Swiss Franc Currency Index The Swiss Franc continues its bad performance against the dollar index that started with Brexit. Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket) On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. The dollar makes up 40% of the SNB...

Read More »Weekly Speculation Positions: Bullish on Dollar and Dollar-Bloc

Speculators made several significant position adjustments in the CFTC reporting period ending 19 July. Swiss Franc Speculators reduced their long Swiss Franc position from 6.7K contracts to 4.7K contracts (against USD). The 2K was certainly smaller than the increase of 15K shorts in the euro (against USD) Euro The euro bears added to their gross short position for the fourth consecutive week and for...

Read More »FX Daily, July 22: Flash PMIs Show Brexit Impact Localized

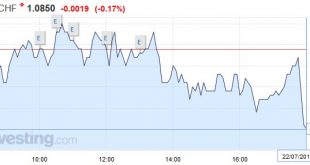

Swiss Franc The EUR/CHF ended lower today. Today’s data showed that Germany has stronger growth than the rest of the Eurozone. Given the strong Swiss trade ties with Germany, the Swiss franc appreciated. See more in Correlation between CHF and the German Economy Click to enlarge. FX Rates As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US...

Read More »FX Daily, July 21: Monetary Policy Expectations are Driving Foreign Exchange

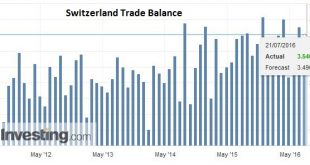

Swiss Franc The Swiss trade balance was published today, and once again, it remained close to record-high. For us, the trade balance is the most important indicator if a currency is fairly valued. Over the long-term the Swiss trade surplus must adjust towards zero, while the currency must appreciate. The consequence of the stronger currency is a higher purchasing power which leads to more spending and finally more...

Read More »Effective Fed Funds and Money Markets

Summary: Fed funds have been trading firmly. There are several reasons and one of them is the shift that is taking place in the US money markets. Still the risk of a Fed hike has increased, just as speculation increases of easing in other major centers. The weighted average of the Fed funds rate has edged higher. Following the Fed hike in December 2015, the Fed funds average around 36 bp in January before...

Read More »Draghi Does not Surprise and Euro Edges Away from $1.10

Summary: Draghi does not show the kind of urgency many bank economists do over the shortage of bonds to buy. Draghi kept options open and suggested a review in September when new staff forecasts are available and more data will be seen. The euro firmed, mostly it seemed on sell the rumor buy the fact, and/or possibly some disappointment that no fresh action was taken. Draghi said nothing that surprised the...

Read More »FX Daily, July 20: Sterling’s Jump Slows Dollar’s Ascent

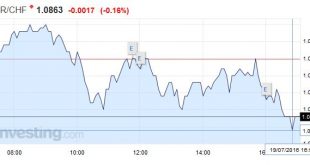

Swiss Franc The euro Swiss remains at relatively low levels, compared to the ones achieved in the recent risk-on enviornment. Click to enlarge. It is a bizarre turn of events. Just like the Game of Throne’s Westeros is a map of the UK put on top of an inverted Ireland, so too do UK events seem to be a strange permutation of the pre-referendum views. Although sterling and interest rates have not fully recovered...

Read More »Great Graphic: Aussie Approaches Two-Month Uptrend

Summary: Australian dollar is the second heaviest currency this week after a key downside reversal at the end of last week. It is approaching an uptrend line near $0.7450. Many perceive an increased likelihood that the RBA eases and many are reassessing chance of a Fed hike later this year. Australian dollar The Australian dollar recorded a key downside reversal last Friday (July 15) and had seen follow...

Read More »FX Daily, July 19: Dollar-Bloc Tumbles, but Euro and Yen Little Changed

Swiss Franc Click to enlarge. FX Rates The US dollar is sporting a firmer profile today, but it is not the driver. Heightened speculation that Australia and New Zealand may cut interest rates next month is pushing those respective currencies more than 1% lower today. The Canadian dollar is being dragged lower (~).5%0 in what looks to be primarily sympathy, but it had seemed vulnerable to us in any event....

Read More »Dollar Bull Case Intact: It is All About the Perspective

Summary: Our bullish dollar outlook was based on divergence and we judge it to still be intact. The Dollar Index has been trading broadly sideways since March 2015, but never did more than a minimum retacement of its earlier rally. The Dollar index is at it highest level since March today. Our underlying constructive outlook for the US dollar remains intact. It is broadly based on the divergence between the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org