The U.S. Department of Treasury has just published its semi-annual report on International Economic and Exchange Rate Policies. It comes at a time when the US Administration remains deeply concerned by the significant trade imbalances in the global economy. The report only focuses on the US’s 12 largest trading partners, which collectively account for more than 70% of the US’s trade in goods. Although Switzerland is...

Read More »Insurance boss suggests Swiss health insurance deductibles of 10,000 francs

Philomena Colatrella, the CEO of Swiss insurer CSS Insurance, has stirred the lively debate around Switzerland’s rising cost of health insurance by proposing deductibles of CHF 5,000 and CHF 10,000 – deductibles set the amount people pay out of their own pockets before their insurance kicks in. - Click to enlarge Colatrella discussed the idea in an interview with Blick. The response to her comments was widely...

Read More »FX Daily, April 18: Greenback is Firm, While Soft Inflation Drags Sterling from Perch

Swiss Franc The Euro has risen by 0.11% to 1.1962 CHF. EUR/CHF and USD/CHF, April 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is enjoying a firmer tone against major and most emerging market currencies. Sterling, which has become a market darling, hit an air pocket after softer than expected CPI. Sterling had reached its highest level since the 2016...

Read More »EU and Euro Exposed To Risks Including Trade Wars and War With Russia In Middle East

– EU and euro face growing risks including trade wars, energy independence and war with Russia in Middle East – Middle East war involving Russia may badly impact energy dependent & fragile EU – Trade and actual wars on European doorstep show the strategic weakness of the EU– Toxic combination due to growing anti-EU and anti-Euro sentiment in many EU nations– Investors should diversify to hedge investment, currency...

Read More »Global Asset Allocation Update: The Certainty of Uncertainty

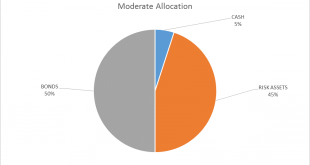

There is no change to the risk budget this month. For the moderate risk investor, the allocation to bonds is 50%, risk assets 45% and cash 5%. Stocks continued their erratic ways since the last update with another test of the February lows that are holding – for now. While we believe growth expectations are moderating somewhat (see the Bi-Weekly Economic Review) the change isn’t sufficient to warrant an asset...

Read More »Geneva hotels are the most expensive in Europe

The Royal Penthouse Suite at Geneva's President Wilson Hotel is reputedly the most expensive holiday room in the world. (Keystone) - Click to enlarge Staying in a hotel in Geneva costs more than anywhere else in Europe, according to an international survey. The €242.90 (CHF288 or $300) average charge per night puts Geneva ahead of Paris (€232.30), while Zurich is listed as the third most expensive...

Read More »FX Daily, April 17: Dollar Recovers from Further Selling as Turnaround Tuesday Unfolds

Swiss Franc The Euro has risen by 0.29% to 1.1914 CHF. EUR/CHF and USD/CHF, April 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After the retreating in the North American session yesterday, despite a rebound in retail sales after three-months of declines, the greenback has been sold further in Europe and Asia. The euro edged through last week’s high near $1.24, and...

Read More »Silent Circle founder joins metals-backed crypto coin project

Renowned cryptographer Philip Zimmermann, who moved his smartphone encryption firm Silent Circle to Switzerland four years ago, has signed up to the metals-backed crypto Tiberius Coin venture as chief science and security officer. Zimmermann, who was inducted into the Internet Hall of Fame by the Internet Society in 2012, came to Switzerland to further develop his anti-snooping Blackphone away from invasive...

Read More »Why Trade Wars Ignite and Why They’re Spreading

The monetary distortions, imbalances and perverse incentives are finally bearing fruit: trade wars. What ignites trade wars? The oft-cited sources include unfair trade practices and big trade deficits. But since these have been in place for decades, they don’t explain why trade wars are igniting now. To truly understand why trade wars are igniting and spreading, we need to start with financial repression, a catch-all...

Read More »Negative Rates: Rise of the Japanese Androids

Good Intentions One of the unspoken delights in life is the rich satisfaction that comes with bearing witness to the spectacular failure of an offensive and unjust system. This week served up a lavish plate of delicious appetizers with both a style and refinement that’s ordinarily reserved for a competitive speed eating contest. What a remarkable time to be alive. It seemed a good idea at first… - Click to enlarge...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org