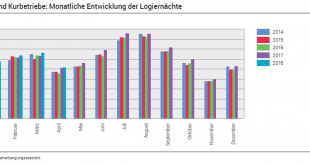

Neuchâtel, 7 June 2018 (FSO) – The Swiss hotel industry registered 16.5 million overnight stays during the winter tourist season (November 2017 to April 2018), i.e. an increase of 4.6% (+724 000) compared with the same period of the previous year. With a total 8.7 million overnight stays, foreign demand grew by 5.6% (+460 000). Domestic demand rose by 3.5% (+264 000) reaching 7.8 million units. These are the provisional...

Read More »Swiss Producer and Import Price Index in May 2018: +3.2 percent YoY, +0.2 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »Vaud Plans Tax Cuts

Last week, Vaud’s government announced a plan for future tax cuts. ©-Erix2005-_-Dreamstime.com_ - Click to enlarge The residents of Vaud are among the highest taxed in Switzerland. In 2016, a single person in Lausanne earning CHF 100,000 paid CHF 16,050 in cantonal and communal tax on top of CHF 1,840 of federal tax. This was the fourth highest across all of Switzerland’s 26 cantonal capitals, and almost triple Zug,...

Read More »FX Daily, June 13: Dollar Edges Higher Ahead of FOMC

The US dollar is trading firmly as the FOMC decision looms. In many ways, the actionable outcome of this meeting has hardly been in doubt this year. By all accounts, the Fed will deliver its second hike of the year today. The question is not so much about the next meeting in August. The Fed has only hiked rates at meetings that a press conference follows. This is the source of one of our persistent criticisms of the...

Read More »A Slight Hint Of A 2011 Feel

Whenever a big bank is rumored to be in unexpected merger talks, that’s always a good sign, right? The name Deutsche Bank keeps popping up as it has for several years now, this is merely representative of what’s wrong inside of a global system that can’t ever get fixed. In this one case, we have a couple of perpetuated conventional myths colliding into what is still potentially grave misfortune. As noted last time, I...

Read More »Der umtriebige Demokrat! Interview mit Stefan Thöni

Von Lucien Looser – Er hält den ganzen Kanton Zug auf Trab. Mal kämpft er bis vor Bundesgericht um Akteneinsicht, dann will er ans Verwaltungsgericht und brüskiert damit die etablierten Parteien, die die Sitze gerne untereinander verteilt hätten. Wer ist dieser umtriebige Demokrat. Die...

Read More »Sovereign Money Referendum: A Swiss Awakening to Fractional-Reserve Banking?

On Sunday 10 June 2018, Switzerland’s electorate voted on a referendum calling for the country’s commercial banks to be banned from creating money. In a country world-famous for its banking industry, this was quite an interesting turn of events. Known as the Sovereign Money Initiative or ‘Vollgeld’, the referendum was brought to the Swiss electorate in the form of a ‘Popular Initiative‘. The Sovereign Money referendum...

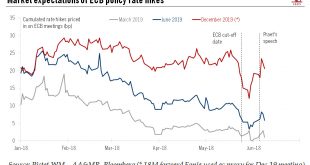

Read More »ECB gets ready to make the leap

The ECB has had essentially two options going into the June meeting: either a dovish decision but a hawkish communication (hinting at an imminent QE tapering), or a hawkish decision but a dovish communication (counterb alancing a tapering announcement with dovish sweeteners). Ever since economic indicators have started to deteriorate this year and risks to global trade have accumulated, ECB rhetoric has been...

Read More »Swiss pensions – lump sum withdrawal restrictions rejected by Council of States

© Edgars Sermulis | Dreamstime.com Against the wishes of the Federal Council, Switzerland’s upper house, the Council of States, rejected a plan to prevent people from withdrawing lump sums from their 2nd Pillar pensions, according to the newspaper Tribune de Genève. Last week, the Council of States voted 25 to 15 to reject the plan. The Federal Council thinks forcing people to convert their pension money into an...

Read More »FX Daily, June 12: US-Korea Summit Fails to Impress Investors

Swiss Franc The Euro has risen by 0.03% to 1.1609 CHF. EUR/CHF and USD/CHF, June 12(see more posts on EUR/CHF, EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar initially rallied in early Asia ahead of the US-North Korea summit but has subsequently shed the gains and more. As North American dealers return to their desks, the dollar is lower against nearly all the major...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org