Investec Switzerland. SMI The Swiss Market Index is set to close slightly higher this week, outperforming global equities thanks to defensive heavyweights such as Nestlé and Novartis. Click to enlarge. Pessimism hit European shares at the beginning of the week as sliding oil prices and bank stress test results helped revive concerns over the strength of the recovery and stability of the financial sector. The bank stress tests results showed most of the region’s banks would have an adequate level of capital in a crisis. However, investors remained skeptical about the results and the sector sold off on concerns about profitability amid low interest rates, a weakening economy and a potential banking crisis in Italy. Click to enlarge. Bank of England On Thursday, European shares rebounded and rose from a near three-week low, with UK stocks heading for their biggest jump since June after the Bank of England unveiled a fresh round of measures to help the domestic economy. The BoE announced its first interest-rate cut in seven years, and said more easing could come as Britain feels the effects of its decision to leave the European Union. Click to enlarge.

Topics:

Investec considers the following as important: Credit Suisse, Deutsche Bank, Featured, MSCI World, newsletter, SMI, Swiss Markets, Swiss stock market

This could be interesting, too:

investrends.ch writes UBS zahlt für CS-Steuerstreit mit US-Justizministerium weitere halbe Milliarde

investrends.ch writes Deutsche Bank mit Gewinnsprung – Aktie steigt

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

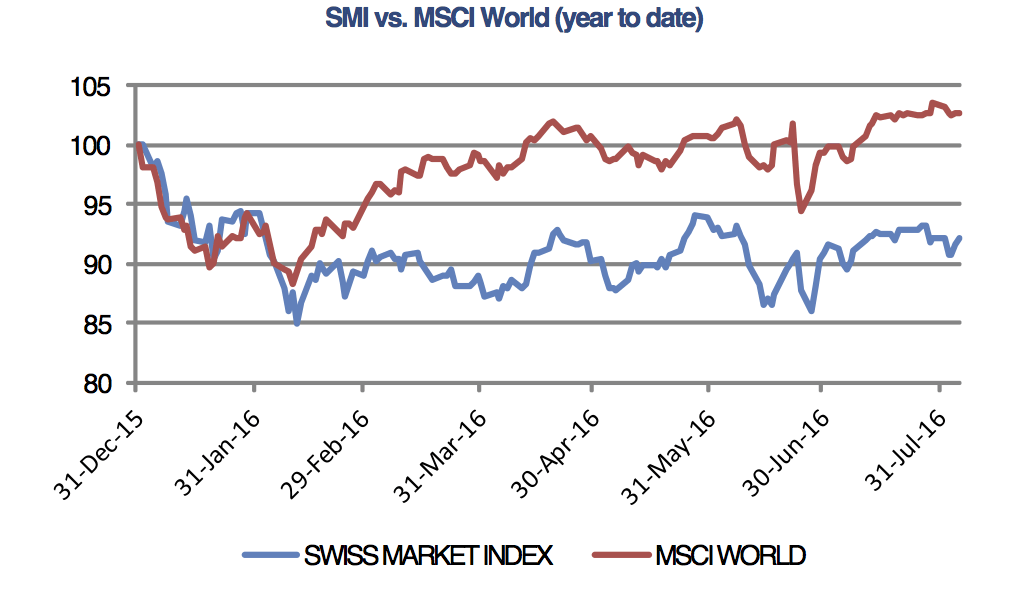

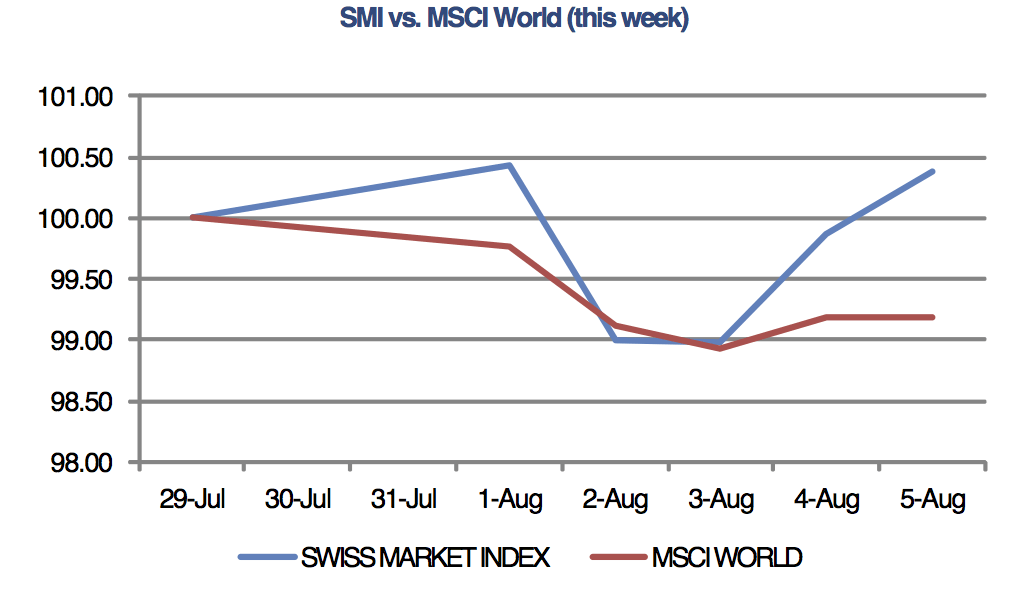

SMIThe Swiss Market Index is set to close slightly higher this week, outperforming global equities thanks to defensive heavyweights such as Nestlé and Novartis. |

|

| Pessimism hit European shares at the beginning of the week as sliding oil prices and bank stress test results helped revive concerns over the strength of the recovery and stability of the financial sector. The bank stress tests results showed most of the region’s banks would have an adequate level of capital in a crisis. However, investors remained skeptical about the results and the sector sold off on concerns about profitability amid low interest rates, a weakening economy and a potential banking crisis in Italy. |

Click to enlarge. |

Bank of EnglandOn Thursday, European shares rebounded and rose from a near three-week low, with UK stocks heading for their biggest jump since June after the Bank of England unveiled a fresh round of measures to help the domestic economy. The BoE announced its first interest-rate cut in seven years, and said more easing could come as Britain feels the effects of its decision to leave the European Union. |

|

Swiss economic dataIn Swiss economic data, The KOF Economic Barometer, a composite leading indicator for the Swiss economy, has changed very little compared to last month and shows that despite increased uncertainty about international economic development, export opportunities for Swiss enterprises have improved slightly. On the other hand, data for the manufacturing industry suggests a slowdown. In other economic news, Swiss retail sales fell more-than-expected. In nominal terms, overall retail turnover dropped 4.6% in June compared to the previous year. The decline has been ongoing since January 2015 but this was the largest decline since January 2003. Domestic clothing and shoes sales continue to suffer the most amid fierce competition from online retailers and customers shopping abroad. |

|

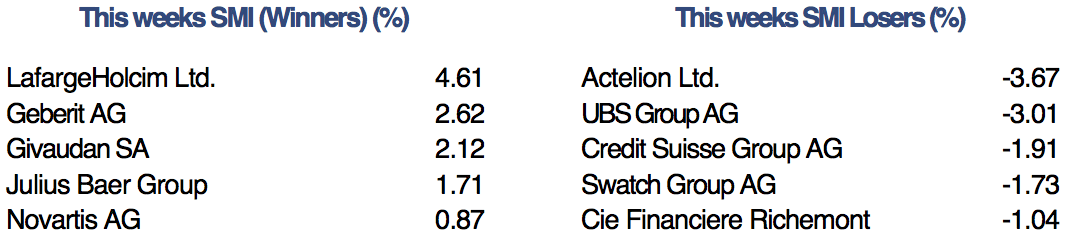

Swiss CompaniesIn company news, Credit Suisse was kicked out of the Eurostoxx 50 after its market cap shrunk to record lows. In line with so-called “fast-exit” rules, the bank was dropped from the index before the typical quarterly reviews due to its poor performance. Deutsche Bank also lost its place at the top-table of European firms. Its position will be taken by French construction firm Vinci and Dutch semiconductor supplier ASML Holding. |