Swiss Franc The Euro has risen by 0.09% to 1.1691 CHF. EUR/CHF and USD/CHF, December 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed in relatively quiet activity. Year-end adjustment is well underway, and the news stream is light to start the week that sees more than a dozen central bank meetings. There is little doubt in the market...

Read More »EU tax grey list splits Federal Council

Johann Schneider-Ammann listening to Ueli Maurer in May (Keystone) - Click to enlarge It’s “hardly a tragedy” that the European Union has placed Switzerland on a grey list of non-cooperative jurisdictions for tax purposes, says Finance Minister Ueli Maurer. Economics Minister Johann Schneider-Ammann, on the other hand, says he is “irritated” by the move. “I rate the significance of the list as negligible,” Maurer said...

Read More »What Is Money? (Yes, We’re Talking About Bitcoin)

Good ideas don’t require force. That describes the Internet, mobile telephony and cryptocurrencies. What is money? We all assume we know, because money is a commonplace feature of everyday life. Money is what we earn and exchange for goods and services. Everyone thinks the money they’re familiar with is the only possible system of money—until they run across an entirely different system of money. Then they realize money...

Read More »Giant Sucking Sound Sucks (Far) More Than US Industry Now

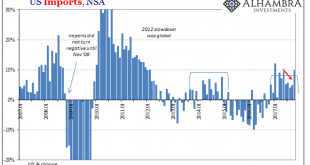

There are two possibilities with regard to stubbornly weak US imports in 2017. The first is the more obvious, meaning that the domestic goods economy despite its upturn last year isn’t actually doing anything positive other than no longer being in contraction. The second would be tremendously helpful given the circumstances of American labor in the whole 21st century so far. In other words, perhaps US consumers really...

Read More »FX Weekly Preview: FOMC and ECB Highlight Central Banks’ Last Meetings of the Year

No fewer than thirteen central banks meet in the week ahead. The UK and the US report the latest inflation figures, and the US and eurozone report industrial production. The eurozone sees the flash PMI for December, and the Japan’s latest Tankan business survey will be released. Most of the central banks that meet will not be changing policy. Of the major central banks, the Bank of England, which hiked rates last...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX closed on a firm note, though most currencies were down for the entire week. TRY and ZAR outperformed, but we do not think that will be sustained. FOMC meeting this week will provide some event risk for EM. Stock Markets Emerging Markets, December 06 Source: economist.com - Click to enlarge China China reports November money and loan data this week, but no schedule has been set. China reports...

Read More »Large email hack reported – Swiss agency tool lets you check if your account was compromised

© Igor Stevanovic | Dreamstime It’s the question lurking in many people’s minds, especially during the frenzy of online Christmas shopping: has my email account been hacked? MELANI has got your back – up to a point. The Reporting and Analysis Centre for Information Assurance (MELANI), is part of the Swiss Federal Intelligence Service. They have recently come into possession of a database with 21,000 combinations of...

Read More »General Electric to cut 1,400 Swiss jobs

General Electric's Swiss headquarters is based in Baden in northern Switzerland (Keystone) - Click to enlarge General Electric (GE) has announced plans to cut around a third of its workforce based in northern Switzerland as the American multinational responds to a sharp fall in demand for fossil fuel power equipment. GE aims to cut up to 1,400 jobs over the next two years at its GE Power unit in the northern...

Read More »UK Pensions Risk – Time to Rebalance and Allocate to Cash and Gold

UK Pensions Risk – Time to Rebalance and Allocate to Cash and Gold – Value of Sterling and increased risks place pressure on pensioners both in UK and abroad – 500,000 British expats face ‘frozen’ pensions – 61% of UK Direct Benefit pension schemes have more money going out than coming in – OECD report finds ‘UK workers face the biggest retirement cliff edge in developed world’ – Combined pension deficit of FTSE 350...

Read More »Reduced Trade Terms Salute The Flattened Curve

The Census Bureau reported earlier today that US imports of foreign goods jumped 9.9% year-over-year in October. That is the second largest increase since February 2012, just less than the 12% import growth recorded for January earlier this year. US Imports, Jan 2007 - 2017 - Click to enlarge In both monthly cases, however, the almost normal rates of increase which would have at least suggested moving closer to a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org