Weakness in the sector signals continuing downward trend. The euro area economy started the fourth quarter on a weak note; the flash composite PMI dipped to 52.7 in October from 54.1 in September. Both manufacturing and services showed a notable loss of momentum. A common feature in France and Germany was the weakness in manufacturing, where both countries posted similar declines. Part of the drop may reflect issues in...

Read More »Gloomy signals for euro area manufacturing

Weakness in the sector signals continuing downward trend.The euro area economy started the fourth quarter on a weak note; the flash composite PMI dipped to 52.7 in October from 54.1 in September. Both manufacturing and services showed a notable loss of momentum. A common feature in France and Germany was the weakness in manufacturing, where both countries posted similar declines. Part of the drop may reflect issues in the car industry, but trade tensions, uncertainty over Brexit and...

Read More »Contrasting Fortunes within the Euro Area

While the recent economic ‘soft patch’ has hurt all the main euro area economies, some have been more affected more than others. A divergence in fortunes can be seen across asset classes. The four biggest euro area economies slowed in H1 2018 due to a number of factors, including weak exports. We expect a rebound in H2—except in Italy, where political uncertainty has been denting business confidence. Forward indicators...

Read More »Contrasting fortunes within the euro area

While the recent economic ‘soft patch’ has hurt all the main euro area economies, some have been more affected more than others. A divergence in fortunes can be seen across asset classes.The four biggest euro area economies slowed in H1 2018 due to a number of factors, including weak exports. We expect a rebound in H2—except in Italy, where political uncertainty has been denting business confidence. Forward indicators show that Italy is the only of the four major euro area economies to face...

Read More »PMIs point to downside risk to near term euro area growth

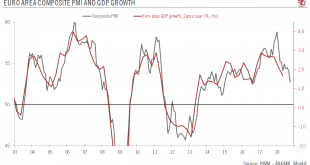

Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the situation prevailing a few months ago. The deterioration...

Read More »PMIs point to downside risk to near term euro area growth

Following another disappointing set of business sentiment indicators, speculation over a longer extension of QE is rising.Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the...

Read More »Euro area: The sky is the limit

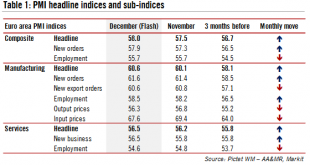

Momentum in the euro area picked up further at the end of the year. The flash composite purchasing managers’ index (PMI) increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2). The improvement was once again broad-based across sectors. Both the manufacturing (+0.5 to 60.6) and services (+0.3 to 56.5) indices improved in December, with the former reaching its highest level since the...

Read More »Euro area: The sky is the limit

The latest flash purchasing managers index surveys showed robust momentum for the euro area. We maintain our GDP growth forecast of 2.3% for 2017.Flash purchasing managers’ indices (PMIs) for the euro area ended the year on a strong note. The composite PMI increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2).The robust momentum was led by a booming manufacturing sector, while services sentiment also improved.The breakdown by sub-indices was pretty strong,...

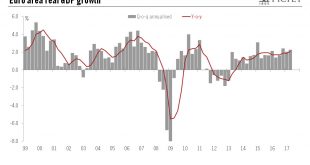

Read More »In spite of broadening growth, ECB will remain prudent

A growth spurt may push us to raise our euro area GDP forecast for this year and next, although we expect some slowdown in the pace of expansion and the ECB to continue to act cautiously.While the latest euro area GDP numbers were broadly in line with expectations, at 0.6% quarter-on-quarter in Q2, net revisions to past data pushed the GDP profile higher again.Once detailed estimates are published by Eurostat—and assuming there are no significant revisions to past data—we might revise our...

Read More »Euro area : Momentum slows at the start of Q3

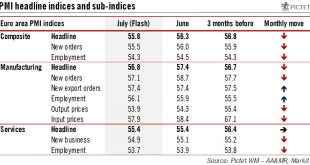

PMI surveys for the euro area eased somewhat in July, suggesting that momentum slowed at the start of Q3. We maintain our GDP growth forecast of 1.9% for 2017.The composite flash PMI fell to 55.8 in July from 56.4 in May, below consensus expectations (56.2). The headline dip was entirely driven by the manufacturing index, which fell to 56.8 in July from 57.4 in June. By contrast, the services index remained stable at 55.4. The PMI’s forward-looking components remained pretty strong, despite...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org