Click to see video. I was invited to appear on CNBC Asia Rundown show with Pauline Chiou. We discuss the Chinese yuan on the anniversary of last summer’s unexpected devaluation. I suggest that most of the things that get observers excited, like the internationalization of the yuan, or the Hong Kong-Shanghai link or, perhaps by the end of the year,a Hong Kong-Shenzhen link are really Chinese machinations that...

Read More »Trump’s Tax Plan, Clinton Corruption and Mainstream Media Propaganda

Fake Money, Fake Capital OUZILLY, France – Little change in the markets on Monday. We are in the middle of vacation season. Who wants to think too much about the stock market? Not us! Yesterday, Republican presidential candidate Donald Trump promised to reform the U.S. tax system. His proposals are nothing new – simplification, fewer brackets, eliminate loopholes for rich people. But he also targeted the “carried...

Read More »Swiss Nominal Wages to Rise by 0.8 Percent

Via Google Translate and some improvements: In the pharmaceutical industry, which is well under way, the salaries should increase by at least 1 percent. (Image: Simon Tanner / NZZ) The unions are demanding higher salaries for next year. However, gains are realistic only in individual sectors. In addition, can be expected in Switzerland with a lower purchasing power gain. The workers umbrella organization Travail...

Read More »FX Daily, August 10: FX Consolidation Resolved in Favor of Weaker US Dollar

Swiss Franc Click to enlarge. FX Rates European bourses are mixed, and this is leaving the Dow Jones Stoxx 600 practically unchanged in late-European morning turnover. Financials are the strongest sector (+0.4%), and within it, the insurance sector is leading with a 0.8% advance and banks are up 0.4%. The FTSE’s Italian bank index is up 1.4% to extend its recovery into a fifth session. Bond markets are broadly...

Read More »Great Graphic: Bullish Emerging Market Equity Index

Summary: Liquidity rather than intrinsic value seems to be driving EM assets. MSCI EM equity index looks constructive technically. The chart pattern suggests scope for around 13% gains from here. Scratch an investor, and you will find two models. One is a fair value model, perhaps based on free-cash-flow or earnings expectations, or breakup value. The other is based on liquidity. We suspect that the latter...

Read More »No Fines for Iberia, but Remedial Action Demanded and Possible Loss of Some ESI Funds

Summary: Spain and Portugal need to make some relatively small budget adjustments or will be denied some transfer payments. Spain’s political situation is fluid, but another window of opportunity to break the logjam is at hand. The euro seems immune to these fiscal developments; some retracement objectives are in sight. The eurozone finance ministers have accepted the EC’s recommendation that Spain and...

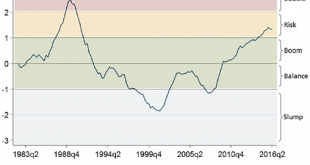

Read More »Real Estate Bubble Index continues falling, Still in Risk Zone

The UBS Swiss Real Estate Bubble Index nudged down in 2Q 2016 to 1.32 points and thus remains in the risk zone. This second drop in a row was due to house prices falling in real terms and the declining momentum of mortgage growth. Investments in real estate remain popular due to low interest rates. Zurich, 10 August 2016 – The UBS Swiss Real Estate Bubble Index was in the risk zone in 2Q 2016 at 1.32 index points....

Read More »Real vs. Nominal Interest Rates

Calculation Problem What is the real interest rate? It is the nominal rate minus the inflation rate. This is a problematic idea. Let’s drill deeper into what they mean by inflation. You can’t add apples and oranges, or so the old expression claims. However, economists insist that you can average the prices of apples, oranges, oil, rent, and a ski trip at St. Moritz. This is despite problems that prevent them from...

Read More »The Fabian Society and the Gradual Rise of Statist Socialism

The “Third Way” “Stealth, intrigue, subversion, and the deception of never calling socialism by its right name” – George Bernard Shaw The Brexit referendum has revealed the existence of a deep polarization in British politics. Apart from the public faces of the opposing campaigns, there were however also undisclosed parties with a vested interest which few people have heard about. And yet, they have been...

Read More »Another Serious Real Interest Rate Fallacy

What is the real interest rate? It is the nominal rate minus the inflation rate. I previously wrote about one problem with this notion (the nominal rate exists in the market, but the real rate is imaginary). Now let’s turn to another problem. To visualize this problem, let’s make an analogy to someone who inherits a family farm. There are two approaches to making a living from a farm. In the first—we’ll call this...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org