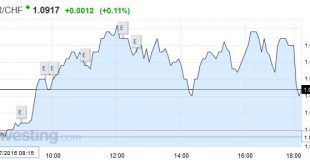

Swiss Franc The Euro kept on climbing, after yesterday’s rapid rise. Click to enlarge. The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. Switzerland UBS Consumption Indicator Japan As uncertainty over Japan’s fiscal stimulus roiled the yen and domestic...

Read More »UBS Consumption Indicator: Summer tourism inspires confidence

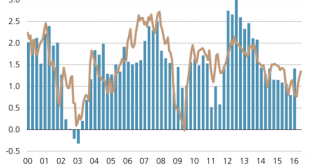

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. In June, the UBS consumption indicator rose from 1.24 to 1.34 points. This was mainly due to a better performance in the tourism industry as well as a slight improvement in sentiment in the retail trade....

Read More »Oil and Economy Pull the Canadian Dollar Lower

Summary: The decline in oil prices is a factor weighing on the Canadian dollar. US premium over Canada is rising, and may continue as the economies diverge. The general risk appetite is supportive for the Canadian dollar. Our informal and simple model for the Canadian dollar has three variables. Oil, interest rates, and general risk environment. Over time, the coefficient of the variables can and do change....

Read More »Props to Armani!

Champion of the Downtrodden? “Democracy is the theory that the common people know what they want, and deserve to get it good and hard.” – H.L. Mencken A mass e-mail has been making the rounds lately, and it is quite possible that many of our readers have already seen this. For those who haven’t, we wanted to share this moment of hilarity provided to us by Deep State candidate Hillary Clinton. It revolves around...

Read More »Why a “Dollar” Should Only Be a Name for a Unit of Gold

Once Upon a Time… Prior to 1933, the name “dollar” was used to refer to a unit of gold that had a weight of 23.22 grains. Since there are 480 grains in one ounce, this means that the name dollar also stood for 0.048 ounce of gold. This in turn, means that one ounce of gold referred to $20.67. Now, $20.67 is not the price of one ounce of gold in terms of dollars as popular thinking has it, for there is no such entity...

Read More »Great Graphic: How the US Recovery Stacks Up

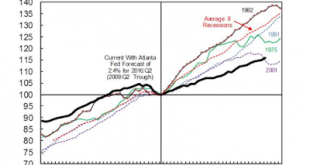

Summary: The US recovery may have surpassed the 2001 recovery in Q2. Though disappointing, the recovery has been faster than average from a balance sheet crisis. Although slow, it is hard to see the secular stagnation in the data. This Great Graphic was tweeted Alan Kruger (@Alan_Kruger). Drawing on official data and the Atlanta Fed’s GDP Now tracker for Q2 GDP (2.4%), it shows the current business cycle in...

Read More »A Nation of Crooks?

Apples to Oranges Either we’re doing something wrong or we’ve got the most criminal population on the planet. – Senator and 2016 presidential candidate Jim Webb PARIS – The stock market seemed chilled last week, like a corpse waiting for an autopsy. Monday morning, gold was falling in Europe… as investors anticipate a higher dollar. But we’ll return to the markets, the dollar and the absurdities wrought by our...

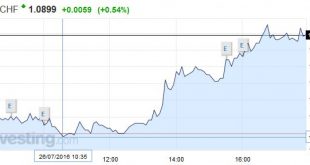

Read More »FX Daily, July 26: Strange Day: Yen Soars , Swissie Falls

Swiss Franc The Swiss Franc strangely depreciated on a day, when the other safe-haven, the yen strongly improved. The euro went up to 1.0899 by 0.54%. The reason seems to be technical. USD/CHF Finally over 200DMA? After USD/CHF broke the 200 days moving average (0.9854), and a descending channel since November 2015. This break could lead to a new pattern building. If the SNB has sustained the rise with some...

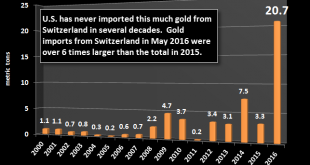

Read More »Record Swiss Gold Flow Into The United States

Submitted by the SRSrocco Report Record Swiss Gold Flow Into The United States There was a huge trend change in U.S. gold investment in May. Something quite extraordinary took place which hasn’t happened for several decades. While Switzerland has been a major source of U.S. gold exports for many years, the tables turned in May as the Swiss exported a record amount of gold to the United States. How much gold? A...

Read More »Fed to Stand Pat, but Statement may be More Constructive

Summary: The Fed’s nervousness in June has likely largely eased on the back of better economic data and stable international climate. The Fed may reintroduce its risk assessment. Who are the possible dissents? The Federal Reserve’s two-day meeting concludes tomorrow. There is little doubt that it will stand pat. There is not press conference afterward, so the statement is the only thing investors will get....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org