016 click to enlarge USD/CHF As Marc explains, the dollar recovered a bit in the second part of the week. Still enough so that the...

Read More »Weekly Speculative Positions after Uneventful ECB and Surprisingly Weak US Jobs

On the Swiss Franc: Price action shows a increase of the Swiss franc after the bad US payrolls report. Commitments of traders, however, indicate a move to a short CHF position of 9600 x 100k contracts against the dollar. Chandler: “Although Swiss franc speculative position adjustment was not large, it was counterintuitive. The market has been rife with talk of Swiss franc buying, and the euro-franc cross has fallen...

Read More »FX Daily, June 10: Yen and Swiss Franc maybe Drawing Support from Brexit Fears

Swiss Franc Once again, CHF is one of the strongest performers on the FX market. Next Monday we will report how much the Swiss National Bank had to intervene in our regular “Weekly SNB sight deposits” report. See the Dukascopy Video FX Rates The US dollar weakened in the first half of the week as participants continued to react to the shockingly poor jobs report and shift in Fed expectations. However, it...

Read More »Chart up-date: Stocks, Bonds, Copper, Gold

Well that escalated quickly…All-time highs within reach… everything is awesome…wait what… Quite a week: Gold +5.25% in last 2 weeks – best run in 4 months Silver +5.65% this week – best week since May 2015 Copper -4% this week to lowest weekly close since January Sterling -2.5% in last 2 weeks – worst drop in 3 months US Dollar Index +0.6% – up 7 of last 9 weeks 30Y Yields -21bps in last 8 days – best rally in 4...

Read More »Emerging Markets: What has Changed

China granted US asset managers a CNY250 bln ($38 bln) quota under the existing QFII system Bank of Korea surprised the market by delivering a 25 bp rate cut to 1.25% Oman issued its first global bond since 1997 Polish President Duda softened his CHF loan conversion plan Central Bank of Russia resumed its easing cycle with a 50 bp cut to 10.5% There appears to have been a significant change in FX strategy from the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org