We expect the ECB to announce a tapering of its asset purchase programme in the summer, but not to overreact to strong economic data. Our first choice as the title for our 2018 ECB outlook was “The courage not to act”, but regular readers will know that we used this hommage to Ben Bernanke earlier this year. Yet our faith in ECB’s courage knows no bounds and this still feels relevant today, with the caveat that the ECB...

Read More »Chinese demand leads the Swiss watch industry’s recovery

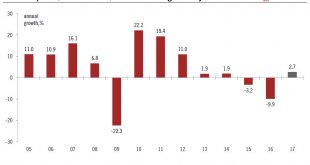

The most important driver of the Swiss watch industry’s recovery has been the revival of the mainland China market. After years of impressive growth, the Swiss watch industry faced difficult conditions in 2015 and 2016, when exports declined by 3.2% and 9.9% respectively in value terms. The last time that there were two consecutive years of decline was in 1995-96. The appreciation of the Swiss franc, the collapse of...

Read More »Emerging Markets: What has Changed

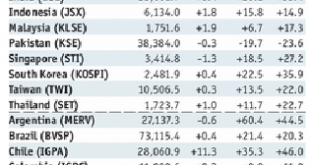

Summary Fitch upgraded Indonesia by a notch to BBB with stable outlook. EU-Poland tensions entered a new phase. Cyril Ramaphosa was elected as the new ANC President over opponent Nkosazana Dlamini-Zuma. Argentina’s lower house approved President Macri’s pension reform bill. Sebastian Pinera won the Chilean presidency in the second round vote. Mexico political risk is rising as the PRI slush money scandal widens....

Read More »Darwin Airlines bankruptcy under criminal investigation

The public prosecutor of the southern Swiss canton of Ticino has opened criminal proceedings over irregularities concerning the bankruptcy of regional carrier Darwin Airlines. According to the SonntagsZeitung paper, the Ticino public prosecutor opened criminal proceedings against “unknown persons” on Thursday after the bankruptcy office in Lugano drew his attention to suspected irregularities. The regional carrier,...

Read More »Great St Bernard Tunnel reopens after three-month closure

The collapse of a beam holding up the ventilation system was responsible for the tunnel closure in September (Keystone) - Click to enlarge Switzerland’s oldest traffic tunnel through the Alps reopened on Christmas eve after a three-month closure due to problems with the ventilation system. After extensive repair work, the tunnel that connects Martigny in the western Swiss canton of Valais with the Aosta...

Read More »Christmas 2017: Why I’m Hopeful

A more human world lies just beyond the edge of the Status Quo. Readers often ask me to post something hopeful, and I understand why: doom-and-gloom gets tiresome. Human beings need hope just as they need oxygen, and the destruction of the Status Quo via over-reach and internal contradictions doesn’t leave much to be happy about. The most hopeful thing in my mind is that the Status Quo is devolving from its internal...

Read More »UBS consumption indicator: Solid private consumption in 2018

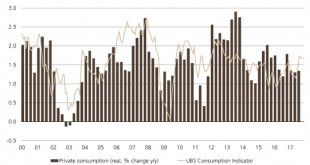

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. At 1.67 points, the UBS consumption indicator was above its long-term average in November, indicating solid consumption growth in 2018. Thanks to solid economic growth, private consumption will likely continue...

Read More »FX Daily, December 27: What Happened on Boxing Day?

Swiss Franc The Euro has risen by 0.32% to 1.1763 CHF. EUR/CHF and USD/CHF, December 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There were several developments on the day after Christmas, while many markets remained closed and investors sidelined. One of the most important developments was the euro’s complete recovery from the flash crash of nearly three...

Read More »Swiss National Bank buys paper factory for banknote production

To guarantee the smooth roll-out of its new banknote series, the Swiss National Bank (SNB) has bought a struggling paper factory in eastern Switzerland. The takeover of Landqart AG, valued at CHF21.5 million ($21.7 million), is split between the SNB (90%) and the security printing division of Swiss publisher Orell Füssli (10%). + Switzerland is rolling out a new series of banknotes with numerous security features...

Read More »Bitcoin: Attention à l’arnaque. Dossier.

C’est la monnaie préférée des pirates informatiques. Celle qu’exigent les hackers lorsqu’ils formulent une demande de rançon. Mais pas seulement ! Depuis que le bitcoin flambe (il a dépassé le 15 décembre les 17 000 dollars), de plus en plus de fonds d’investissement, alléchés par les perspectives haussières de son cours, s’y intéressent. Et de nombreux sites de commerce en ligne se mettent à facturer produits et...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org