The Swiss are getting ready to negotiate with the EU when European Commission President Jean-Claude Juncker visits next week (Keystone) The seven-member Federal Council has refused to reveal its position on future negotiations with the European Union over CHF1 billion (little over $1 billion) in voluntary ‘cohesion’ payments destined for central and eastern European countries. On Wednesday, the government discussed its...

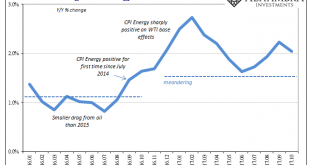

Read More »Can’t Hide From The CPI

On the vital matter of missing symmetry, consumer price indices across the world keep suggesting there remains none. Recoveries were called “V” shaped for a reason. Any economy knocked down would be as intense in getting back up, normal cyclical forces creating momentum for that to (only) happen. In the context of the past three years, symmetry is still nowhere to be found. It’s confounding even central bankers who up...

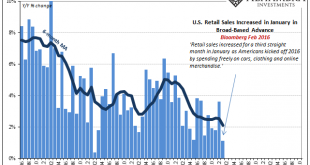

Read More »Retail Sales (US) Are Exhibit #1

In January 2016, everything came to a head. The oil price crash (2nd time), currency chaos, global turmoil, and even a second stock market liquidation were all being absorbed by the global economy. The disruptions were far worse overseas, thus the global part of global turmoil, but the US economy, too, was showing clear signs of distress. A manufacturing recession had emerged which would only ever be the case on weak...

Read More »Emerging Markets: What has Changed

Summary Moody’s raised India’s sovereign debt rating for the first time since 2004 by a notch to Baa2. Nigerian officials are on a global roadshow to support plans to issue its longest-dated Eurobonds ever The head of South Africa’s budget office resigned. President Robert Mugabe was placed under house arrest by the Zimbabwe military. Turkey’s central bank will introduce FX hedges for domestic companies with FX...

Read More »Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe Show Why Physical Gold Is Ultimate Protection

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe – Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis – Venezuela’s new 100,000-bolivar note is worth less oday thehan USD 2.50 – Maduro announces plans to eliminate all physical cash – Gold rises in response to ongoing crises One Hundred Trillion Dollars Zimbabwe - Click to enlarge A military coup-de-grace in Zimbabwe...

Read More »Swiss HSBC settles French tax fraud dispute

The HSBC settlement brings an end to the French tax dispute. (AP) - Click to enlarge With a payment of €300 million (CHF350 million), the Swiss subsidiary of British bank HSBC has settled its tax fraud dispute with the French authorities. Investigations by the French government revealed that many French taxpayers had hidden their assets with help from HSBC’s private bank. However, HSBC Switzerlandexternal...

Read More »What Central Banks Have Done Is What They’re Actually Good At

As a natural progression from the analysis of one historical bond “bubble” to the latest, it’s statements like the one below that ironically help it continue. One primary manifestation of low Treasury rates is the deepening mistrust constantly fomented in markets by the media equivalent of the boy who cries recovery. That narrative “has ruffled a few feathers,” BMO Capital Markets strategists Ian Lyngen and Aaron Kohli...

Read More »Business Cycles and Inflation – Part I

Incrementum Advisory Board Meeting Q4 2017 – Special Guest Ben Hunt, Author and Editor of Epsilon Theory The quarterly meeting of the Incrementum Fund’s Advisory Board took place on October 10 and we had the great pleasure to be joined by special guest Ben Hunt this time, who is probably known to many of our readers as the main author and editor of Epsilon Theory. He is also chief risk officer at investment management...

Read More »FX Daily, November 17: Euro, Yen and Sterling Regain Footing

Swiss Franc The Euro has fallen by 0.09% to 1.1686 CHF. EUR/CHF and USD/CHF, November 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is trading with a heavier bias against the euro, sterling, and yen, but is firmer against the Antipodean currencies and many of the actively traded emerging market currencies. This mixed performance is the story of the...

Read More »Switzerland asked to aid Mauritian inquiry into Basel-based Dufry

Dufry, which handles about one-quarter of the world's duty-free goods business, is based in Basel (Keystone) - Click to enlarge Switzerland’s federal prosecutor’s office is handling a request for mutual assistance in an investigation involving the Basel-based duty-free group Dufry. The request was sent by the government of Mauritius, which according to reports in two Swiss newspapers is looking into the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org