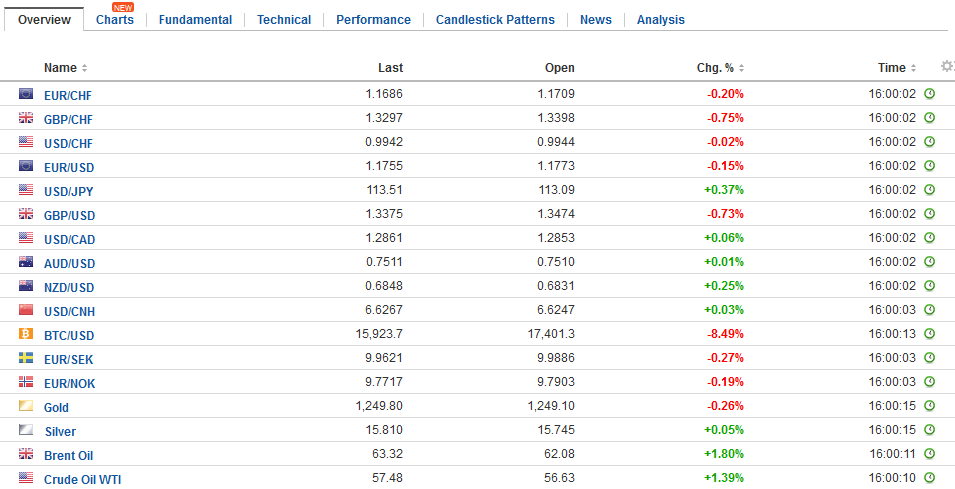

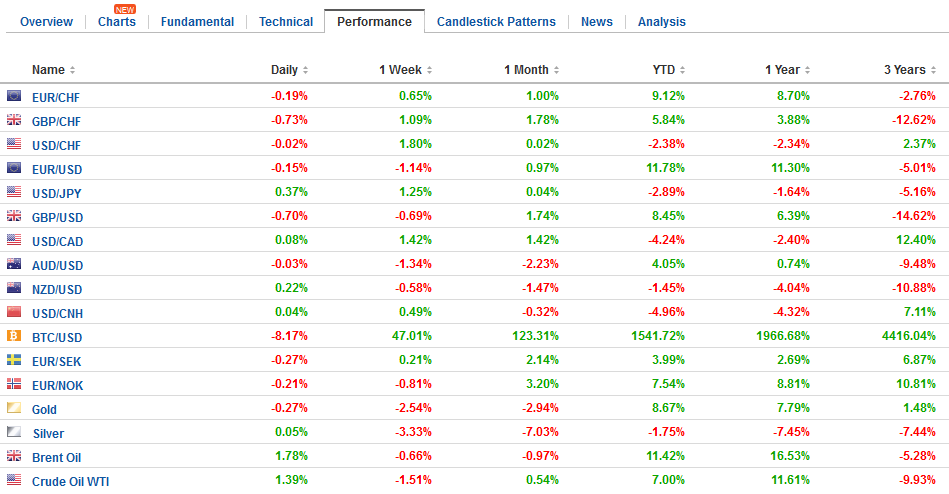

Swiss Franc The Euro has fallen by 0.21% to 1.1679 CHF. EUR/CHF and USD/CHF, December 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sufficient progress will be judged to have been made, and negotiations of the separation between the UK and EU will be allowed to enter the second stage. The formal decision will be made at next week’s EU summit. To be sure, “sufficient progress,” which the diplomatic-speak that does not mean that any agreement has really been reached, but rather that the UK has made a few concessionary signals. The Irish border issue has not been resolved. The UK committed itself to regulatory equivalence, which will mean different thing to different

Topics:

Marc Chandler considers the following as important: Brexit, China, China Exports, China Imports, China Trade Balance, EUR, Featured, FX Trends, GBP, Germany Trade Balance, Japan Average Cash Earnings, Japan Gross Domestic Product QoQ, newslettersent, SPY, U.K. industrial production, U.K. trade balance, U.S. Average Weekly Hours, U.S. Michigan Consumer Expectations, U.S. Michigan Consumer Sentiment, U.S. Nonfarm Payrolls, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.21% to 1.1679 CHF. |

EUR/CHF and USD/CHF, December 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesSufficient progress will be judged to have been made, and negotiations of the separation between the UK and EU will be allowed to enter the second stage. The formal decision will be made at next week’s EU summit. To be sure, “sufficient progress,” which the diplomatic-speak that does not mean that any agreement has really been reached, but rather that the UK has made a few concessionary signals. The Irish border issue has not been resolved. The UK committed itself to regulatory equivalence, which will mean different thing to different people. When the UK leaves, and after a transition period, a hard border is needed. The question of where is the customs house and passport check? The EU and Ireland say it cannot be between the Republic and Northern Ireland. Many Brexiters and the DUP, which itself is a minority party in North Ireland, reject that it is between Northern Ireland and the rest of the UK. Also, the Brexiters are not keen on any role for the European Court of Justice within the sovereign UK territory. |

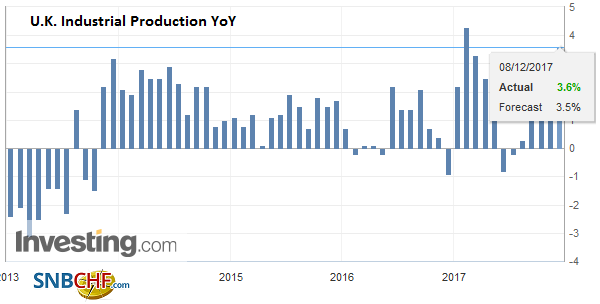

FX Daily Rates, December 08 |

| The bottom line is that the second stage of negotiations may be just as trying as the first, and there is less time. The EU negotiator Barnier wants the second stage to be concluded by next October. A final agreement must be approved by several entities and it will take some time.

Sterling trading firmly initially after running up smartly yesterday in anticipation of the agreement. It posted an outside up day, trading on both sides of Wednesday’s range and closing above its high. Following through buying was seen briefly, lifting sterling to $1.3520, where sellers emerged ahead of the week’s high near $1.3540. There are options struck at $1.3450 (GBP326 mln) and $1.3500 (GBP273 mln) that expire today and could be in play. The euro is moving lower. It finished last week just below $1.19 and tested $1.1730 in the European morning. It is near a three-week low. Some pressure is coming from the cross against sterling, which the single currency was sold briefly through GBP0.8700 for the first time in six months. There is a roughly 540 bln euro option struck at $1.1750 expiring today. Earlier this week, the euro fell through the uptrend line from last month, and then mid-week fell below the 38.2% retracement of the November rally (~$1.1805), and today, was sold through the 50% retracement (~$1.1760). The 61.8% retracement is found near $1.1710 and corresponds to the low from November 21. |

FX Performance, December 08 |

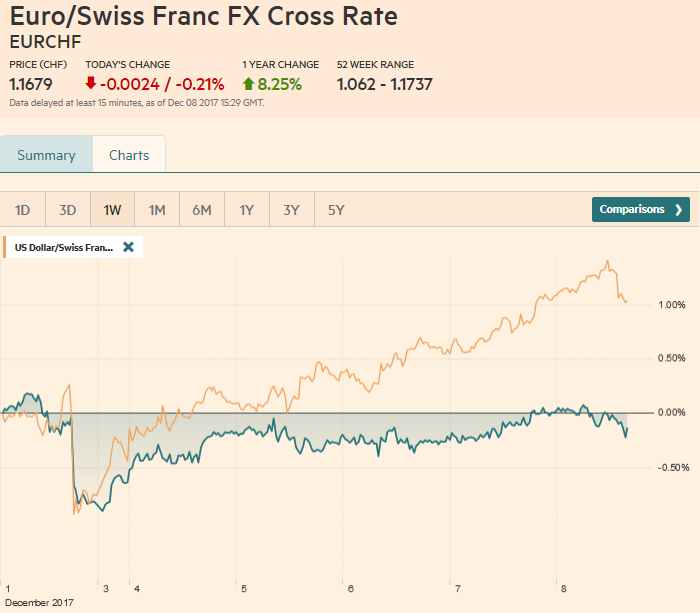

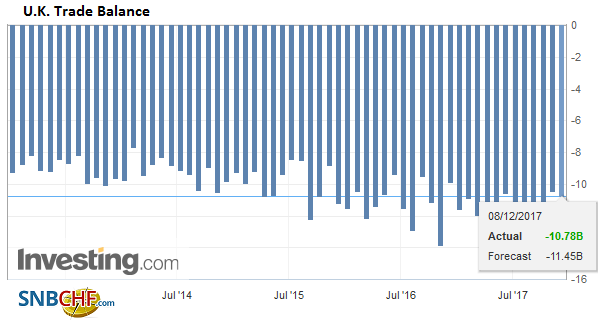

United KingdomUK interest rates were goosed higher by the news. The foreign exchange market largely reacted yesterday to the prospects, but the UK debt market is responding today. The two-year yield is up three basis points, which is the increase on the week, and the 10-year yield is up six basis points and is up three basis points on the week. The economic data were mixed. Industrial output was flat as expected after a strong 0.7% gain in September. Manufacturing output rose 0.1%. However, the slump in construction (-1.7%) was considerable worse than expected (0.1). It is the back-to-back decline is the largest in five years. On the other hand, the UK reported a smaller trade deficit than expected and revisions to the September series that reduces the sting (GBP1.14 bln vs GBP2.75 bln). |

U.K. Industrial Production YoY, October 2017(see more posts on U.K. Industrial Production, ) Source: Investing.com - Click to enlarge |

U.K. Trade Balance, October 2017(see more posts on U.K. Trade Balance, ) Source: Investing.com - Click to enlarge |

|

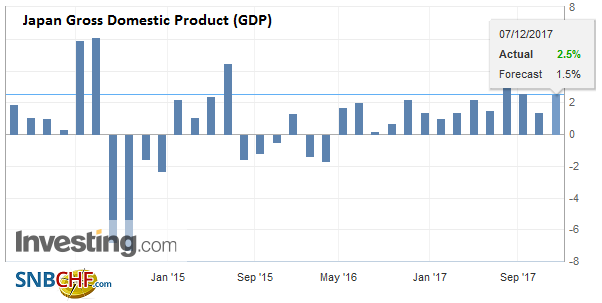

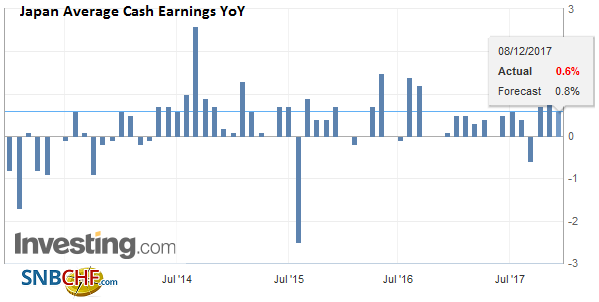

JapanThe yen is the weakest of the major currencies today, easing around 0.4%. For the week, it is off 1.2%. The US dollar poked through the JPY113.50 level for the first time since mid-November. The JPY113.25 area corresponded with a key retracement target of the down move since early November’s peak near JPY11.75. Today’s dollar gains come despite the doubling of the initial estimate for Japan’s Q3 GDP from 0.3% to 0.6%, and a larger than expected current account surplus (JPY2.176 trillion). The driver for the GDP revision was a boost in business investment from 0.2% to 1.1%. When thinking about Japan’s current account surplus, keep in mind that it is not driven by trade. Japan’s trade surplus was JPY430 bln, a fifth of the current account surplus, which is driven by investment income. |

Japan Gross Domestic Product (GDP) YoY, Q3 2017(see more posts on Japan Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

Japan Average Cash Earnings YoY, November 2017(see more posts on Japan Average Cash Earnings, ) Source: Investing.com - Click to enlarge |

|

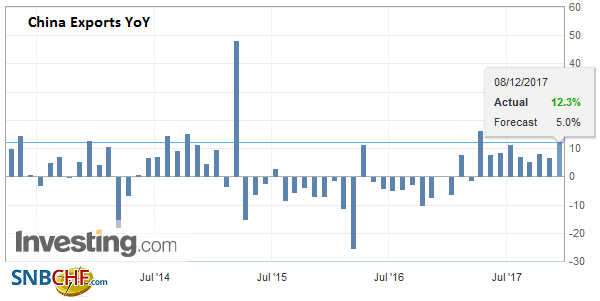

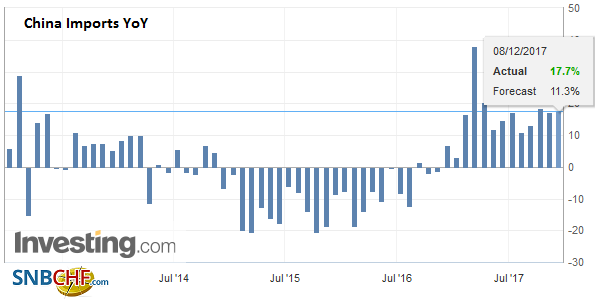

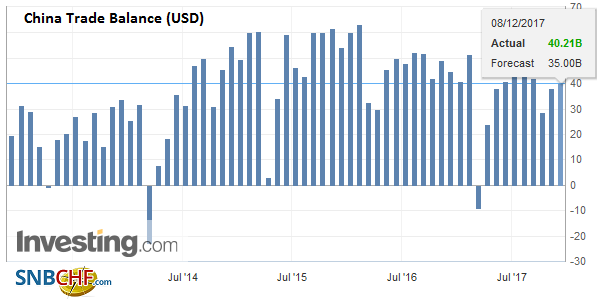

ChinaSeparately, China reported a larger than expected November trade surplus bolstered by a surge in exports. The $40.2 bln trade surplus is the largest in three months and is about $5 bln more than expected. The average monthly surplus this year through October had been $33.6 bln. Last year’s monthly average was $42.5 bln. Exports rose 12.3% year-over-year, up from 6.8% in October, and defying expectations for a decline. Imports rose 17.7% year-over-year, up from 17.2% in October. Economists had expected imports to have slowed. China recently announced some tariff reductions. China’s commodity imports surged, with natural gas and copper jumping to record levels. Crude oil imports are up 12% through November this year. Often Australia, and to a lesser extent, New Zealand, are thought to benefit from China’s commodity imports among the major countries. The New Zealand dollar is the only major currency that is firmer against the US dollar today, and it slightly at that, while the Australian dollar is a shade lower. |

China Exports YoY, November 2017(see more posts on China Exports, ) Source: Investing.com - Click to enlarge |

China Imports YoY, November 2017(see more posts on China Imports, ) Source: Investing,.com - Click to enlarge |

|

China Trade Balance (USD), November 2017(see more posts on China Trade Balance, ) Source: Investing.com - Click to enlarge |

|

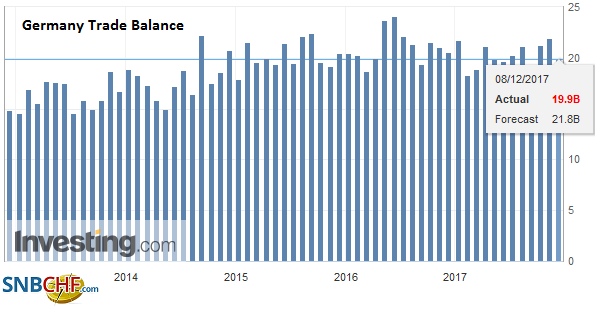

GermanyIn contrast, Germany reported a smaller than expected October trade and current account surplus. The trade balance fell to 18.9 bln euros from 24.1 bln. It is the smallest surplus since April, but there does seem to be a seasonal component. Exports fell 0.4% in October, which are seasonally adjusted, and it is the second consecutive monthly decline after the 2.4% surge in August. Imports, which were expected to have reversed September’s 1.0% decline, jumped 1.8%. France reported a surge in industrial production, led by manufacturing, and follows yesterday’s German news of an unexpected decline. The strength of the French economy has been a pleasant surprise this year. Industrial output jumped 1.9% in October. Economists had expected a small decline, and September series was revised to 0.8% from 0.6%. |

Germany Trade Balance, October 2017(see more posts on Germany Trade Balance, ) Source: Investing.com - Click to enlarge |

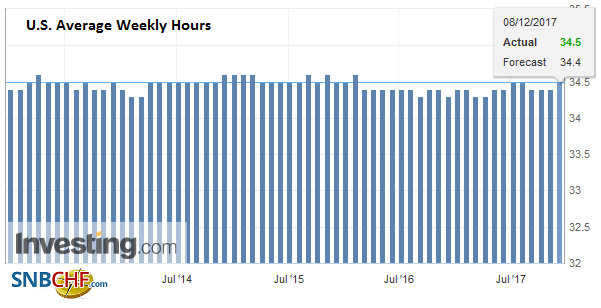

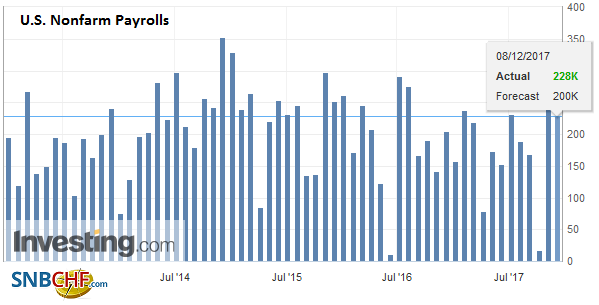

United StatesThe US reports the November jobs data today. It often is among the most important high frequency economic reports. However, barring a significant surprise, the market’s focus is elsewhere. That said, within the jobs report, the hourly earnings may be the most important. It is expected to rise 0.3% and lift the year-over-year rate to 2.7%. Investors are very confident the Fed will raise rates next week. |

U.S. Average Weekly Hours, November 2017(see more posts on U.S. Average Weekly Hours, ) Source: Investing.com - Click to enlarge |

| Late yesterday, Congress extended the spending authorization until December 22. This prevents a government shutdown that could have taken place beginning tomorrow. Kicking the can down the road for such a short period was to get the tax bill passed. If it is not passed by then, and we are somewhat skeptical that it will be, the “continuing resolution” can extend the spending authority further. The Treasury Department has said it will begin the now usual measures to operate within the debt ceiling. |

U.S. Nonfarm Payrolls, November 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to enlarge |

| After a swoon in equity markets in the first half of the week, a recovery is under way. The MSCI Asia Pacific Index rose for its second day (~0.6%) and recouped about half of this week’s losses coming into today. Still, it recorded back-to-back weekly losses for the first time since the end of June and the start of July. The Dow Jones Stoxx 600 is up almost 1% today, which would be the largest gain in almost two months. It is up nearly 1.6% this week after have fallen in three of past four weeks. The S&P 500 is off 0.2% this week before today’s session. We suspect it follow Asia and European markets higher and allow the US benchmark to extend its advancing streak for a third consecutive week. |

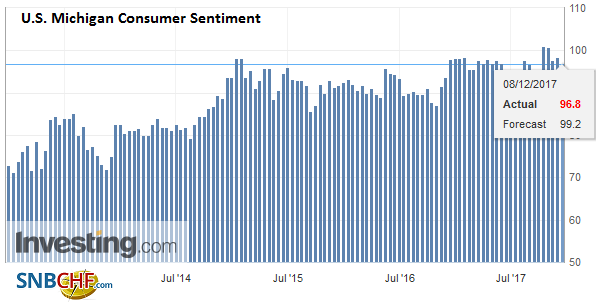

U.S. Michigan Consumer Sentiment, November 2017(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

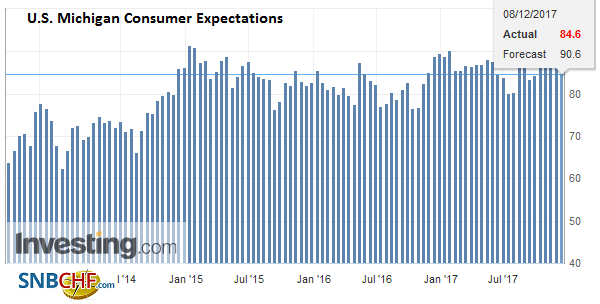

U.S. Michigan Consumer Expectations, November 2017(see more posts on U.S. Michigan Consumer Expectations, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,Brexit,China,China Exports,China Imports,China Trade Balance,Featured,Germany Trade Balance,Japan Average Cash Earnings,Japan Gross Domestic Product QoQ,newslettersent,SPY,U.K. Industrial Production,U.K. Trade Balance,U.S. Average Weekly Hours,U.S. Michigan Consumer Expectations,U.S. Michigan Consumer Sentiment,U.S. Nonfarm Payrolls