Since 2000, average wealth per adult in Switzerland has risen by 130%, largely due to the appreciation of the Swiss franc against the US dollar (Keystone) The average fortune of a Swiss adult is $537,600 (CHF528,000), according to the 2017 Credit Suisse Global Wealth Report. Switzerland continues to top the Credit Suisse global list for wealth per adult, followed by Australia ($402,600), the United States ($388,600)...

Read More »UK Debt Crisis Is Here – Consumer Spending, Employment and Sterling Fall While Inflation Takes Off

– UK debt crisis is here – consumer spending, employment and sterling fall while inflation takes off – Personal debt crisis coming to fore – litigation cases go beyond 2008 levels – October consumer spending fell by 2% in October, the fastest year-on-year decline in four years– Britons ‘face expensive Christmas dinner’ as food price inflation soars – Gold investors buying physical gold due to precarious UK and...

Read More »Is This Why Productivity Has Tanked and Wealth Inequality Has Soared?

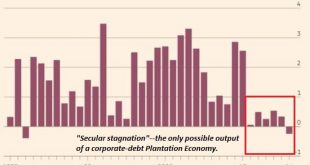

Needless but highly profitable forced-upgrades are the bread and butter of the tech industry. One of the enduring mysteries in conventional economics (along with why wages for the bottom 95% have stagnated) is the recent decline in productivity gains (see chart). Since gains in productivity are the ultimate source of higher wages, these issues are related. Simply put, advances in productivity are core to widespread...

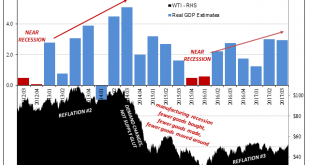

Read More »Globally Synchronized Downside Risks

Oil prices were riding high after several weeks of steady, significant gains. It’s never really clear what it is that might actually move markets in the short run, whether for crude it was Saudi Arabia’s escalating activities or other geopolitical concerns. Behind those, the idea of “globally synchronized growth” that is supposedly occurring for the first time since before the Great “Recession” while it may not have...

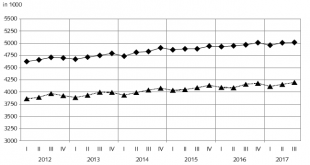

Read More »Swiss Labour Force Survey in 3rd quarter 2017: labour supply: 1.0% increase in number of employed persons; unemployment rate based on ILO definition at 5.0%

Swiss Labor Force Survey in the third quarter of 2017: Job Offer The number of persons in employment increases by 1.0 percent; Unemployment rate according to ILO is 5.0 percent Neuchâtel, 16.11.2017 (FSO) – The number of employed persons in Switzerland rose by 1.0% between the 3rd quarters of 2016 and 2017. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) declined...

Read More »FX Daily, November 16: Euro Extends Pullback

Swiss Franc The Euro has risen by 0.25% to 1.1679 CHF. EUR/CHF and USD/CHF, November 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After rising to its best level since October 20, the euro reversed direction yesterday and has extended its pullback today. The unexpected tick up in US core CPI and better than expected retail sales may have helped spur the euro losses...

Read More »Saudi Billionaires Scramble To Move Cash Offshore, Escape Asset Freeze

Over the weekend, Saudi King Salman shocked the world by abruptly announcing the arrests of 11 senior princes and some 38 ministers, including Prince Al-Waleed bin Talal, the world’s sixty-first richest man and the largest shareholder in Citi, News Corp. and Twitter. The purge was orchestrated by a new “supreme committee” to investigate public corruption created by King Salman but under the control of Crown Prince...

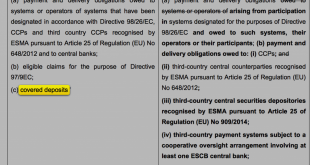

Read More »Protect Your Savings With Gold: ECB Propose End To Deposit Protection

– Protect Your Savings With Gold: ECB Propose End To Deposit Protection – New ECB paper proposes ‘covered deposits’ should be replaced to allow for more flexibility – Fear covered deposits may lead to a run on the banks – Savers should be reminded that a bank’s word is never its bond and to reduce counterparty exposure – Physical gold enable savers to stay out of banking system and reduce exposure to bail-ins -...

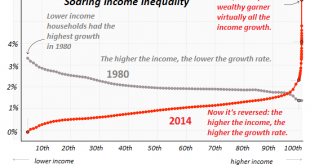

Read More »Forget the Bogus Republican “Reform”: Here’s What Real Tax Reform Would Look Like

The point is to end the current system in which billionaires get all the privileges and financial benefits of owning assets in the U.S. but don’t pay taxes that are proportional to the benefits they extract. As has been widely noted, the Republicans’ proposed “tax reform” is not only just more BAU (business as usual, i.e. cut taxes for the wealthy), it’s also not real reform. At best, it’s just another iteration of D.C....

Read More »What President Trump and the West Can Learn from China

Expensive Politics Instead of a demonstration of its overwhelming military might intended to intimidate tiny North Korea and pressure China to lean on its defiant communist neighbor, President Trump and the West should try to learn a few things from China. Photo credit: AP - Click to enlarge President Trump meets President Xi. The POTUS reportedly had a very good time in China. The President’s trip to the Far East...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org