The Gift that Keeps on Giving Every year a certain stock market phenomenon is said to recur, anticipated with excitement by investors: the Santa Claus rally. It is held that stock prices typically rise quite frequently and particularly strongly just before the turn of the year. I want to show you the Santa Claus rally in the German DAX Index as an example. Price moves are often exaggerated in the German stock market,...

Read More »Switzerland’s “harmful tax regime” gets it on EU grey list

© Kevkhiev Yury | Dreamstime This week EU Finance ministers came out with a list of countries it thinks don’t measure up to its definition of good tax behaviour. There are two categories: blacklist and so-called “grey list”. Black is bad and grey is heading toward good, but not yet there. Switzerland is on the “grey list”. To stay off the list, countries must have fair tax rules, which are defined as not offering...

Read More »The Latte Index: Using The Impartial Bean To Value Currencies

Like any other market, there are many opinions on what a currency ought to be worth relative to others. With certain currencies, that spectrum of opinions is fairly narrow. As an example, for the world’s most traded currency – the U.S. dollar – the majority of opinions currently fall in a range from the dollar being 2% to 11% overvalued, according to organizations such as the Council of Foreign Relations, the Bank of...

Read More »Emerging Markets: What Changed

Summary China eased curbs on coal use for heating in the northern provinces to cope with colder weather. Poland announced a cabinet shuffle. Poland’s lower house approved the controversial judicial reform bill. President Trump announced that the US recognizes Jerusalem as Israel’s capital. Brazil COPOM was more dovish than expected after cutting rates 50 bp to 7.0%. Chile central bank cut its 2017 and 2018 inflation...

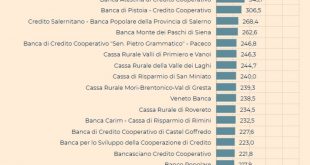

Read More »Bailins Coming In EU – 114 Italian Banks Have Non Performing Loans Exceeding Tangible Assets

Bailins Coming In EU – 114 Italian Banks Have NP Loans Exceeding Tangible Assets – Italy opposes ECB proposal that holds banks to firm deadlines for writing down bad loans – Italy’s banks weighed down under €318bn of bad loans – New ECB rules could ‘derail’ any recovery in Italy’s financial system – Draft proposal requires banks to provision fully for loans that turn sour from 2018 – ECB insists banks have better...

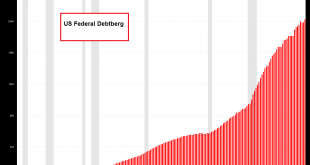

Read More »The Party of Spend More vs. the Party of Tax Less

Eternal Spendathon The Senate just passed a 500-page tax reform bill. Assuming it lives up to its promise, it will cut taxes on corporations and individuals. Predictably, the Left hates it and the Right loves it. I am writing to argue why the Right should hate it (no, not for the reason the Left does, a desire to get the rich). US Federal Debt, 1970 - 2017The Federal debtberg has grown beyond all measure since...

Read More »Comment les cédules hypothécaires suisses alimentent le marché européen des produits dérivés

« Beaucoup d’emprunteurs ne se rendent pas compte qu’en concluant le contrat, ils acceptent que leur hypothèque soit transmise à des tiers. […] Les clauses de transmission de l’hypothèque à des tiers sont pratique courante, comme il ressort de nos prises de renseignement auprès [d’UBS,] Credit Suisse, Banque cantonale de Zurich et Raiffeisen. » (TagesAnzeiger, 10.03.2014) Le 23 septembre 2011, le Conseil fédéral...

Read More »FX Daily, December 08: Brexit Talks Move to Stage II, While Greenback Remains Firm

Swiss Franc The Euro has fallen by 0.21% to 1.1679 CHF. EUR/CHF and USD/CHF, December 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sufficient progress will be judged to have been made, and negotiations of the separation between the UK and EU will be allowed to enter the second stage. The formal decision will be made at next week’s EU summit. To be sure, “sufficient...

Read More »L’Union européenne fait semblant de lutter contre l’évasion fiscale. Attac

- Click to enlarge Les paradis fiscaux lovés au coeur de l’UE, de l’Asie et des Etats-Unis d’Amérique sont occultés… L’analyse vire à la farce! Après avoir étudié la situation de 92 pays en matière de lutte contre l’évasion fiscale, l’Union européenne n’en retient donc que 17 sur sa liste noire des paradis fiscaux. Parmi ces États dits « non-coopératifs » on trouve, entre autres, le Panama, la Tunisie, les...

Read More »Airbnb charges some customers more than others, particularly the Swiss

© Mohamed Ahmed Soliman | Dreamstime - Click to enlarge Many Swiss residents travel to neighbouring eurozone countries for their holidays. These countries are close and Swiss francs go far there. However, to get the most out of a strong currency you need a good exchange rate. If a Swiss resident presenting euro cash at a checkout in Germany or France was told they couldn’t pay in euros because they live in Switzerland...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org