Summary: Service prices are rising, while goods prices have steadily fallen. Non-durable goods prices are stabilizing, while durable goods prices are still falling. The decline in durable goods prices is an important economic development. The rust line is service prices. They are steadily increasing. No deflation or disinflation here. Think about rent, medical services, education, and entertainment. The three...

Read More »Abe’s Fiscal Policy: More of the Same

Summary: Japan’s fiscal stimulus if smaller than it appear and is unlikely to boost the economy as much as officials may think. The problem in Japan is not that interest rates are too high or that pubic investment is too weak. The risk is that the yen strengthens further, and we suggest the dollar may fall toward JPY94.60. The Japanese government is delivering the other half of its fiscal policy today....

Read More »Silver Kangaroo Coins – Sales Surge To Over 10 Million

Silver kangaroo coins have seen sales surge to over 10 million coins which is double the expected demand for the year. Silver Kangaroo Coins 1 oz (2016) Introduced to the market less than 11 months ago in September 2015 at a launch attended by GoldCore, sales of the new release Perth Mint’s 2016 Australian Kangaroo 1 ounce silver bullion coin were anticipated to reach 5 million coins in their introductory first year....

Read More »Swiss Retail Sales -4.6 percent nominal (YoY) and -3.9 percent real (YoY)

02.08.2016 09:15 – FSO, Economic Surveys (0353-1607-20) The Used Goods Question Retail sales in several countries like Germany, Italy, Japan and Switzerland continue to fall. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans...

Read More »FX Daily, August 01: Dog Days of August Begin

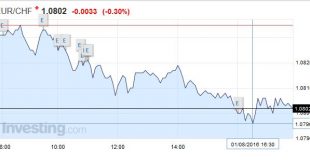

Swiss Franc Click to enlarge. FX Rates The US dollar is trading with a small upside bias in narrow trading ranges. The main news has consisted of PMI reports, while investors continue to digest last week’s developments. In particular the BOJ’s underwhelming response to poor economic data and a missed opportunity to reinforce the fiscal stimulus, and the dismal US GDP. The dollar has been pinned today in the lower...

Read More »Great Graphic: Real Broad Trade-Weighted Dollar

Summary: The real broad trade-weighted dollar index rose in July for the third month. It peaked in January above trendline drawn through the Reagan and Clinton dollar rallies. Expect the trendline to be violated again before the end of the year. This Great Graphic, created on Bloomberg, depicts the Federal Reserve’s real broad trade-weighted index of the dollar. Real means that it is adjusted for inflation...

Read More »No Big Thoughts, but Several Smaller Observations

Summary: Notable that as the CRB Index moves lower, MSCI emerging market equities have done well. European banks are retreating after the stress test results. Tokyo elected its first women governor as this seem to be in part a sign of protest against Abe. August has begun off with clear price action. The US dollar is stronger against nearly all the major currencies. Bond yields are higher. Equities and...

Read More »The Helicopter Mortgage

Medical vs. Financial Engineering I broke my elbow a month ago, pretty badly as I was told. The surgeon screwed the pieces back together, using a steel alloy bracket and six screws. Two hours later, I left the hospital with no cast, a bandage (just to cover a very ugly scar), a prescription for painkillers and therapy started a week later. What would have happened if I had suffered the same accident in 1975? The...

Read More »Switzerland has world’s priciest Big Macs. So eat Swiss chocolate instead.

The Economist invented the Big Mac index in 1986 as a tongue-in-cheek guide to currency valuations. Because the well-known burger is the same throughout much of the world, the magazine thought it could be used as a measure of how over or undervalued a currency was. An overpriced burger suggests an overvalued currency and a cheap one an undervalued currency. As it did last year, Switzerland topped the chart this year...

Read More »The Dollar Is Going to 1/10,000 Ounce – One Day

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. An image from the future: the US dollar, which one of these days is going to sink. Alas, there is many a slip ‘twixt the cup and the lip… Image via pinterest.com The Long Term vs. Trading Ideas The price of gold was up about thirty bucks this week. The price of silver was up almost seventy cents. Last week, a reader...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org