Summary China eased curbs on coal use for heating in the northern provinces to cope with colder weather. Poland announced a cabinet shuffle. Poland’s lower house approved the controversial judicial reform bill. President Trump announced that the US recognizes Jerusalem as Israel’s capital. Brazil COPOM was more dovish than expected after cutting rates 50 bp to 7.0%. Chile central bank cut its 2017 and 2018 inflation forecasts and shifted to a more dovish stance. Stock Markets In the EM equity space as measured by MSCI, Turkey (+4.0%), Qatar (+2.7%), and Philippines (+2.1%) have outperformed this week, while South Africa (-3.7%), Chile (-3.4%), and Egypt (-3.2%) have underperformed. To put this in better context,

Topics:

Win Thin considers the following as important: Beata Szydlo, emerging markets, Featured, global macro, Mateusz Morawiecki, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

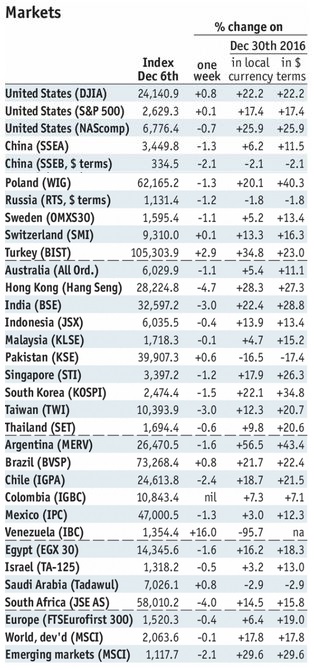

Stock MarketsIn the EM equity space as measured by MSCI, Turkey (+4.0%), Qatar (+2.7%), and Philippines (+2.1%) have outperformed this week, while South Africa (-3.7%), Chile (-3.4%), and Egypt (-3.2%) have underperformed. To put this in better context, MSCI EM fell -0.4% this week while MSCI DM rose 0.1%. In the EM local currency bond space, Korea (10-year yield -15 bp), Turkey (-8 bp), and Poland (-8 bp) have outperformed this week, while Malaysia (10-year yield +9 bp), Argentina (+5 bp), and South Africa (+4 bp) have underperformed. To put this in better context, the 10-year UST yield rose 2 bp to 2.38%. In the EM FX space, TRY (+2.0% vs. USD), ZAR (+0.7% vs. USD), and PLN (+0.2% vs. EUR) have outperformed this week, while MXN (-1.6% vs. USD), BRL (-1.4% vs. USD), and CLP (-1.3% vs. USD) have underperformed. |

Stock Markets Emerging Markets, December 06 Source: economist.com - Click to enlarge |

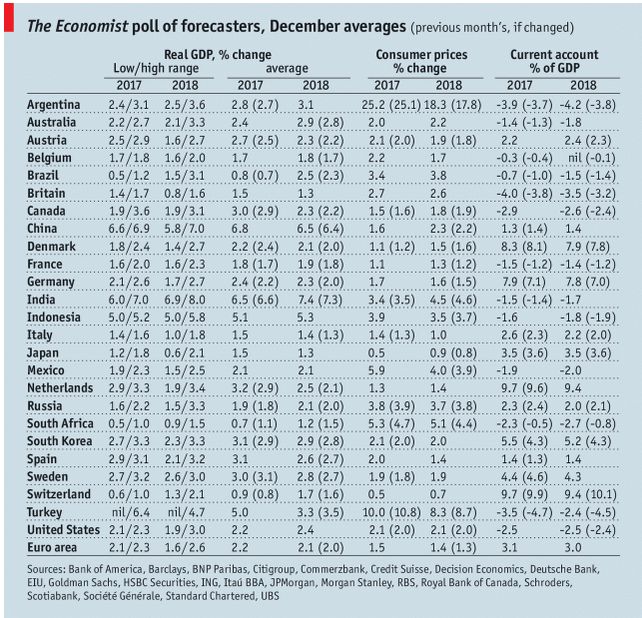

ChinaChina eased curbs on coal use for heating in the northern provinces to cope with colder weather. The Ministry of Environmental Protection eased the coal curbs after some provinces reportedly suspended some household heating and curtailed factory usage due to shortages of natural gas. China’s November trade data showed record imports of natural gas, as well as strong demand for coal and iron ore. PolandPoland announced a cabinet shuffle. Prime Minister Beata Szydlo will step down, with Deputy Prime Minister and Finance Minister Mateusz Morawiecki picked as her successor. The shuffle comes halfway through the 4-year term of the ruling Law and Justice government. Poland’s lower house approved the controversial judicial reform bill. The bill now goes to the Senate. If approved, the bill would hamper the independence of the judiciary. The EU has issued several warnings already, and some sanctions are likely to be seen if the reforms are enacted. IsraelPresident Trump announced that the US recognizes Jerusalem as Israel’s capital. The US embassy will be moved there, upending 70 years of US policy that recognized Tel Aviv as the capital. Hamas called for a third intifada in response to the controversial move. BrazilBrazil COPOM was more dovish than expected after cutting rates 50 bp to 7.0%. Many (including us) thought this was the last cut but the statement noted that it “views an additional moderate reduction of the pace of easing as appropriate.” This suggests a 25 bp cut to 6.75% will be seen at the next meeting on February 7. Press reports that Brazil’s lower house will begin the vote on pension reforms on December 18. The news is surprising, as most analysts and politicians believe the government lacks the votes needed to pass. Indeed, President Temer reportedly sees 280 votes in favor vs. 308 needed to pass. ChileChile central bank cut its 2017 and 2018 inflation forecasts and shifted to a more dovish stance. 2017 inflation is now seen at 2.1% vs. 2.4% in September, while the 2018 forecast was cut to 2.9% from 3% previously. The bank noted that “Downward deviations in short-term inflation should be monitored with special attention. Inflation convergence could be affected, in which case a more expansionary monetary policy would be required.” |

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, December 2017 Source: economist.com - Click to enlarge |

Tags: Beata Szydlo,Featured,Mateusz Morawiecki,newsletter,win-thin