Meet the Scapegoats Last week, an Irish court sentenced three prominent banksters for their roles in the 2008 financial crisis. Judge Martin Nolan, who pronounced judgment, said that the bansksters had committed “a very serious crime.” He continued: “The public is entitled to rely on the probity of blue chip firms. If we can’t rely on the probity of these banks we lose all hope or trust in institutions.”* Meet the scapegoats! Three Irish bankers sent to jail: former finance director at the failed Anglo Irish Bank, Willie McAteer (42 months); former Irish Life and Permanent Bank Chief Executive Denis Casey (33 months); and former head of capital markets at the Anglo Irish Bank, John Bowe (24 months). This may very well be a case of going to jail for stupidity. They were doing the bidding of regulators, in the erroneous belief that they wouldn’t throw them under the bus when push came to shove. The three had engaged in a scheme of pushing money around in circular fashion in order to make Anglo Irish Bank look healthier than it was. However, as the defense noted: they reacted to the what Irish regulators told them at the time, who demanded that “Irish banks support one another as the financial crisis worsened, in a program called the green jersey agenda.

Topics:

Antonius Aquinas considers the following as important: Central Banks, coin clipping, Debt and the Fallacies of Paper Money, Denis Casey, ECB, Featured, fiduciary media, John Bowe, John Hurley, Martin Nolan, newsletter, On Economy, Willie McAteer

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Meet the ScapegoatsLast week, an Irish court sentenced three prominent banksters for their roles in the 2008 financial crisis. Judge Martin Nolan, who pronounced judgment, said that the bansksters had committed “a very serious crime.” He continued:

Meet the scapegoats! Three Irish bankers sent to jail: former finance director at the failed Anglo Irish Bank, Willie McAteer (42 months); former Irish Life and Permanent Bank Chief Executive Denis Casey (33 months); and former head of capital markets at the Anglo Irish Bank, John Bowe (24 months). This may very well be a case of going to jail for stupidity. They were doing the bidding of regulators, in the erroneous belief that they wouldn’t throw them under the bus when push came to shove. The three had engaged in a scheme of pushing money around in circular fashion in order to make Anglo Irish Bank look healthier than it was. However, as the defense noted: they reacted to the what Irish regulators told them at the time, who demanded that “Irish banks support one another as the financial crisis worsened, in a program called the green jersey agenda.” As former Irish central bank governor John Hurley said in testimony, “The ECB told Ireland to stand with its failing banks”. Former Taoiseach Brian Cowen in turn said: “Ireland was bounced into the bailout by Hurley’s friends in the ECB, which was ‘at all times pushing’ us into an international rescue program.” We would note: not a single regulator, central bank bureaucrat or politician was ever even remotely in danger of getting jail time! |

|

| A number have criticized the judge’s sentence for its mildness in light of the catastrophic damage that the banks have done to the economy. Irish taxpayers have bailed out the banks five times since 2011, while it has been estimated that it will take up to 15 years, if ever, to recover.

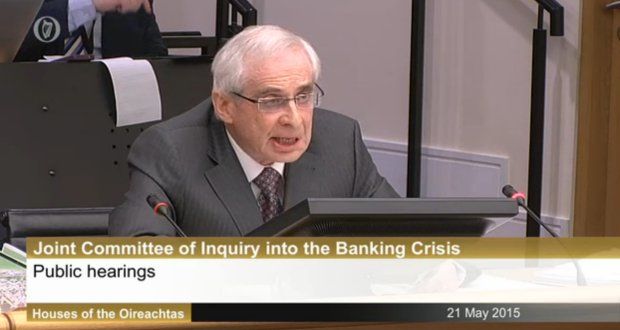

While Irish bankers and the political class who have enabled them are certainly deserving jail time and much worse, punishing them or other banksters who have committed similar crimes will not prevent a recurrence of further economic crisis, undo the harm done to the Irish economy, or pull Ireland and the rest of the Western world out of its economic malaise. Former Bank of Ireland governor John Hurley appearing at the Oireachtas banking inquiry, where he blamed the ECB for pushing the country into the hugely expensive bailout. Somehow he seems to have forgotten that he himself was a member of the ECB council at the time! Sentence, so far: 0 months. |

|

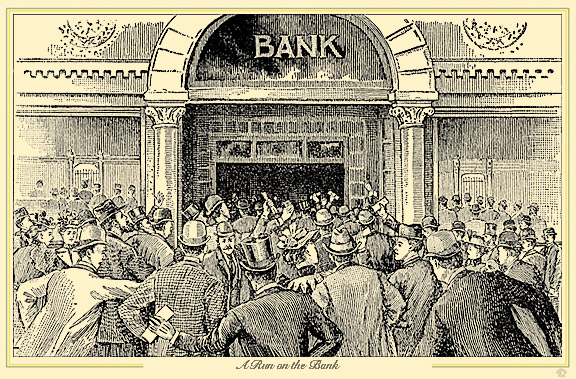

The Root CauseThe seminal cause of the economic crisis of 2008 and almost every one preceding it has been the fraudulent expansion of the money supply by the banking system through the practice of fractional reserve banking. Until this economy-wrecking and social destructive scheme is abolished, along with the central banks that oversee and protect the nefarious practice, the economic crisis will continue and deepen no matter how many banksters are jailed. Simply put: fractional-reserve banking, for those who do not know (which includes 99.9% of the financial press), is the practice by which banks keep only a fraction of their deposits on hand and “invest” or loan out the rest at interest. Of course, if any other warehouse or storage facility engaged in such a practice it would be rightly considered fraud. Fractional reserves allow banks to create deposit money out of thin air; occasionally this can lead to scenes like above, as this money is really fictional, although it can be used in payment as if it were standard money. These uncovered money substitutes are also referred to as “fiduciary media” – a term that basically indicates that depositors need to trust that they will be the first in line when, or ideally just before, the above happens… and get their money out before everybody else tries to get theirs out as well (for an in-depth discussion see: “The Problem with Fractional Reserve Banking”, part 1, part 2 and part 3). |

|

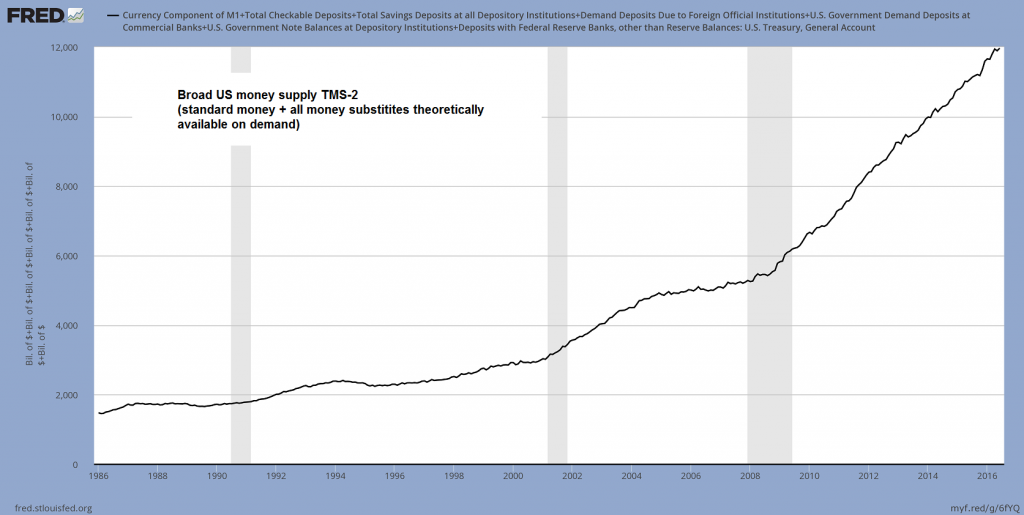

| The process is augmented by central banks, which expand the money supply through the deposits that individual banks keep with them. In fact, the main purpose for the creation of central banking in the first place was to enable individual banks to engage in this fraudulent undertaking, which leads to all sorts of monetary mischief.

The beautiful part of outlawing fractional reserve banking is that it requires no creation of regulatory agencies, commissions, or convoluted legislation. All that is needed is a simple universal prohibition of the nefarious practice applicable at all times and all places: any bank or financial intermediary which engages in fractional reserve banking or similar practices will be condemned and prosecuted with its perpetrators punished! Medieval bankers: there is a documented case of a 14th century Spanish banker being beheaded in front of his place of business for engaging in fractional reserve banking. Then the government discovered that it could actually get a cut and would benefit greatly from allowing bankers to carry on with the practice. And suddenly, a practice that had been considered fraudulent since antiquity was no longer prosecuted – instead it became a state-sanctioned privilege. |

|

| The judicial system is culpable too in this process. Courts that actually prosecute bankers are not trying to get to the root of the problem, but are merely saving face with the public by doling out prison time or uttering harsh rebukes at the bankers.

Of course, as an arm of the state, the courts have a vested interest in not seeking the truth, since doing so would expose the actual method upon which nation-states obtain a good deal of their power. Fines and jail time (usually reduced or suspended) to placate the angry populace is as far as the judicial system will typically go. Naturally, a financial order devoid of fractional reserve banking would, as Providence had intended, consist of gold and silver, where paper currency and notes would most likely be of limited if any use. The only significant hanky-panky which would occur with metallic money would be the old ploy of “coin clipping” which, although deplorable, was limited as compared to the inflation episodes that have taken place under a pure paper, fiat standard. To keep coin debasement in check, however, the same punitive measures should prevail as with those who engage in fractional reserve banking. Punishing banksters for their monetary transgressions years after their dastardly deeds have taken place is comparable to buying fire insurance after a house has burned down. |

Conclusion

If the Irish and the rest of the world’s populations want to eliminate the monetary chaos and the declining living standards which have ensued over the past half dozen years or so, they need to look at the ultimate cause of the crisis – eliminate fractional reserve banking and the central banks which condone and engage in the practice.

Reference:

*Tyler Durden, “Ireland Jails 3 Top Bankers Over 2008 Collapse . . . Instead of Bailing Them Out.” Zero Hedge. 30 July 2016.

Chart by: St. Louis Federal Reserve Research

Chart and image captions by PT

This article originally appeared on Antonius Aquina’s blog.