Summary:

Eternal Spendathon

The Senate just passed a 500-page tax reform bill. Assuming it lives up to its promise, it will cut taxes on corporations and individuals. Predictably, the Left hates it and the Right loves it. I am writing to argue why the Right should hate it (no, not for the reason the Left does, a desire to get the rich).

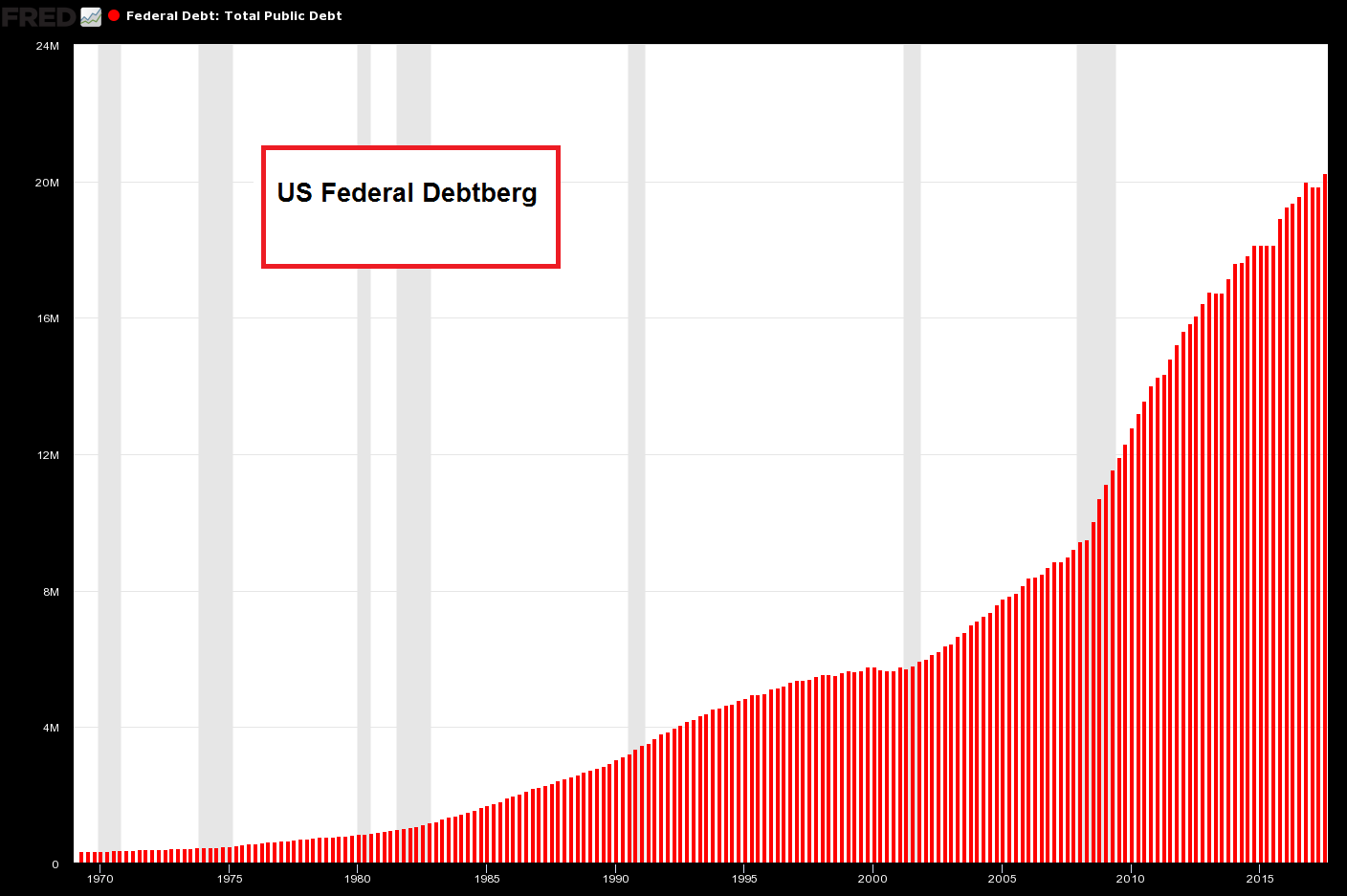

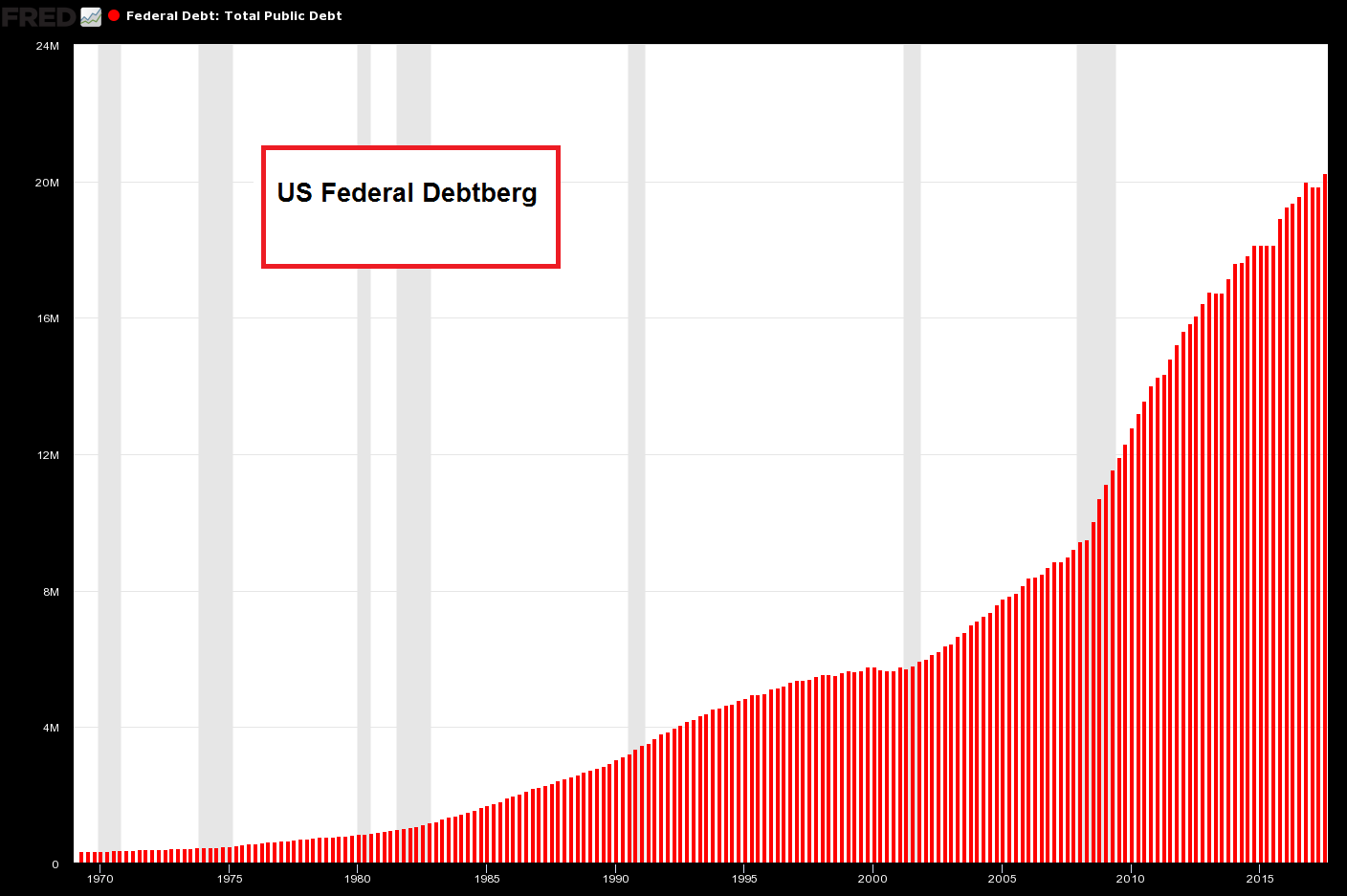

US Federal Debt, 1970 - 2017The Federal debtberg has grown beyond all measure since Nixon’s gold default. - Click to enlarge

So has the money supply and the amount of private debt. No-one expects this debt to be paid back ever. The idea that it is payable (without a massive devaluation of the currency) is a kind of illusion we have collectively decided to live with. Government spending

Topics:

Keith Weiner considers the following as important:

Debt and the Fallacies of Paper Money,

Featured,

newsletter,

On Economy,

On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Eternal Spendathon

The Senate just passed a 500-page tax reform bill. Assuming it lives up to its promise, it will cut taxes on corporations and individuals. Predictably, the Left hates it and the Right loves it. I am writing to argue why the Right should hate it (no, not for the reason the Left does, a desire to get the rich). |

US Federal Debt, 1970 - 2017 The Federal debtberg has grown beyond all measure since Nixon’s gold default. - Click to enlarge So has the money supply and the amount of private debt. No-one expects this debt to be paid back ever. The idea that it is payable (without a massive devaluation of the currency) is a kind of illusion we have collectively decided to live with. Government spending perforce leads to capital consumption – while it disturbs the production structure intra- rather than inter-temporally, it still results in an allocation of scarce resources that is not in line with actual consumer wants. Government bureaus cannot possibly ascertain the opportunity cost of their spending. They are not expected to make profits, economic calculation is not something they even care about. On the contrary, their incentives are often quite perverse: the more lavishly they spend, the better from their perspective, as that is often the best way to ensure they will receive the largest possible budget allocations every year. |

| The root of our problem is spending. The federal government spends much of our income, and an increasing amount of our wealth to the tune of over $4 trillion a year. That is over $11,000 for every man, woman, and child. But children don’t work and many adults don’t either (or they work for the government or a contractor).

Assuming 100 million work in the productive sector, the government spends $40,000 in cash for each one, not counting the promises it racks up. This is the federal government only, and of course the people also bear the burden of spending at state, county, city, and municipal water district levels.

The government spends more than it takes in tax revenues. A lot more. The federal debt today is over $700 billion more than it was a year ago. The reason is simple. The people may love spending, but they hate taxes. So the government makes it up by borrowing.

I have written a lot about this concept, borrowing. They call it borrowing, but without the means or intent to repay it, it’s really a fraud. This is my definition of inflation—counterfeit credit. It is the compromise between the party of spend more, and the party of tax less: the policy of borrow more. |

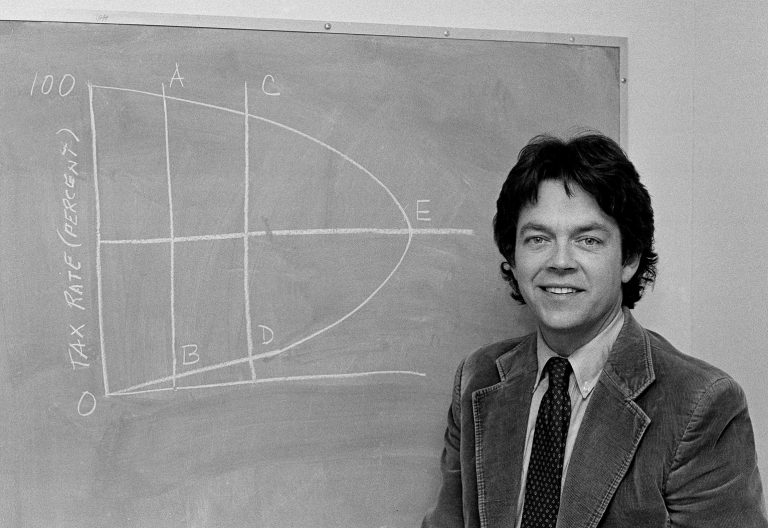

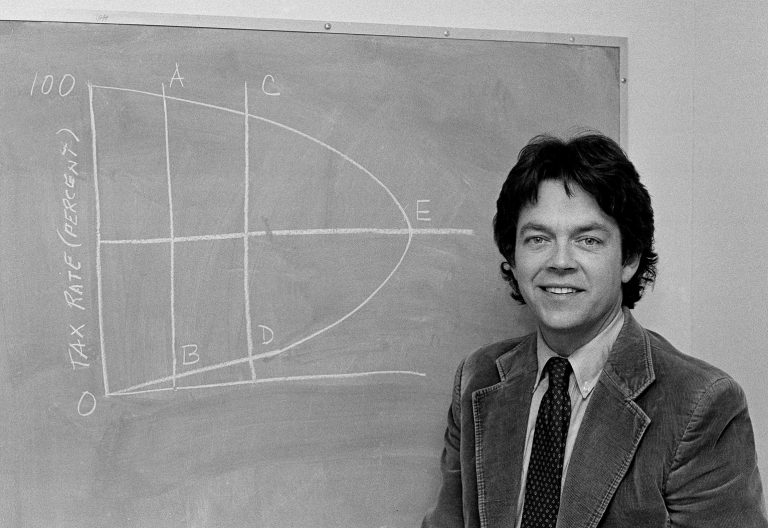

Photo credit: AP - Click to enlarge Arthur Laffer next to his famous curve.While we disagree that the “optimal tax rate” that both minimizes taxation and maximizes government revenue can actually be quantified and pressed into an equation, Laffer’s idea had merit in principle. To put it bluntly: all the CBO “projections” about supposed revenue shortfalls “over the next decade” due to the tax cuts are complete nonsense with absolutely no basis in reality. No-one can forecast what the economy will do in the next ten years, and it is entirely possible that revenues will ceteris paribus actually rise rather than fall due to the incentives provided by lower tax rates. Moreover, the main complaint of the Left, namely that “tax cuts don’t help the poor” is even greater hooey than these useless forecasts: 1. around 50% of Americans make so little income, they actually don’t pay any taxes, so, duh, a tax cut obviously won’t benefit them directly. 2. But now the poor have a far greater incentive to try to become rich, as they know that once they make more money, they won’t immediately have to feed Leviathan to the same extent as before. 3. Because there will be more new enterprises and existing entrepreneurs will invest more, there will be more jobs and wages are likely to rise, all of which benefits the poor. What really bugs the Left is that in this case fewer people will be dependent on government (who are widely assumed to vote for the Left). Note: this is by no means intended to detract from the need to cut spending. |

The Seen and the Unseen

And that brings us to the present topic. Is it good to cut taxes? Economist Frederic Bastiat could have written this essay for me, in only 168 words. The first paragraph of the introduction to his 1850 book That Which is Seen, and That Which is Not Seen reads:

“In the department of economy, an act, a habit, an institution, a law, gives birth not only to an effect, but to a series of effects. Of these effects, the first only is immediate; it manifests itself simultaneously with its cause — it is seen. The others unfold in succession — they are not seen: it is well for us, if they are foreseen. Between a good and a bad economist this constitutes the whole difference — the one takes account of the visible effect; the other takes account both of the effects which are seen, and also of those which it is necessary to foresee. Now this difference is enormous, for it almost always happens that when the immediate consequence is favourable, the ultimate consequences are fatal, and the converse. Hence it follows that the bad economist pursues a small present good, which will be followed by a great evil to come, while the true economist pursues a great good to come, — at the risk of a small present evil.”

|

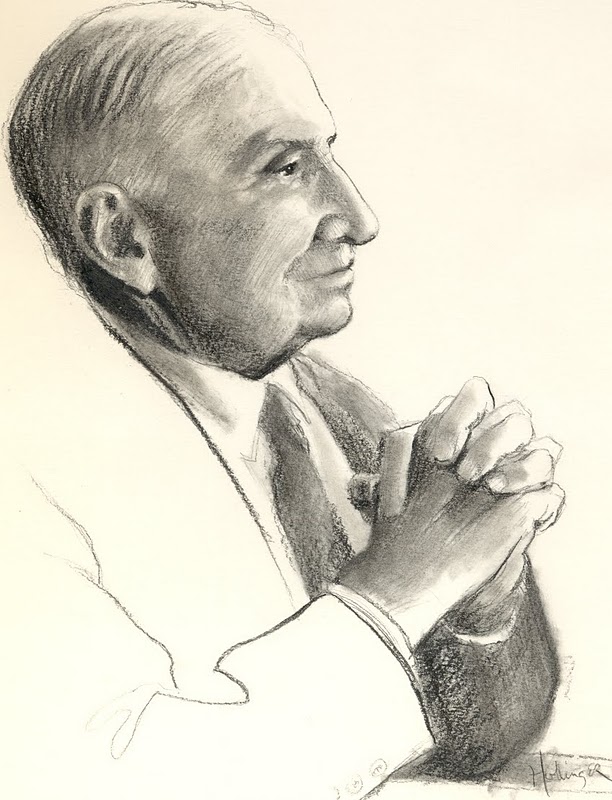

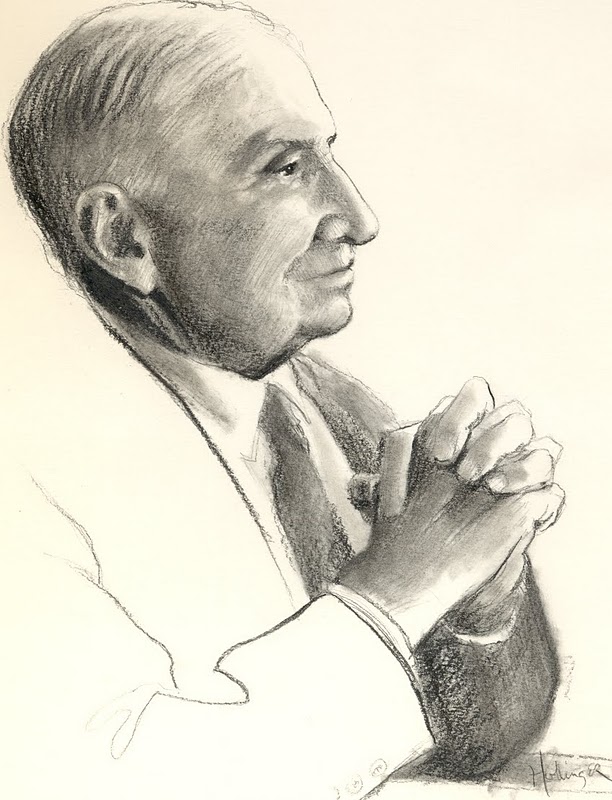

Frédéric Bastiat, a French “proto-Austrian” economist whose valuable lessons apparently have to be retaught incessantly. - Click to enlarge |

| If they cut taxes, the seen is the lower tax you must pay. That is good and everyone is happy. But what is the unseen? What is that thing to which Bastiat refers as the “ultimate fatal consequence”?

It is an increase in borrowing. The “great evil to come” is the collapse of the debt, which is the backing for what we call money nowadays. When the debt is defaulted on, our money will be worthless.

A reduction in tax revenues necessarily means an increase in net borrowing. Borrowing, of course, does not generate revenues. It is merely an addition to the debt.

To manage the rising debt — it is rising exponentially — they suppress the rate of interest. This keeps the monthly payment down, but it has many other unseen but foreseeable consequences. Just ask a retiree trying to live on fixed income. |

Ludwig von Mises had the following to say about the nature of government debt: “The long-term public and semi-public credit is a foreign and disturbing element in the structure of a market society. - Click to enlarge Its establishment was a futile attempt to go beyond the limits of human action and to create an orbit of security and eternity removed from the transitoriness and instability of earthly affairs. What an arrogant presumption to borrow and to lend money for ever and ever, to make contracts for eternity, to stipulate for all times to come! In this respect it mattered little whether the loans were in a formal manner made irredeemable or not; intentionally and practically they were as a rule considered and dealt with as such. In the heyday of liberalism some Western nations really retired parts of their long-term debt by honest reimbursement. But for the most part new debts were only heaped upon old ones. The financial history of the last century shows a steady increase in the amount of public indebtedness. Nobody believes that the states will eternally drag the burden of these interest payments. It is obvious that sooner or later all these debts will be liquidated in some way or other, but certainly not by payment of interest and principal according to the terms of the contract.” from: Human Action |

Impoverished by Spending

The bottom line is that when the government spends our income and our wealth, we are impoverished. That is a fact, and there cannot be any real debate over it. The debate is whether it is less bad to tax us or to borrow.

When the government taxes us, we know we are poorer. It is seen. We adjust downward our consumption and our quality of life. This is why everyone hates taxes.

When the government borrows, by contrast, we do not feel the pinch of the impoverishment. Instead, the government sells us bonds. The bond is a financial asset which not only pays interest, but has been in a bull market since Ronald Reagan took office in 1981.

We not only don’t feel poorer, but we actually feel richer. The purchasing power of our investment portfolios is going up.

Borrowing is not a magic perpetual motion machine. It is not a way to spend above your revenues. It is not a way to consume without first producing. It is a just a way to deceive — to consume without the taxpayer realizing it.

It is Bastiat’s unseen.

Tags:

Featured,

newsletter,

On Economy,

On Politics