No CPI Change Several ill-defined economic data points were unveiled this week. Namely, the Labor Department’s July consumer price index report. According to the government data, on whole, consumer prices for the month didn’t change one iota. Reportedly, energy prices went down, food prices were unchanged, and all other items slightly increased. So when the official number crunchers tallied them all up, the...

Read More »Should we Be Concerned About the Fall in Money Velocity?

Alarmed Experts A fall in the US velocity of money M2 to 1.44 in June from 1.51 in June last year and 2.2 in May 1997 has alarmed many experts. Note that the June figure is the lowest since January 1959. Some commentators are of the view that this points to a severe liquidity crunch, which could culminate in a massive stock market collapse and an economic disaster in the months ahead. Money velocity is widely...

Read More »Does the UK Need Even More Stimulus?

AEP Speaks for Himself “We are all Keynesians now, so let’s get fiscal.” This is one view according to Ambrose Evans-Pritchard from The Telegraph who believes the time is right for the UK government to loosen its fiscal stance. He suggests that the “Bank of England has done everything possible under the constraints of monetary orthodoxy to cushion the Brexit shock. It is now up to the British government to save the...

Read More »Don’t Expect a Return to a Gold Standard Any Time Soon

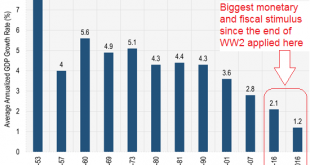

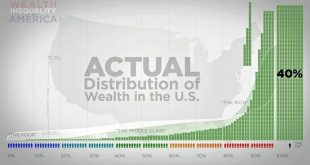

Lies and Distortions Despite trillions of paper currency units poured into the world economies since the start of the financial crisis, there has been no recovery, in fact, all legitimate indicators have shown worsening conditions except, of course, for the pocketbooks of the politically – connected financial elites. Economy is “Recovering” at its Slowest Pace Since WW2 A comparison of average annual GDP growth in...

Read More »FX Daily, August 22: Fischer Joins Dudley; Waiting for Yellen

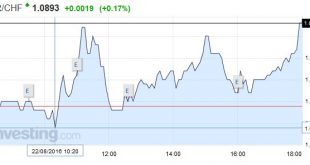

Swiss Franc As usual, when discussions about rate hikes go on, then both the dollar and the euro gain against the Swiss Franc. Click to enlarge. Federal Reserve Last week, some market participants were giving more credence to what seemed like dovish FOMC minutes than to NY Fed President Dudley’s remarks that accused investors of complacency over the outlook for rates. Yesterday, Vice-Chairman of the Federal Reserve...

Read More »FX Weekly Preview: Yellen at Jackson Hole

Lastly, a brief word about next week. I will not post my usual piece on macro considerations on Sunday. Here, though, is a brief thumbnail sketch of the top five things I will be watching: 1. Yellen at Jackson Hole at the end of next week: To the extent that she shares her assessment of the economy, I would expect to largely echo the broad sentiment expressed by NY Fed President Dudley. Click to enlarge. 2....

Read More »Swiss Labour Force Survey in 2nd quarter 2016: labour supply: 1.6percent increase in number of employed persons; unemployment rate based on ILO definition rises slightly to 4.3percent

18.08.2016 09:15 – FSO, Labour Force (0353-1607-60) Swiss Labour Force Survey in 2nd quarter 2016: labour supply 1.6% increase in number of employed persons; unemployment rate based on ILO definition rises slightly to 4.3% Neuchâtel, 18.08.2016 (FSO) – The number of employed persons in Switzerland rose by 1.6% between the 2nd quarter 2015 and the 2nd quarter 2016. During the same period, the unemployment rate as...

Read More »The Deep State’s Catch-22

What happens if the Deep State pursues the usual pathological path of increasing repression? The system it feeds on decays and collapses. Catch-22 (from the 1961 novel set in World War II Catch-22) has several shades of meaning (bureaucratic absurdity, for example), but at heart it is a self-referential paradox: you must be insane to be excused from flying your mission, but requesting to be excused by reason of...

Read More »Emerging Markets: Preview of the Week Ahead

EM ended last week on a soft note. Fed tightening expectations were buffeted first by hawkish Dudley comments and then by the more balanced FOMC minutes. On net, the markets adjusted the odds for tightening by year-end a little higher from the previous week, and stand at the highest odds since the Brexit vote. Yet despite the strong jobs data in June and July, odds of a move on September 21 or November 2 are...

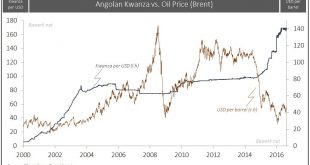

Read More »The Dos Santos Succession Saga

Arguably one of the easier calls for us to make after 37 years in power was that President dos Santos would find ways of affording himself another 5 years in. Like any ‘effective’ leader, Mr. Santos made sure the final deal to do just that was stitched up long before the Party Congress formally convenes in Luanda, with a lower level MPLA ‘Central Committee’ already rubber stamping his name in mid-August. That also...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org