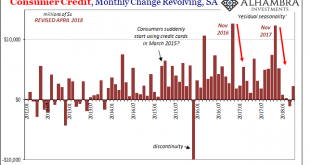

US consumers continue to recover from their debt splurge at the end of last year. Combined with still weaker income growth, the Federal Reserve estimates that aggregate revolving credit balances grew only marginally for the fourth straight month in April 2018. To put it in perspective, the total for revolving credit (seasonally adjusted) is up a mere $2.2 billion for all four months of this year combined, compared to...

Read More »Swiss wage index 2017: Nominal wage increase of 0.4percent in 2017 – real wages decrease by 0.1percent

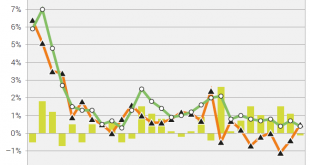

Neuchâtel, 11 June 2018 (FSO) -The Swiss nominal wage index rose by +0.4% on average in 2017 compared with 2016. It settled at 101.1 points (base 2015 = 100). Given an average annual inflation rate of +0.5%, real wages registered a decrease of -0.1% (101.0 points, base 2015 = 100) according to calculations by the Federal Statistical Office (FSO). Development of nominal wages to the consumer prices and real wages...

Read More »Financial watchdog accuses Raiffeisen of major governance failings

The former chief executive of Raiffeisen bank in Switzerland, Pierin Vincenz, spent 15 weeks behind bars. Vincenz was released on Wednesday (Keystone) The Swiss Financial Market Supervisory Authority (FINMA) has concluded its investigation into Swiss bank Raiffeisen, saying it identified “serious shortcomings” in governance. “FINMA has found that the bank’s handling of conflicts of interest was inadequate,” the...

Read More »FX Daily, June 15: Dollar Slips While Escalating Trade Tensions may Roil Markets

Swiss Franc The Euro has risen by 0.40% to 1.1576 CHF. EUR/CHF and USD/CHF, June 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge The Dollar Index edged higher to its best level this year before turning down as market attention shifts from central banks to trade tensions. Reports confirm that the US will go ahead with the 25% tariff on $50 bln of Chinese goods and provide some...

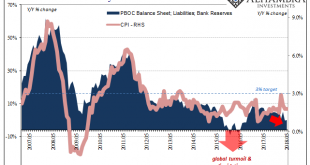

Read More »Chinese Inflation And Money Contributions To EM’s

The People’s Bank of China won’t update its balance sheet numbers for May until later this month. Last month, as expected, the Chinese central bank allowed bank reserves to contract for the first time in nearly two years. It is, I believe, all part of the reprioritization of monetary policy goals toward CNY. How well it works in practice remains to be seen. Authorities are not simply contracting one important form of...

Read More »Credit Spreads: Polly is Twitching Again – in Europe

Junk Bond Spread Breakout The famous dead parrot is coming back to life… in an unexpected place. With its QE operations, which included inter alia corporate bonds, the ECB has managed to suppress credit spreads in Europe to truly ludicrous levels. From there, the effect propagated through arbitrage to other developed markets. And yes, this does “support the economy” – mainly by triggering an avalanche of capital...

Read More »Swiss health costs set to exceed CHF10,000 per person

Outpatient treatment is expected to grow faster than inpatient care over the coming years The average Swiss will for the first time spend more than CHF10,000 ($10,159) on health care in 2018 and 2019, according to an economic research institute and think tank. KOF, part of the federal technology institute ETH Zurich, says this is down to the growing economy: the more people earn, the more they spend on their health. It...

Read More »FX Daily, June 14: Dollar Punished Ahead of ECB

Swiss Franc The Euro has risen by 0.43% to 1.1568 CHF. EUR/CHF and USD/CHF, June 14(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge The US dollar is slumping against all the major currencies in the aftermath of the hawkish Federal Reserve. In fact, the inability of the greenback to hold on to the gains scored in the initial reaction to the Fed’s hike, optimism on the economy,...

Read More »Bi-Weekly Economic Review – VIDEO

[embedded content] Interview with Joe Calhoun about BiWeekly Economic Review 15/06/2018. Related posts: Bi-Weekly Economic Review: As Good As It Gets? Bi-Weekly Economic Review – VIDEO Weekly SNB Intervention Update: SNB Resumes Interventions Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth Bi-Weekly Economic Review Bi-Weekly...

Read More »Swiss National Bank commits to FX Global Code and supports establishment of foreign exchange committee

The Swiss National Bank (SNB) has signed a Statement of Commitment to the FX Global Code (“Code”), thereby demonstrating that its internal processes are consistent with the principles of the Code. It also expects its regular counterparties to adhere to the Code and comply with the agreed rules of conduct. Published on 25 May 2017, the Code outlines principles of good practice developed by central banks and market...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org