[unable to retrieve full-text content]One of my reading projects over the past year is to learn more about empires:how they are established, why they endure and why they crumble. To this end, I've recently read seven books on a wide variety of empires. The literature on empires is vast, so this is only a tiny slice of the available books. Nonetheless I think these 7 titles offer a fairly comprehensive spectrum:

Read More »Incrementum Advisory Board Meeting, July 2016

Quarterly meeting of the Incrementum Fund The quarterly meeting of the Incrementum Fund’s advisory board was held on July 19. A pdf transcript of the discussion can be downloaded via the link below. We were once again joined by special guest Brent Johnson, the CEO of Santiago Capital. When Will the Helicopter Take Off? This time the debate revolved around the threat of “helicopter money”, which has become a lot...

Read More »Party Like It’s 1999

The War on Moles OUZILLY, France – The farther you get from the big city, or the international press… the closer you get to reality. The myth and claptrap disappears as distance shortens. Imagination gives way to fact. Gone is global warming, for instance. Instead, you find – as we did when we drove to Nova Scotia for a summer holiday in the 1990s – that it will be “75 degrees in Halifax again today… No relief in...

Read More »What Are the Odds that the 2020-2022 Olympics Will Be Cancelled?

It’s tough to pay for an Olympics when 95% of your supposed “wealth” has vanished. In the modern era (1896-present), the Olympics have only been cancelled in wartime: 1916 (World War I), 1940 and 1944 (World War II). But world war is not the only circumstance that could derail the Olympics; a global crisis in energy, finance or geopolitics could send the risks and costs of the Olympics beyond the reach of most...

Read More »Gold Trends: The Myth of Leverage

Mining Stocks, Gold Prices and Commodity Price Trends Gold has gone up >400% over the last 16 years. Ironically, it is hard to find a gold mining equity exhibiting similar performance. In retrospect, if one invested in gold, one not only made much better returns, one also took a relatively insignificant risk in comparison to owning equities—equities can go to zero while it is hard for a commodity to fall much...

Read More »FX Daily, August 23: Broadly Mixed Dollar in a Mostly Quiet Market

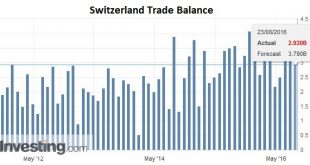

Swiss Franc Switzerland Trade Balance (See more posts for Switzerland Trade Balance) Click to enlarge. Source Investing.com FX Rates The US dollar is mostly little changed against the major, as befits a summer session. There are two exceptions. The first is the New Zealand dollar. Comments by the central bank’s governor played down the need for urgent monetary action and suggested that the bottom of cycle may be...

Read More »Swiss Exports + 7.9 percent YoY, Imports +11.8 percent. Trade Surplus +2.9 bn CHF.

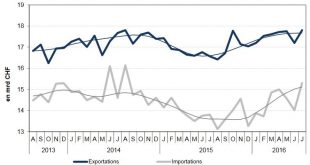

Exports and Imports YoY Development In July 2016, Swiss exports declined due to two working days less. Adjusted for this difference, exports were up 7.9% YoY (in real terms: + 2.4%) and imports 11.8% YoY (in real terms: + 8.2%). Exports and Imports MoM Development Compared with June 2016, seasonally adjusted exports rose by 3.5% (in real terms: + 5.5%). Thus the positive trend that began in mid-2015 continues....

Read More »Swiss Sovereign Money Initiative: Reserves For Everyone

On a new website, Aleksander Berentsen rejects the Swiss Vollgeld initiative. As an alternative, he suggests the Swiss National Bank should offer transaction accounts for everybody, in line with proposals I have made earlier (see here (2016), here (2015), here (2015)). In the Handelszeitung (here and here), Simon Schmid reports....

Read More »Dollar Weakness and Fed Expectations

Summary: Dollar weakness does not line up with increased perceived risk of Fed hiking rates. Frequently the rate differentials lead spot movement. Some now turning divergence on its head, claiming too expensive to hedge dollar-investments so liquidation. TIC data, though, shows central banks not private investors, were the featured sellers in June, the most recent month that data exists. The US dollar has...

Read More »Silver is in a Different World

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Lighthouse Problem Measured in gold, the price of the dollar hardly budged this week. It fell less than one tenth of a milligram, from 23.29 to 23.20mg. However, in silver terms, it’s a different story. The dollar became more valuable, rising from 1.58 to 1.61 grams. Most people would say that gold went up $6 and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org