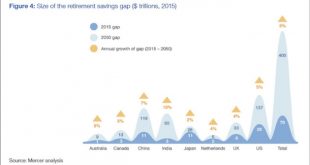

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without...

Read More »Gold Matches S&P 500 Performance In First 3 Quarters; Up 12% 2017 YTD

– Gold climbs over 12% in YTD, matching S&P500 performance– Palladium best performing market, surges 36% 2017 YTD– Gold outperforms Nikkei 225, Euro Stoxx 50, FTSE and ISEQ– Geo-political concerns including Trump and North Korea supporting gold– Safe haven demand should push gold higher in Q4 – Owning physical gold not dependent on third party websites and technology remains essential Year to Date Relative...

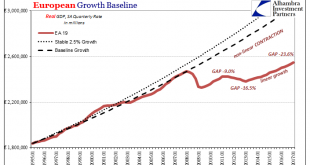

Read More »Eurozone: Distinct Lack of Good Faith

The erosion of social order in any historical or geographic context is gradual; until it isn’t. Germany has always followed a keen sense of this process, having experienced it to every possible extreme between the World Wars. Hyperinflationary collapse doesn’t happen overnight; it took three years for the Weimar mark to disintegrate, and then Weimar Germany. Even Nazism wasn’t all it once. What was required was...

Read More »Fed Quack Treatments are Causing the Stagnation

Bleeding the Patient to Health There’s something alluring about cure-alls and quick fixes. Who doesn’t want a magic panacea to make every illness or discomfort disappear? Such a yearning once compelled the best and the brightest minds to believe the impossible for over two thousand years. Instantaneous relief! No matter what your affliction is, snake oil cures them all. - Click to enlarge For example, from antiquity...

Read More »Rappel: Que sont devenus les excédents de la balance courante de la Suisse

Le professeur Tille, membre du conseil de banque de la BNS nous présente un graphique ci-dessous avec une courbe verte qui est l’accumulation des excédents de la balance courante de la Suisse. Rappelons que les soldes de TARGET2 sont précisément les soldes -excédents/déficits- de la balance courante. Les excédents de l’Allemagne serviraient à combler les déficits des autres, en échange bien évidemment de reconnaissances...

Read More »Swiss Retail Sales, August 2017: -0.6 percent Nominal and -0.3 percent Real

The Used Goods Question Retail sales in several countries like Germany, Japan and Switzerland continue to fall or they remain steady for years. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so...

Read More »FX Daily, October 02: Dollar Upbeat to Start Fourth Quarter

Swiss Franc The Euro has fallen by 0.30% to 1.1404 CHF EUR/CHF and USD/CHF, October 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is broadly higher as the quarter-end positioning losses seen at the end of last week area reversed. Developments in the US are seen as dollar positive, while the Catalonia-Madrid conflict, and slightly softer EMU...

Read More »Switzerland Tourism Names New Director – Martin Nydegger

Martin Nydegger's appointment as the new head of Switzerland Tourism was announced on Friday. (Keystone) - Click to enlarge The top Swiss tourism body has announced that Martin Nydegger will take over from his predecessor Jürg Schmid as head of the organisation. The 46-year-old Nydegger has been a member of Switzerland Tourism’s executive board since 2008. A selection committee within Switzerland Tourism’s...

Read More »Switzerland Tourism names new director

Martin Nydegger's appointment as the new head of Switzerland Tourism was announced on Friday. (Keystone) - Click to enlarge The top Swiss tourism body has announced that Martin Nydegger will take over from his predecessor Jürg Schmid as head of the organisation. The 46-year-old Nydegger has been a member of Switzerland Tourism’s executive board since 2008. A selection committee within Switzerland Tourism’s...

Read More »FX Weekly Preview: Changing Dynamics

We agree with the consensus that the markets are in a transition phase. The consensus sees this transition phase as a new economic convergence. European and Japanese economic growth continues above trend. Large emerging markets, including BRICs, are also expanding. Central banks are gradually moving away from the extreme accommodation. We recognize the robust economic growth, but we do not see this economic convergence...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org