Summary: This technical pattern is most often a reversal pattern, but not always. It may be a continuation pattern in the dollar against the yen. It highlights the importance of the JPY100 level and warns of risk toward JPY92.50. It aligns well with the sequence of macro events. This Great Graphic was created on Bloomberg. I use it to illustrate a possible head and shoulder pattern that has been carved by the...

Read More »FX Daily, August 16: Dollar Slumps, but Driver may Not be so Obvious

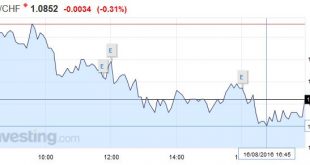

Swiss Franc Click to enlarge. FX Rates The US dollar is being sold across the board today. The US Dollar Index is off 0.65% late in the European morning, which, if sustained, would make it the largest drop in two weeks. The proximate cause being cited by participants and the media is weak US data that is prompting a Fed re-think. However, we are a bit skeptical. It is not that the US data has been strong, or that...

Read More »Will Ireland Be First Country In World To See Bail-in Regime?

Deposit bail-in risks are slowly being realised in Ireland, after it emerged overnight that FBD, one of Ireland’s largest insurance companies, have been moving cash out of Irish bank deposits and into bonds. Revelations regarding deposit bail-in risks came in the wake of warnings of a new property crash centred on the housing market in Ireland. The former deputy governor of the Central Bank warned in an op-ed in a...

Read More »Retail Snails

Second Half Recovery Dented by “Resurgent Consumer” We normally don’t comment in real time on individual economic data releases. Generally we believe it makes more sense to occasionally look at a bigger picture overview, once at least some of the inevitable revisions have been made. The update we posted last week (“US Economy, Something is Not Right”) is an example. We’ll make an exception today though. Our friend...

Read More »FX Daily, August 15: Dollar Eases to Start the New Week

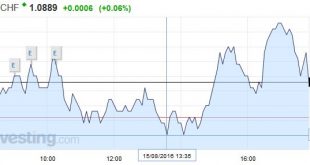

Swiss Franc The Swiss Franc was nearly unchanged against the euro. Click to enlarge. FX Rates The US dollar closed the pre-weekend session well off its lows that were seen in response to the disappointing retail sales report. It has been unable to sustain the upside momentum, and as North American dealers prepare to return to their posts, it is trading lower against most of the major currencies. The notable...

Read More »Bretton Woods: RIP

Summary: Some romanticists want to have another Bretton Woods fixed exchange rate regime. Bretton Woods had difficulty from nearly the day it went operational. It is misguided to think a new rigid regime is needed or is appropriate. Today is the anniversary of the final blow to the dollar-gold standard. By August 15, 1971, the exchange of dollars for gold was limited to central banks, and US President...

Read More »Swiss Producer and Import Price Index, July 2016: +0.1 percent MoM, -0.8 percent YoY

15.08.2016 09:15 – FSO, Prices (0353-1607-50) The Producer Price Index or officially named “Producer and Import Price Index” describes how the changes in price for producers and importers. For us it interesting because it is used in the formula for the Real Effective Exchange Rate. I When producers and importers profit on lower prices (compared to other countries), then the Swiss Franc reduces its overvaluation. In...

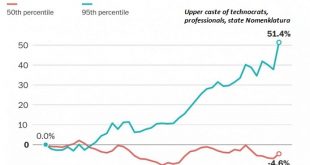

Read More »Why Wages Have Stagnated–and Will Continue to Stagnate

The only way to reverse declines in labor participation and stagnation in wages and demand is to make it easier to start enterprises and hire people. Mainstream economists are mystified why wages/salaries are still stagnant after 7+ years of growth / “recovery.” The conventional view is that wages should be rising as the labor market tightens (i.e. the unemployment rate is low) and demand for workers increases in an...

Read More »The Great Stock Market Swindle

Short Circuited Feedback Loops Finding and filling gaps in the market is one avenue for entrepreneurial success. Obviously, the first to tap into an unmet consumer demand can unlock massive profits. But unless there’s some comparative advantage, competition will quickly commoditize the market and profit margins will decline to just above breakeven. Unfortunately, finding and filling gaps in the market is much easier...

Read More »Insanity, Oddities and Dark Clouds in Credit-Land

Insanity Rules Bond markets are certainly displaying a lot of enthusiasm at the moment – and it doesn’t matter which bonds one looks at, as the famous “hunt for yield” continues to obliterate interest returns across the board like a steamroller. Corporate and government debt have been soaring for years, but investor appetite for such debt has evidently grown even more. A huge mountain of interest-free risk has...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org