We remain relatively upbeat about euro area growth, but the pressures on banks are a concern, and decisive pro-investment moves remain in abeyance Leaving aside the possible disruptions surrounding the Brexit referendum and other near-term political events, a number of fundamental factors — most notably strengthening domestic demand — mean we are cautiously optimistic about the euro area economy over the short term, with an above-consensus GDP growth forecast for this year of 1.8%.Quarter-on-quarter annualised growth in the euro area came in at more than 2% in the first quarter, better than in the final quarter of 2015. This growth was due exclusively to domestic demand, particular consumer spending, whereas net trade was a drag. Consumer spending in the currency union has been boosted by improving employment and the fall in oil prices. According to Eurostat, unemployment in the 19-country euro area dropped from 11.0% in April 2015 to 10.2% a year later. While the oil price dividend is dropping out of the equation, and while wage growth remains flaccid (+1.5% excluding benefits in Q4 2015), there are some indications that, at least in some countries like Germany, wage growth is beginning to respond to tight labour markets, helping to sustain consumer spending.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: euro area, euro area domestic demand, euro area GDP, euro area growth, euro area investment spending, euro area recovery, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We remain relatively upbeat about euro area growth, but the pressures on banks are a concern, and decisive pro-investment moves remain in abeyance

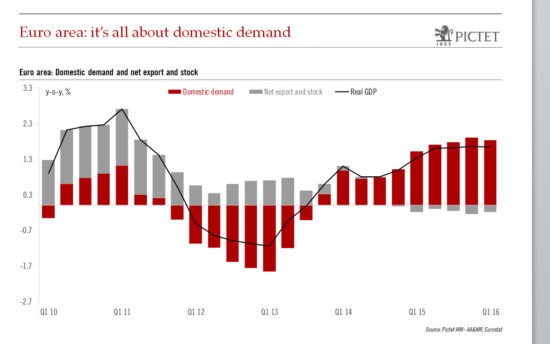

Leaving aside the possible disruptions surrounding the Brexit referendum and other near-term political events, a number of fundamental factors — most notably strengthening domestic demand — mean we are cautiously optimistic about the euro area economy over the short term, with an above-consensus GDP growth forecast for this year of 1.8%.

Quarter-on-quarter annualised growth in the euro area came in at more than 2% in the first quarter, better than in the final quarter of 2015. This growth was due exclusively to domestic demand, particular consumer spending, whereas net trade was a drag. Consumer spending in the currency union has been boosted by improving employment and the fall in oil prices. According to Eurostat, unemployment in the 19-country euro area dropped from 11.0% in April 2015 to 10.2% a year later. While the oil price dividend is dropping out of the equation, and while wage growth remains flaccid (+1.5% excluding benefits in Q4 2015), there are some indications that, at least in some countries like Germany, wage growth is beginning to respond to tight labour markets, helping to sustain consumer spending. Further good news for domestic demand comes from analysis of changes in the primary balance, which shows that the euro area as a whole has moved away from austerity to a mild form of fiscal stimulus.

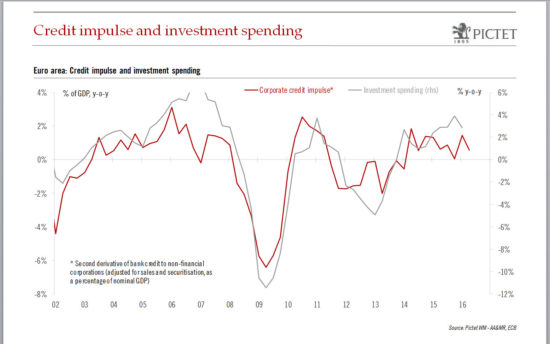

Investment spending remains the missing link in the current European recovery. Gross fixed capital formation has picked up modestly since 2013, but is still significantly below its pre-crisis level. The growth in gross fixed capital formation in the euro area slipped in Q1 2016 to 0.8%, down from 1.4% in Q4 2015, but this is still a strong figure in historical terms. Further analysis shows that equipment spending is actually expanding at a healthy clip, with the weak investment spending figure due entirely to lacklustre construction spending across the euro area’s main economies. But a look at business spending also paints a positive picture, with the most recent surveys show increasing numbers of European businesses’ expecting to increase their investment spending in the year ahead.

Where’s the credit impulse?

Our relatively optimistic forecast for the euro area economy this year is nuanced by our analysis of credit conditions. While investment spending has been expanding (however fitfully), the ‘credit impulse’ (defined as the change in new credit as a % of GDP) showed a lack of traction in April — and this in spite of the best efforts of the European Central Bank (ECB) to boost credit growth. But data from earlier this year showed the credit impulse was quite strong, and ECB actions have undoubtedly gone a long way to improving credit conditions, with access to credit becoming markedly easier for small companies across the fragile periphery of the euro area over the past three years. One must hope that this improvement will help the ‘credit impulse’ to pick up again in the months ahead.

The growth in debt securities as an alternative to bank loans has been a welcome diversification of corporate funding in the euro area—but here again, our analysis suggests that most of the new funds being raised through issuing debt securities is being used to roll over existing loans while new projects funded by this source have stalled. In short, bank disintermediation still has a long way to go in Europe.

Will the series of innovative measures introduced by the ECB to boost growth and inflation be enough? True, the stock of debt in the euro area remains high (government debt to GDP alone came to 90.7% in 2015, while private-sector debt is well over 100% in most countries). But there has been a marked improvement in flows, stemming from falling borrowing costs combined with strengthening income growth. The progressive deleveraging this improvement holds out the hope that the asset quality of banks will also improve.

But this process is proving slow, and in the meantime banks (and savers) are being penalised by the negative deposit interest rates introduced by the ECB earlier this year. The attractive conditions attached to the bank’s latest targeted longer-term refinancing operations (TLTRO II) has sugar-coated the pill for banks, and the hope must be that the pressure on bank margins will be compensated for the increase in loan volumes and in loan quality that the ECB is trying to engineer. But the pressure on the banking system poses question marks over this essential transmission mechanism for ECB policies.

More generally, while ECB activism is generally to be applauded (the latest instance being the launch of its corporate bonds purchase programme, the CSPP), one might argue that decisive pro-investment policies are still missing, notably on the budgetary side. As a result, while the economy is currently in the middle of a cyclical upswing, the conditions are still not in place for a significant increase in the euro area’s growth potential.