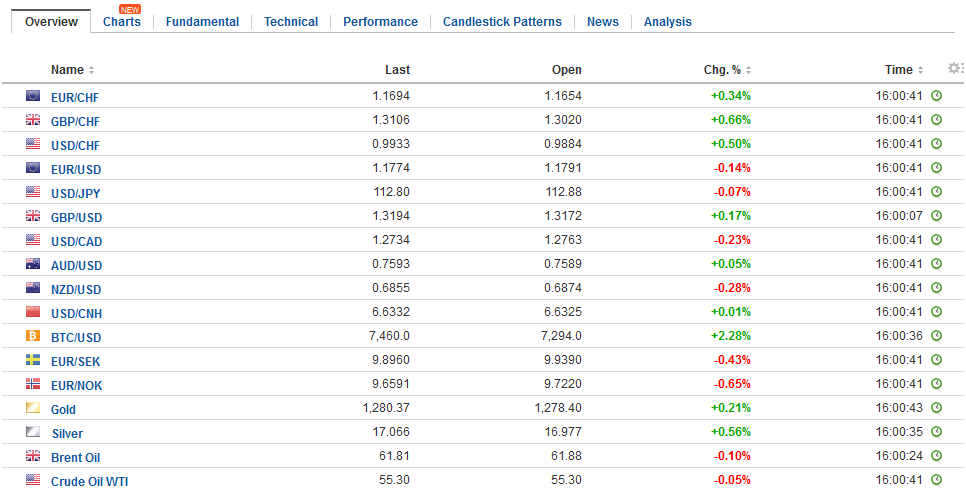

Swiss Franc The Euro has risen by 0.25% to 1.1679 CHF. EUR/CHF and USD/CHF, November 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After rising to its best level since October 20, the euro reversed direction yesterday and has extended its pullback today. The unexpected tick up in US core CPI and better than expected retail sales may have helped spur the euro losses after three cent run-up over the past several sessions. There bearish candlestick (shooting star) leaves the late euro longs in weak hands. However, the single currency remains above the down trendline drawn off the year’s high, recorded two months ago, that was violated earlier in the week. It comes in

Topics:

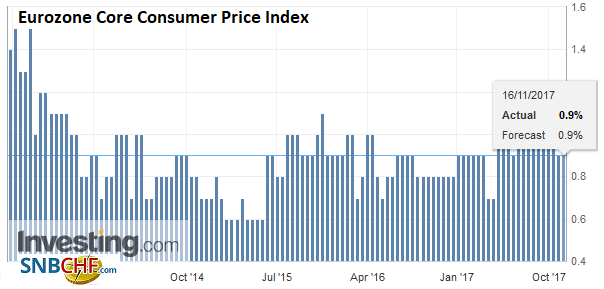

Marc Chandler considers the following as important: AUD, EUR, EUR/CHF, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Featured, FX Trends, GBP, newslettersent, SEK, TLT, U.K. Retail Sales, U.S. Capacity Utilization Rate, U.S. Industrial Production, U.S. Initial Jobless Claims, U.S. Philadelphia Fed Manufacturing Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.25% to 1.1679 CHF. |

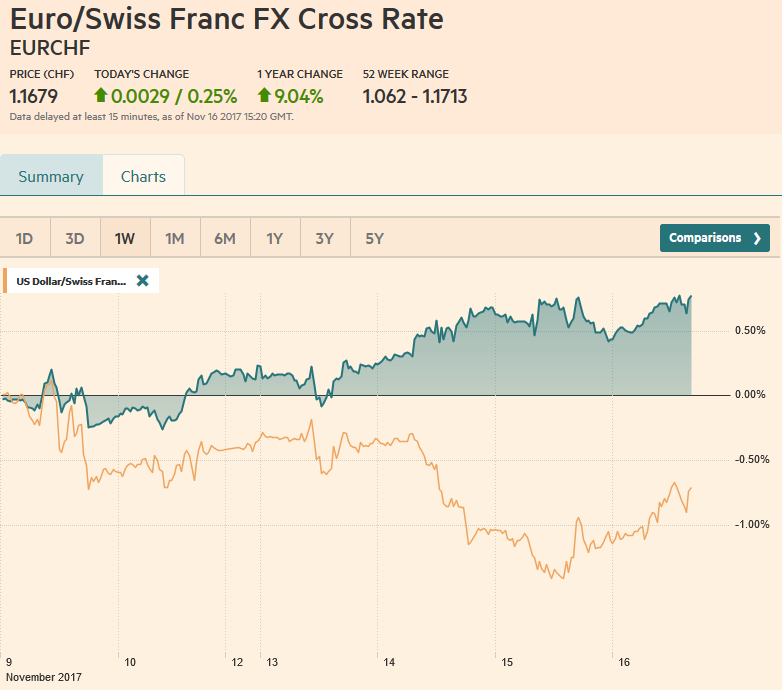

EUR/CHF and USD/CHF, November 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesAfter rising to its best level since October 20, the euro reversed direction yesterday and has extended its pullback today. The unexpected tick up in US core CPI and better than expected retail sales may have helped spur the euro losses after three cent run-up over the past several sessions. There bearish candlestick (shooting star) leaves the late euro longs in weak hands. However, the single currency remains above the down trendline drawn off the year’s high, recorded two months ago, that was violated earlier in the week. It comes in today near $1.1735. That area is likely to prove important in the near-term. It corresponds to the five-day moving average (~$1.1740), which the euro has not closed below since November 8 and is near the 38.2% retracement of the recent gains (~$1.1745). Fresh fundamental developments are light. We do note that the self-imposed deadline of the end of the week to work out the new German coalition is approaching, and reports suggest that large gaps remain as the four-party talks continue. The Green Party has a special conference scheduled for November 25 to ostensibly vote on the terms. That said, the prospects that hammering out a coalition on a national level between such disparate parties as the Greens and the FDP is too much even for one with Merkel’s political acumen. |

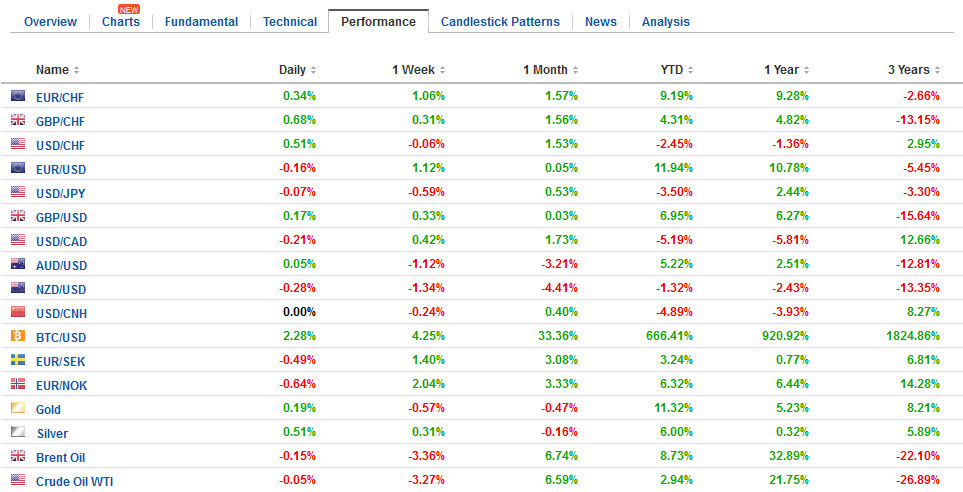

FX Daily Rates, November 16 |

| If larger coalition talks fail, some suspect that Merkel might be able to entice the SPD, the current coalition partner back into the fold, but this looks like a stretch. The alternatives, though, are stark: an unprecedented minority government or new elections.

However, as interesting as German politics may be, the driver of the euro may be more economic than political. On a purely directional basis, the correlation between the US-German two-year differential and the euro exchange rate is as tight as it has been all year, with a correlation of 0.85 over the past 60 sessions. After dipping yesterday, the premium is back above 240 bp today. Rising US rates also helps explain the dollar’s firmer tone against the yen. The US 10-year yield is up nearly four basis points. On a purely directional basis, the dollar’s exchange rate against the yen and 10-year US yields enjoy a correlation of 0.94 over the past 60 sessions. The dollar is trading within yesterday’s range against the yen but has recovered nearly a big figures from yesterday’s low just below JPY112.50. A move now above JPY113.50-JPY113.65 would lift the tone and boost confidence that a low is in place. |

FX Performance, November 16 |

United KingdomSterling is also resisting the stronger dollar tone. The slightly stronger than expected retail sales report helped blunt the negative impact from the political developments. A media report claims the EU has ruled out a bespoken trade deal with the UK (like the recently agreed Canadian free-trade agreement). October retail sales rose 0.1%, excluding auto fuel and 0.3% with it. Both measures were 0.1% above the Bloomberg survey median forecast, and the September decline was also pared by 0.1%. Still, the year-over-year pace has turned negative for the first time in four years. A separate report indicated that the demand for autos fell for the seventh month in October. Sterling remains stuck in a trading range that had been carved last month between roughly $1.30 and $1.3320. Since the start of November, it has not managed to move much above $1.3230. Cross-ate adjustments may be helping sterling. As the euro posted a shooting star candlestick against the dollar yesterday, it did the same against sterling. The euro’s push above GBP0.9000 proved premature, and it has been set back toward GBP0.8920 today. Support is seen in the GBP0.8875-GBP0.8900. |

U.K. Retail Sales YoY , Oct 2017(see more posts on U.K. Retail Sales, ) Source: Investing.com - Click to enlarge |

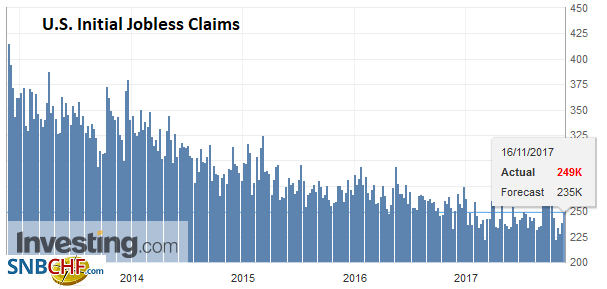

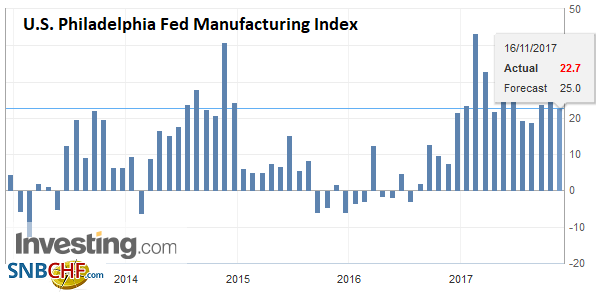

United StatesThe US reports weekly initial jobless claims, the Philly Fed survey (Nov), import/export prices, and industrial production and manufacturing output figures. |

U.S. Initial Jobless Claims, 16 November 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

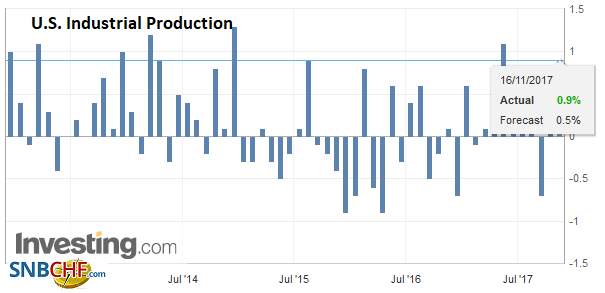

| Industrial production is expected to have risen about 0.5%, led by a 0.6% rise in manufacturing. |

U.S. Industrial Production, Oct 2017(see more posts on U.S. Industrial Production, ) Source: Investing.com - Click to enlarge |

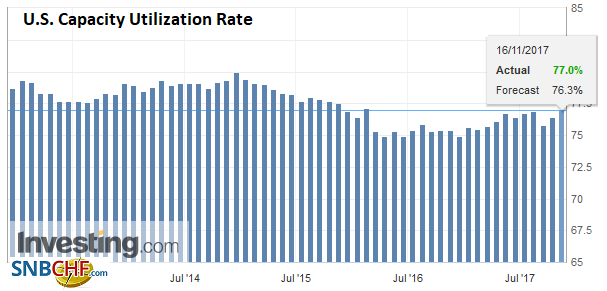

| Capacity utilization may rise to 76.3%. Last October it stood at 75.7%. The House of Representatives is expected to vote on the tax reform bill later today. It appears that it will pass. The Senate is more challenging, and one Republican senator has already indicated he will vote against the bill. |

U.S. Capacity Utilization Rate, Oct 2017(see more posts on U.S. Capacity Utilization Rate, ) Source: Investing.com - Click to enlarge |

| The Republicans have a 52-48 majority in the Senate and cannot afford to lose more than two other senators (the Vice President casts a vote in a tie). Several Fed officials speak, but the market has nearly completely discounted next month’s rate hike. |

U.S. Philadelphia Fed Manufacturing Index, Nov 2017(see more posts on U.S. Philadelphia Fed Manufacturing Index, ) Source: Investing.com - Click to enlarge |

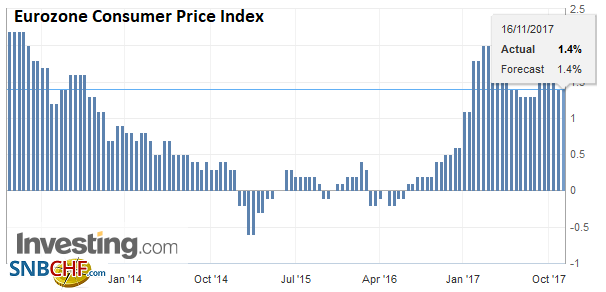

Eurozone |

Eurozone Consumer Price Index (CPI) YoY, Nov 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Eurozone Core Consumer Price Index (CPI) YoY, Oct 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

The Norwegian Krone and Swedish krona are the best performing major currencies against the US dollar today. This seems to be a function of the correction against the euro after the euro’s recent surge. Sweden’s employment report was largely as expected with the unemployment rate ticking up to 6.3% in October from 6.2% in September. The number of unemployed rose slightly. The underlying concern in Sweden is that house prices have begun softening. Meanwhile, note that the OMX Stockholm 30 equity index is trying to snap an eight-day drop, the longest losing streak in six years.

Australia’s October employment report was mixed. Overall job growth was disappointing, but full-time jobs grew a strong 24.3k. The participation rate slipped to 65.1% but and the unemployment rate eased to 5.4% from 5.5%. On the other hand, soft confidence figures were used as an excuse to sell the New Zealand dollar. The Aussie broke below $0.7600 yesterday and is straddling the area today. The Kiwi is testing the week’s low near $0.6845.

The MSCI Asia Pacific Index snapped a four-day swoon with a 0.75% gain. Japan’s Topix broke its longest losing streak of the year with a 1% gain today. Strong earnings by Tencent helped lift the Hang Seng Enterprise Index. European shares are following suit. The Dow Jones Stoxx 600 has not risen since Monday, November 6, but that seven-day fall may be ending today. The benchmark is up 0.65% near midday in London.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$EUR,$TLT,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Featured,newslettersent,SEK,U.K. Retail Sales,U.S. Capacity Utilization Rate,U.S. Industrial Production,U.S. Initial Jobless Claims,U.S. Philadelphia Fed Manufacturing Index,USD/CHF