Swiss Franc The Euro has fallen by 0.25% to 1.1539 CHF. EUR/CHF and USD/CHF, October 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these...

Read More »Suspected Swiss tax spy trial underway in Germany

The German authorities bought 11 CDs with data about suspected German tax dodgers who held bank accounts in Switzerland The trial in Frankfurt of a Swiss private investigator accused of spying on the tax authorities in the German state of North Rhine-Westphalia is underway, but already temporarily suspended. The 54-year-old allegedly acted on behalf of the Swiss intelligence service trying to uncover a series of thefts...

Read More »Silver Bullion Prices Set to Soar

Silver bullion prices are expected to jump as solar and smartphone demand rises and the Fed tries to stave off economic weakness by Myra Saefong via Barrons Gold prices have far outpaced gains in silver so far this year, but silver will emerge as the winner for the second year in a row. With a per-ounce price of $17.41 for silver futures as of Friday, analysts say the white metal is poised for a big climb, particularly...

Read More »Great Graphic: The Euro’s Complicated Top

Summary Euro looks like it is carving out a top. The importance also lies in identifying levels that the bearish view may be wrong. Widening rate differentials, a likely later peak in divergence than previously anticipated, and one-sided market positioning lend support to the bearish view. This Great Graphic depicts the top the euro is carving. We suggest that several fundamental developments lie behind the...

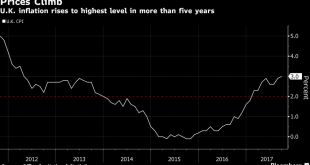

Read More »Global Inflation Continues To Underwhelm

Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months...

Read More »Swiss Trade Balance 3rd Quarter 2017: Foreign Trade at a High Level

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »10 Franc Note: Banknote App Updated

Discover all of the new Swiss notes on mobile devices - Click to enlarge The Swiss National Bank (SNB) is releasing an updated version of ‘Swiss Banknotes’, an app for mobile devices designed to help the public familiarise themselves with the new banknotes.The popular app, which has been downloaded over 70,000 times, now also showcases the new 10-franc note. It can be downloaded free of charge from the Apple...

Read More »Brexit UK Vulnerable As Gold Bar Exports Distort UK Trade Figures

– Brexit UK vulnerable as gold bar exports distort UK trade figures – Britain’s gold exports worth more than any other physical export – Gold accounted for more than one in ten pounds of UK exports in July 2017– UK’s stock of wealth has collapsed from a surplus of £469bn to a net deficit of £22bn – ONS error– Brexiteers argue majority of trade is outside EU, this is due to large London gold exports– Single gold bar...

Read More »Brexit UK Vulnerable As Gold Bar Exports Distort UK Trade Figures

– Brexit UK vulnerable as gold bar exports distort UK trade figures – Britain’s gold exports worth more than any other physical export – Gold accounted for more than one in ten pounds of UK exports in July 2017– UK’s stock of wealth has collapsed from a surplus of £469bn to a net deficit of £22bn – ONS error– Brexiteers argue majority of trade is outside EU, this is due to large London gold exports– Single gold bar...

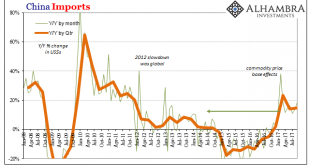

Read More »China Exports/Imports: Enforcing A Global Speed Limit

Chinese imports rose 18.7% in September 2017 year-over-year. That’s up from 13.5% growth in August. While near-20% expansion sounds good if not exhilarating, it isn’t materially different from 13.5% or 8% for that matter. In addition, Chinese trade statistics tend to vary month to month. What is becoming very clear is that China’s economy is behaving no differently than the global economy. Most of that increase for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org