Like any other market, there are many opinions on what a currency ought to be worth relative to others. With certain currencies, that spectrum of opinions is fairly narrow. As an example, for the world’s most traded currency – the U.S. dollar – the majority of opinions currently fall in a range from the dollar being 2% to 11% overvalued, according to organizations such as the Council of Foreign Relations, the Bank of International Settlements, the OECD, and the IMF. For other currencies, the spectrum is much wider. The Swiss franc, which some have called the world’s most perplexing currency, has estimates from those same groups ranging from about 13% undervalued to 21% overvalued. As VisualCapitalist’s Jeff

Topics:

Tyler Durden considers the following as important: Bank of International Settlements, Canadian Dollar, Council of Foreign Relations, currency, economy, Featured, Finance, Foreign exchange market, Global news on Switzerland, Inequalities, International Monetary Fund, Money, New York City, newsletter, NYC, OECD, purchasing power, Purchasing power parity, Swiss Franc, trade, Wall Street Journal

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

| Like any other market, there are many opinions on what a currency ought to be worth relative to others.

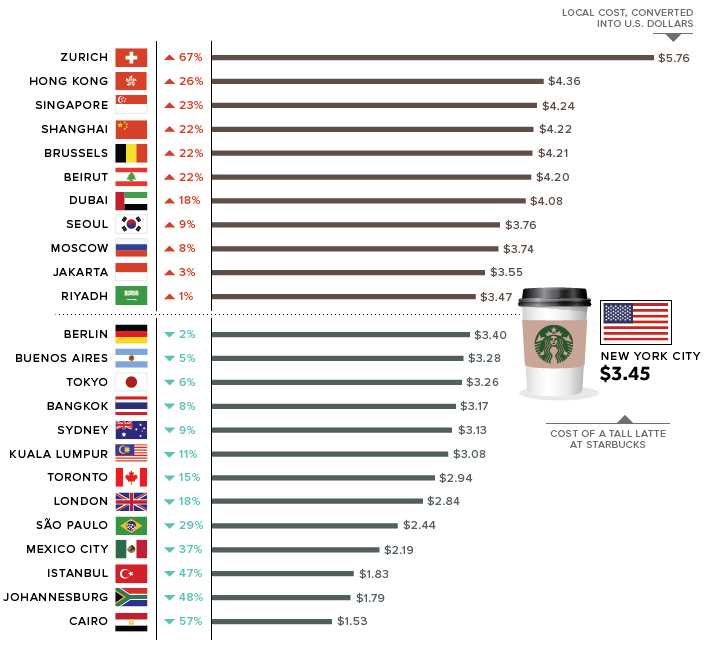

With certain currencies, that spectrum of opinions is fairly narrow. As an example, for the world’s most traded currency – the U.S. dollar – the majority of opinions currently fall in a range from the dollar being 2% to 11% overvalued, according to organizations such as the Council of Foreign Relations, the Bank of International Settlements, the OECD, and the IMF. For other currencies, the spectrum is much wider. The Swiss franc, which some have called the world’s most perplexing currency, has estimates from those same groups ranging from about 13% undervalued to 21% overvalued. As VisualCapitalist’s Jeff Desjardins notes, such a variance in estimates makes it hard to come up with any conclusive consensus – so in today’s chart, we refer to a more caffeinated and fun measure that also approximates the relative value of currencies. |

|

THE IMPARTIAL BEANThe “Latte Index”, developed by The Wall Street Journal, uses purchasing-power parity (PPP) – comparing the cost of the same good in different countries – to estimate which currencies are overvalued and undervalued. In this case, the WSJ tracked down the price of a tall Starbucks latte in dozens of cities around the world. These prices are then converted to U.S. dollars and compared to the benchmark price, which is a tall Starbucks latte in New York City (US$3.45). |

|

| The Latte Index is mostly for fun, but it’s also broadly in line with predictions made by the experts.

For example, the price of a latte in Toronto, Canada works out to US$2.94, which is about 14.8% under the benchmark NYC price. This suggests that relative to the USD, the Canadian dollar is undervalued. Interestingly, estimates from the aforementioned sources (BIS, OECD, CFR, IMF) have the Canadian dollar at being up to 10% undervalued – which puts the Latte Index not too far off. Given the wild range of estimates that exist for currency values, using the relative cost of a cup of joe might be as good of a proxy as any. |

Coffee |

Tags: Bank of international Settlements,Canadian Dollar,Council of Foreign Relations,Currency,economy,Featured,Finance,Foreign exchange market,Inequalities,International Monetary Fund,money,New York City,newsletter,NYC,OECD,purchasing power,Purchasing Power Parity,Swiss Franc,Trade,Wall Street Journal