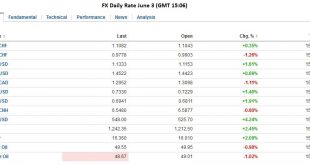

With the dismal jobs reports, speculators had to buy euro to cover their shorts (mostly against USD, but also against CHF). This led to a rising EUR/CHF on Friday. Today fundamental rules were valid again: In times of slow growth, the Swiss franc appreciates. Hence EUR/CHF was down by 49 bips. After the shellacking it took after the shockingly poor jobs data, the US dollar has only managed a shallow recovery...

Read More »Emerging Markets: Preview of the Week Ahead

EM ended the week on a firm note after the US jobs shocker. While we view the weak reading as a fluke, shifting market perceptions of Fed tightening risk should keep EM bid near-term. However, we think the July FOMC meeting is still very much alive. That and the upcoming Brexit vote are potential pitfalls for EM in the coming weeks. Meanwhile, oil prices shrugged off disappointment with OPEC inaction last week, with WTI oil remaining near $50 to close out the week. The central banks...

Read More »FX Weekly Preview: Macro Developments Will Not Stand in Way of Dollar Move Lower

Through the first part of the year, the swinging pendulum of expectations for the trajectory of Fed policy has been a major driver in the foreign exchange market. This is true even though the ECB and BOJ continue to ease monetary policy aggressively. The Australian and New Zealand dollars appear to influenced more by the shifting view of Fed policy than the expectations in some quarter that the RBA and RBNZ could cut interest rates as early as this week. Indeed, anticipation of Fed...

Read More »FX Weekly Review May 30 to June 3: Dollar’s Rally Ends with a Bang

EUR/CHF The massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank.Consequently the biggest short speculative position is in the euro, while traders are long CHF against USD. Click to expand USD/CHF After a relatively steady week, the dollar lost 130 bips on Friday. Click to expand Continued by Marc Chandler:...

Read More »Weekly Speculative Positions: Little Adjustment ahead of ECB and US Jobs

The Swiss Franc net position was reduced from 4.0 contracts long to 0.1 thousand contracts long. Apart from the yen., other speculative position barely changed. We are keen on next week’s data that should reflect the dismal US jobs report. Even recognizing a holiday-short week, speculative position adjustments were minor in the days before the ECB meeting and the US jobs report. There were no gross position adjustments that met the 10k contract threshold. The largest gross...

Read More »Emerging Markets: What has Changed

Local press is reporting that RBI Governor Rajan does not want to serve another term The incoming Philippine government is signaling looser fiscal policies ahead Polish President Duda’s team of experts may present several plans for consideration A second cabinet minister in Brazil was forced to resign Colombia eliminated its FX intervention program The IMF boosted Mexico’s Flexible Credit Line (FCL) from $67 bln to $88 bln Equities In the EM equity space, China (+4.1%), Brazil...

Read More »FX Daily, June 3: FX Market Shocked by Non-Farm Payrolls

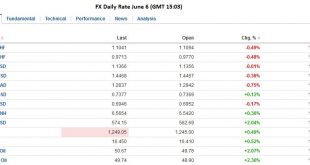

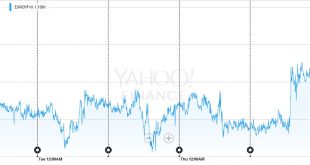

Surprise NFP visible in FX rates The massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank.Consequently the biggest short speculative position is in the euro, while traders are long CHF against USD. The dollar lost 2% against the yen, 1.6% against the euro and 1.3% vs. the Swiss franc. Click to enlarge. Longer term...

Read More »Three Political Events before the UK Referendum

“Every thinking person in America is going to vote for you Governor Stevenson,” said an enthusiastic voter.“I am afraid that won’t do. I need a majority,” reportedly quipped Stevenson (1952 or 1956). The UK referendum on June 23 is the most important political event of the first half of the year. A decision to leave could be a significant disruptive force. No one knows for sure. It is precisely that uncertainty that is fueling the demand for insurance in the options market that...

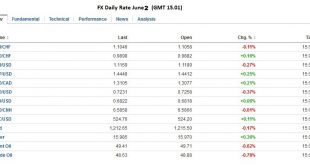

Read More »FX Daily, June 2: Greenback Mostly Softer Ahead of ECB and ADP

The US dollar remains under pressure. It is off for the third day against the yen and slipped below JPY109 for the first time in a little more than two weeks. The Nikkei struggled to cope with the foreign exchange developments, lost 2.3%, the most in a month, after gapping lower. At JPY108.50, the dollar would have given back 50% of its rally off the May 3 low near JPY105.50. Below there, the JPY107.80 is the 61.8% retracement. The euro is north of $1.12 after having briefly...

Read More »Can OPEC Surprise?

OPEC ministers meet in Vienna tomorrow. Expectations could hardly be lower. Attempts to agree on an output freeze were stymied by the Saudi’s insistence that is rival Iran participates as well. Iran cannot agree to limit its production yet, or it would have sacrificed (or postponed) it nuclear program for nought. Many observers have announced the death of OPEC. The Saudi’s refusal in 2014 to continue to act as the swing producer, coupled with the rise of non-OPEC production,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org