Major data this week: German Constitutional Court ruling on OMT. UK referendum. EMU flash PMI. ECB TLTRO II launch. Yellen testifies before Congress, RBI Rajan to step down in early Sept. The Chair of the Federal Reserve testifies before Congress on Tuesday and Wednesday. Given the recent FOMC meeting and Yellen’s press conference, it is unlikely new ground will be broken. It is difficult for the market to price out a July hike more than it already has done. The August Fed funds futures contract, which offers the clearest read on the July 26-27 FOMC meeting, has two of a possible 25 bp hike (which is the same as a 12.5% chance). It is still early in the month, and there is not much data for this month. What data there is has not been particularly encouraging. Weekly jobless claims are relatively elevated. The Philly Fed June survey showed deterioration of the labor market and the Empire State manufacturing survey’s diffusion index was at zero, suggesting that the number of firms increasing and decreasing their workforces was the same. United States Instead of US-centric drivers, the week ahead is the most important of the year and dominated by events in Europe. Of course, the UK referendum on June 23 is the big event that has sent ripples through the global capital markets.

Topics:

Marc Chandler considers the following as important: Brexit, Featured, FX Trends, GBP, Germany, India, Janet Yellen, Jo Cox, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Major data this week:

German Constitutional Court ruling on OMT.

UK referendum.

EMU flash PMI.

ECB TLTRO II launch.

Yellen testifies before Congress, RBI Rajan to step down in early Sept.

The Chair of the Federal Reserve testifies before Congress on Tuesday and Wednesday. Given the recent FOMC meeting and Yellen’s press conference, it is unlikely new ground will be broken. It is difficult for the market to price out a July hike more than it already has done.

The August Fed funds futures contract, which offers the clearest read on the July 26-27 FOMC meeting, has two of a possible 25 bp hike (which is the same as a 12.5% chance). It is still early in the month, and there is not much data for this month. What data there is has not been particularly encouraging. Weekly jobless claims are relatively elevated. The Philly Fed June survey showed deterioration of the labor market and the Empire State manufacturing survey’s diffusion index was at zero, suggesting that the number of firms increasing and decreasing their workforces was the same.

United StatesInstead of US-centric drivers, the week ahead is the most important of the year and dominated by events in Europe. Of course, the UK referendum on June 23 is the big event that has sent ripples through the global capital markets. It is still not clear how the murder of UK MP Jo Cox is going to impact the vote. The first poll fully conducted after Cox’s death found a shift toward remaining in the EU. |

|

The Survation telephone poll on June 18-19 for the Mail found 45% favor remain and 42% want to leave. This is a reversal of Survation’s previous poll. Separately, a YouGov poll for the Sunday Times of which a 2/3 was conducted after Cox’s assassination, showed 44% want to remain part of the EU and 43% want to leave.

The betting has edged in favor or remain and so have the event markets. The bookmakers have widened the odds of Brexit. At the peak last week, one had to wager 47 cents (to win $1) at PredictIt for Brexit. Now an exit wager can be made for 36 cents.

Regardless of the outcome, participant must be prepared for a dramatic reaction in the markets. In the futures market, the net speculative positioning has changed very little over the last couple of weeks (short almost 37k futures contracts), but the size of the gross long and short positions have increased by roughly 30k contracts since the end of last month.

There are nearly 400 local vote counting centers. The polls are open until 10:00 BST (5 pm EST). Although early market reaction is often faded, what may not be widely realized, but some large pools of capital are believed to be paying for their own private exit polls. This is important. This private information gives an obvious edge. A sense of the official results, even if not 100%, will likely be known between 3-5 am BST, which is late-Thursday night in NY, where many market participants are expected to be manning their phones/computers. It is understood that the central banks will provide extra liquidity for the markets as needed.

It is not clear that a vote to remain in the EU will avoid a political crisis in the UK. The Tory Party has been torn asunder. The future of UKIP is not clear. The Labour Party is not in a particularly strong position to push for advantage.

Many think that a UK vote to leave could precipitate a broader crisis in the EU, and especially EMU. European leaders are cognizant of this and some sort of new initiative could be forthcoming. Some more integrated security and defense area activities are perhaps relatively low hanging political fruit. There seems to be less recognition that the EU will negotiate any divorce under the harshest of terms to avoid the dissolution of other marriages. What some said of Grexit would by political necessity (and not because of a particular personality) is applicable for Brexit.

It is important to keep in mind that the UK is a member of the WTO, which comes with reciprocal rights and responsibilities. However, the WTO is not comprehensive. It is stronger on trade in goods, for which the UK runs a trade deficit. It is weaker, and therefore the trade is more vulnerable, on services, which the UK runs a surplus. The UK remains a member of the United Nations, and has a veto in the Security Council. However, many other agreements that the UK is engaged are a function of being the in European Union.

The optimists talk about a two-year negotiating process. The pessimists warn of a much longer process. In any event, Brexit would not necessarily trigger an immediate drop in economic activity as some of the scar-tactic claimed. Rather it would likely be more like a debilitating illness. It would impact decisions about the future, like staffing, investment, expansion, etc. However, the market for capital adjusts quicker, and, of course, can have an impact on the real economy.

Reports indicate, for example, in the week ending June 15, $1.1 bln of UK equities were liquidated by global investors, which is the second highest weekly outflow recorded. It was the eighth week of net sales. Lipper estimates that the assets under management of the UK fund industry has fallen by a GBP200 bln to GBP900 bln over the past twelve months. Outflows from the equities have been recorded in eight of the past nine months, while outflows from UK strategic bond funds has not missed a month. Apparently, some of savings have been drawn to the absolute return funds. Under what conditions will they return? It suggests that volatility will likely remain elevated for a bit longer, even if not as high as seen recently.

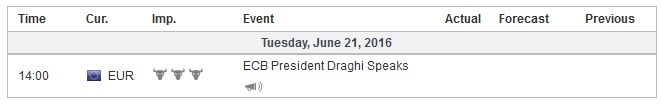

| Two days before the UK referendum, on June 21 the German Constitutional Court will hand down its decision on whether the Bundesbank’s participation in the ECB’s Outright Market Transactions would violate the German constitution. The European Court of Justice, who the German court initially deferred issues of whether OMT violates EU law or the ECB’s mandate, ruled in the central bank’s favor. |  |

Although OMT has been largely superseded by QE, if the German Court finds that it violates German law, it could trigger a crisis. Such a decision would expose a fundamental contradiction between German law and EU law. It would reinvigorate efforts to challenge the (German) constitutionality of QE’s sovereign and corporate bond purchases. Without putting too fine of a point on it, such a decision would open a can of worms which could very well overwhelm the capabilities of the current political leadership given their respective domestic challenges.

We brought this to your attention before the weekend. It does not appear on many economic calendars. There may be only a low probability that the German court reads the German constitution in such a way that challenges what Germany and the Bundesbank can do in the EU in such a direct way. However, it is precisely these kind of low probability high risk events that investors need to be aware.

As the UK goes to the polls, the eurozone will report flash June PMI readings. The ECB has acknowledged, and market economists appear to agree, the eurozone economy is slowing from the heady 0.6% growth in Q1. Growth in Q2 looks to be closer to 0.4%, which for the euro area is close to trend growth. The periphery appears to be slowing more than the core. This means that the risk is for the final PMI to be lower than the flash reading.

As the markets respond on June 24 to the results of the UK referendum, the ECB is expected to launch the first leg of its second round to Targeted Long-Term Repo Operations. The key issue is the size of the take-down or participation. However, the challenge will be to separate the new demand from the rolling over of existing borrowings under previous TLTRO programs. There is an estimated 423 bln euros of outstanding TLTRO borrowings.

The real new demand is expected to be minimal, even if the headline is in the 300-400 bln euro range. At first TLTRO is September 2014, 82 bln euros was borrowed, a small fraction of what was on tap. The issue behind the weak lending figures in the eurozone is not that rates are high or that the banks lack sufficient funds or proper incentives. To the extent that demand is sluggish, more and cheaper funds are not the solution.

The success of the program cannot be simply measured by the amount of new funds provided.The ECB says that its evaluation will focus on improvement of financial conditions, not on size. The TLTRO program can serve a backstop for banks, insuring that sufficient funds are available if needed. In addition, for those banks that doe participate, the possibility of securing funds as cheap asminus40 bp compensates the banks for the charge on extra reserves. Peripheral banks, especially in Italy and Spain, are expected to be the biggest participants.

Lastly we note that global investors will likely to express their disappointment with news over the weekend that the Governor of India’s central bank Rajan will step down at the end of his term in early September. There have been indications over the last couple of weeks that Rajan might do this, and it has weighed on the currency and bonds. Rajan’s tight monetary policy has come under criticism of some key government officials. There also have been reports of Rajan’s desire to leave and return to academia.

Since the start of June when such reports began circulating, the rupee’s 0.25% gain is among the least in emerging markets. It is better than only the pegged Hong Kong dollar (0.15%), the Chinese yuan (-0.02%), and the Mexican peso (-2%). Indian stocks have fared alright in the sense that they are little changed, while the MSCI Asia Pacific Index is off nearly 1.5% so far this month and the MSCI Emerging Market equity index is off around 0.25%. India’s benchmark 10-year bond yield has risen three basis points this month, while most yields are lower.