Strong Flash PMI surveys for April indicate that output growth is accelerating in the euro area.Euro area PMI surveys surprised to the upside in April. The composite flash PMI surged to 56.7 in April from 56.4 in March, above consensus expectations (56.4). Overall, April’s composite PMI is consistent with euro area GDP growth of 0.7% quarter over quarter (q-o-q) in Q2, up from 0.6% in Q1 and higher than our forecasts. Other national surveys and hard data have been more mixed, suggesting that PMI surveys might be overstating the pace of growth to some extent. However, all in all, risks to our 2017 euro area GDP growth forecast of 1.5% are tilted to the upside.The rise in PMI data was broadly based across sectors. Manufacturing PMI rose to 56.8 from 56.2 in March, while the PMI for the services sector increased marginally to 56.2, from 56.0. The breakdown by sub-indices was rather encouraging with most forward-looking components pointing up. Job creation continued its upward trend, boosted by buoyant demand and widespread optimism regarding future activity.At a country level, German composite PMI for April fell from 57.1 in March to 56.3 in April. The decline was mainly driven by the services sector, while manufacturing PMI remained broadly stable. But German PMI is above its Q1 average, which suggests that economic activity in Germany remains pretty strong in Q2.

Topics:

Nadia Gharbi considers the following as important: euro area growth, euro composite PMI, Euro growth forecast, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Strong Flash PMI surveys for April indicate that output growth is accelerating in the euro area.

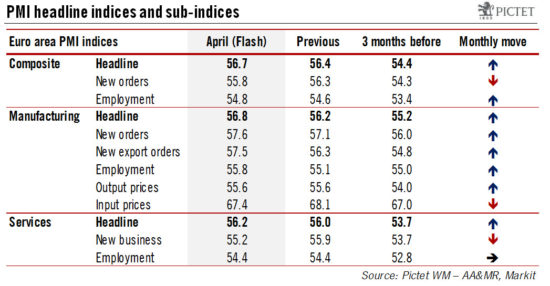

Euro area PMI surveys surprised to the upside in April. The composite flash PMI surged to 56.7 in April from 56.4 in March, above consensus expectations (56.4). Overall, April’s composite PMI is consistent with euro area GDP growth of 0.7% quarter over quarter (q-o-q) in Q2, up from 0.6% in Q1 and higher than our forecasts. Other national surveys and hard data have been more mixed, suggesting that PMI surveys might be overstating the pace of growth to some extent. However, all in all, risks to our 2017 euro area GDP growth forecast of 1.5% are tilted to the upside.

The rise in PMI data was broadly based across sectors. Manufacturing PMI rose to 56.8 from 56.2 in March, while the PMI for the services sector increased marginally to 56.2, from 56.0. The breakdown by sub-indices was rather encouraging with most forward-looking components pointing up. Job creation continued its upward trend, boosted by buoyant demand and widespread optimism regarding future activity.

At a country level, German composite PMI for April fell from 57.1 in March to 56.3 in April. The decline was mainly driven by the services sector, while manufacturing PMI remained broadly stable. But German PMI is above its Q1 average, which suggests that economic activity in Germany remains pretty strong in Q2.

Meanwhile, French PMI improved further (+0.6 point to 57.4), reaching its highest level since May 2011. April’s French PMI numbers suggest that the French private sector remains resilient in spite of the uncertainty surrounding the presidential elections. The index was above its German equivalent for the first time since August 2012. The bulk of the improvement was driven by the manufacturing sector. Elsewhere in Europe, Markit mentioned that growth of output accelerated to the strongest level since July 2007.