Whenever a big bank is rumored to be in unexpected merger talks, that’s always a good sign, right? The name Deutsche Bank keeps popping up as it has for several years now, this is merely representative of what’s wrong inside of a global system that can’t ever get fixed. In this one case, we have a couple of perpetuated conventional myths colliding into what is still potentially grave misfortune. As noted last time, I doubt DB is the next Lehman. That doesn’t mean, however, there won’t be trouble and fallout from what’s (really) going on with the institution. There is absolutely no way the German government doesn’t step in to rescue the ailing bank if it ever comes to that – which might just be only one step removed

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, balance sheet capacity, China, credit-based money, currencies, dark leverage, Derivatives, Deutsche Bank, economy, emerging markets, Featured, Federal Reserve/Monetary Policy, fic, ficc, junk bonds, leveraged loans, Markets, modern money, money dealing, newsletter, rwa, The United States

This could be interesting, too:

investrends.ch writes Bloomberg: DWS stoppt Private-Credit-Geschäft in Asien

investrends.ch writes Deutsche Bank bleibt auf Rekordkurs

investrends.ch writes DWS mit neuem Vertriebsleiter für Institutionelle

investrends.ch writes Deutsche Bank mit Gewinnsprung – Aktie steigt

Whenever a big bank is rumored to be in unexpected merger talks, that’s always a good sign, right? The name Deutsche Bank keeps popping up as it has for several years now, this is merely representative of what’s wrong inside of a global system that can’t ever get fixed. In this one case, we have a couple of perpetuated conventional myths colliding into what is still potentially grave misfortune.

As noted last time, I doubt DB is the next Lehman. That doesn’t mean, however, there won’t be trouble and fallout from what’s (really) going on with the institution. There is absolutely no way the German government doesn’t step in to rescue the ailing bank if it ever comes to that – which might just be only one step removed from what’s behind today’s unusual rumors.

Deutsche Bank on Thursday downplayed the idea that a deal with cross-town rival Commerzbank could materialize soon, after Bloomberg reported that top shareholders had been consulted about a potential tie-up.

It hasn’t been all that long since the spate of “cold fusions” that once gripped the European banking sector. It gives the current “dollar” situation a decided 2011 feel to it. Europe’s back at the center of eurodollar problems, again, something nobody would ever have wished for. Commerzbank itself is no healthy match, another firm that followed DB’s trend if to a substantially lesser degree.

The problem is, for once, pretty well defined at least in general terms.

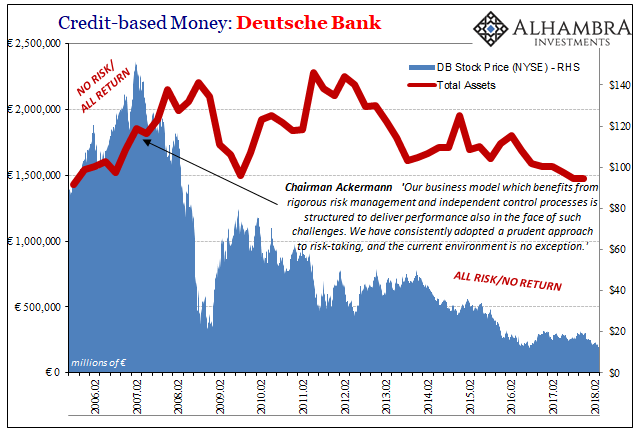

Deutsche Bank, Germany’s flagship lender, is searching for new avenues of growth after it was forced to retreat from a strategy of trying to build a global investment bank.

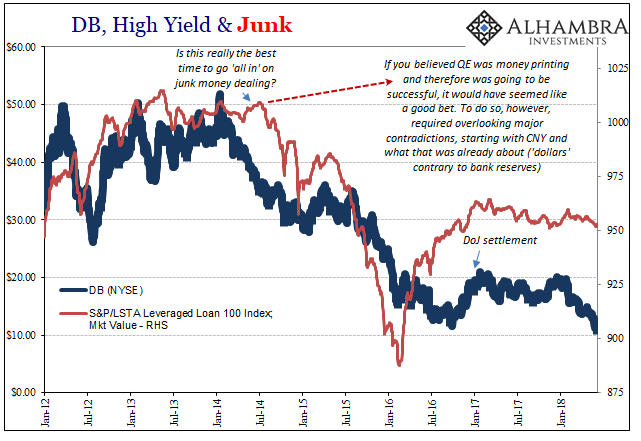

That’s one way to put it. A more accurate way to describe the situation would be by dropping the intentionally charitable euphemism and to admit up front that DB went all in on “global growth” at the worst possible moment and in the worst possible way. They bet, heavily, on leveraged loans and corporate junk in the US (meaning energy) as well as similar capacities, meaning corporate junk, in EM locations. They did this in the middle of 2014 right at the top of both junk and the dollar.

And they went in this direction specifically because they completely believed in central bankers getting it right. Whatever ends up with DB, this is a lesson that should be burned in everyone’s head, the great dangers of buying the global growth story no matter which official version is being offered at any one time (synchronized, as in the latest iteration, is simple marketing to transparently try to differentiate what really isn’t any different). It may be that European banks, again echoing 2011, have been reconsidering this established pattern especially since April 18 (with a reprieve in the euro over the past week or so).

| It was interesting to note that contained within Dr. Urjit Patel’s misguided plea to the Federal Reserve this past Sunday he referenced not just EM currencies undergoing severe (my word) turmoil (his word), but also EM bonds. It’s as if the eurodollar world has had second thoughts about especially the EM corporate sector, upon which the Eurobond market had in 2016 played out as an ad hoc, partial bypass of sorts for the eurodollar market as a dysfunctional whole following the “rising dollar” episode. The bet in Eurobonds in 2016 “reflation” was really the same (risks) as the one for corporate junk and leveraged loans in 2014, only at a better starting price. |

Deutsche Bank(see more posts on Deutsche Bank, ) |

| Maybe even some (or one) of them have been forced into these regrets by its “retreat from a strategy of trying to build a global investment bank” once predicated on little more than the say so of Economists who don’t model money conditions in their forecasts.

This comes on the heels of the bank’s own plans to exit the US junk business (closing DB’s Houston office) and recent reports of planned asset sales related and unrelated to it. While these are being portrayed as the typical winding down of unprofitable business lines, the swirl of rumors regarding a combination with Commerzbank, or anyone else, might propose a bit more urgency underlying everything. We shall see. Good thing DB’s problems were nothing more than the DOJ fine and not some continuing systemic issue plaguing one important player within an offshore, largely foreign credit-based dollar system. |

Deutsche Bank Total Assets Stock Price(see more posts on Deutsche Bank, ) |

Tags: balance sheet capacity,credit-based money,currencies,dark leverage,Derivatives,Deutsche Bank,economy,Emerging Markets,Featured,Federal Reserve/Monetary Policy,fic,ficc,junk bonds,leveraged loans,Markets,modern money,money dealing,newsletter,rwa