The latest Bank Lending Survey from the ECB showed that credit standards for loans to enterprises eased slightly in net terms in Q2. Our GDP growth forecast for the euro area remains unchanged. The July Bank Lending Survey (BLS), released by the ECB today, showed that bank credit standards for loans to enterprises eased slightly in Q2 2017, following a net easing in the previous quarter. This came despite expectations in the previous survey round that these standards would tighten slightly.Competitive pressure remained the main factor explaining the loosening. Looking ahead, banks expect a net easing of credit standards in Q3 for loans to enterprises and loans to households.Demand for credit continued to rise, albeit at a slower pace than in the previous quarter for households.The BLS is

Topics:

Nadia Gharbi considers the following as important: Euro area bank lending survey, euro area credit, euro area GDP, euro area growth, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The latest Bank Lending Survey from the ECB showed that credit standards for loans to enterprises eased slightly in net terms in Q2. Our GDP growth forecast for the euro area remains unchanged.

The July Bank Lending Survey (BLS), released by the ECB today, showed that bank credit standards for loans to enterprises eased slightly in Q2 2017, following a net easing in the previous quarter. This came despite expectations in the previous survey round that these standards would tighten slightly.

Competitive pressure remained the main factor explaining the loosening. Looking ahead, banks expect a net easing of credit standards in Q3 for loans to enterprises and loans to households.

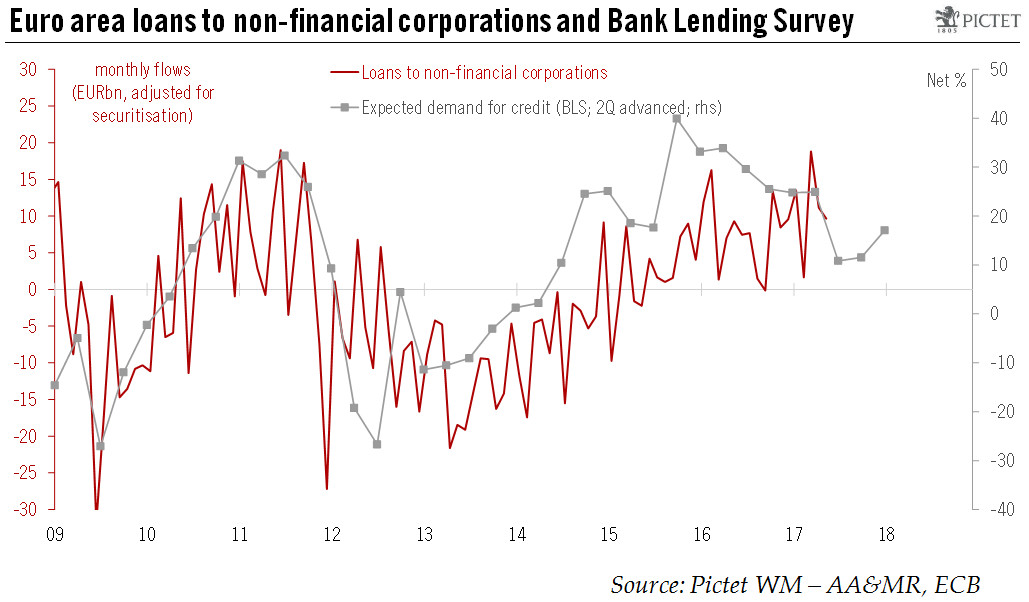

Demand for credit continued to rise, albeit at a slower pace than in the previous quarter for households.

The BLS is still consistent with a rebound in bank credit flows in the next few months and quarters. However, increased use of alternative sources of finance by corporates, as well as elevated corporate cash balances, are likely to remain drags on demand for bank loans.

All in all, financing conditions in the euro area remain favourable, which bodes well for domestic demand. We are keeping unchanged our GDP growth forecast of 1.9% in the euro area for 2017 as a whole.