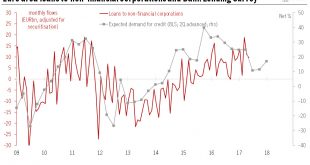

The latest Bank Lending Survey from the ECB showed that credit standards for loans to enterprises eased slightly in net terms in Q2. Our GDP growth forecast for the euro area remains unchanged. The July Bank Lending Survey (BLS), released by the ECB today, showed that bank credit standards for loans to enterprises eased slightly in Q2 2017, following a net easing in the previous quarter. This came despite expectations in the previous survey round that these standards would tighten...

Read More »Latest PMI numbers tilt growth forecast upwards

Strong Flash PMI surveys for April indicate that output growth is accelerating in the euro area.Euro area PMI surveys surprised to the upside in April. The composite flash PMI surged to 56.7 in April from 56.4 in March, above consensus expectations (56.4). Overall, April’s composite PMI is consistent with euro area GDP growth of 0.7% quarter over quarter (q-o-q) in Q2, up from 0.6% in Q1 and higher than our forecasts. Other national surveys and hard data have been more mixed, suggesting that...

Read More »PMI survey signals sustained euro area expansion in Q1

Although business surveys outpaced expectations and there are signs of rising price pressures, we continue to believe the ECB will not shift its monetary stance in the near term.The euro area composite flash PMI surged to 56.0 in February, the highest reading since April 2011. The main boost came from a surge in the services index due to strong data in Germany and France.The euro area average composite PMI is now consistent with a GDP growth rate of about 0.6% q-o-q in Q1, above our...

Read More »Euro area growth slowed as expected in Q2

Growth in the euro area fell to 0.3% in the second quarter from 0.6% in the first. Nevertheless, leading indicators point to post-Brexit resilience and we are leaving our full-year forecast unchanged Euro area real GDP expanded by 0.3% quarter-on-quarter (q-o-q) in the second quarter (1.2% q-o-q annualised, 1.6% year-on-year), in line with expectations and our forecast. This compares with GDP growth of 0.6% q-o-q in the first quarter.According to preliminary estimates by country, growth in...

Read More »Some ingredients still missing in euro area recovery

We remain relatively upbeat about euro area growth, but the pressures on banks are a concern, and decisive pro-investment moves remain in abeyance Leaving aside the possible disruptions surrounding the Brexit referendum and other near-term political events, a number of fundamental factors — most notably strengthening domestic demand — mean we are cautiously optimistic about the euro area economy over the short term, with an above-consensus GDP growth forecast for this year of...

Read More »Purchasing Manager Indices signal modest downside risks to near-term euro growth

Flash estimates for euro area composite PMI eased slightly in May, pointing to a slowdown in economic growth after a strong first quarter Read full report here Following a strong performance in Q1, when real GDP expanded by 0.5% q-o-q (2.1% in annualised terms), the euro area economy was expected to slow down a gear to more sustainable levels of growth. The flash purchasing manager indices (PMI) released on May 23 may signal just that, although mixed news at the national level—with...

Read More »Domestic demand fuels strong Q1 euro area growth

The Q1 figure confirms our expectations of 1.8% growth this year, despite some clouds on the horizon Read the full report here Euro area GDP rose by 0.6% quarter on quarter (q-o-q) in Q1, in line with our above-consensus forecast. Evidence from high-frequency data suggests that domestic demand was the main engine of growth once again, supported by a strong rebound in both household consumption and corporate investment spending. We believe that momentum from this source still has legs:...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org