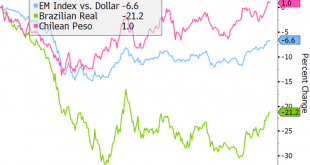

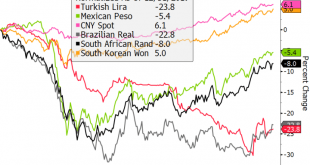

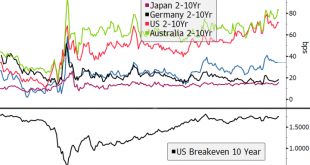

US fiscal negotiations are taking longer than expected; US Treasury auctions $56 bln of 3-year notes; we believe the Fed is watching the yield curve closely; Brazil reports November IPCA inflation; Chile kept rates on hold at 0.50% and tweaked its asset purchase program UK Prime Minister Johnson is going to Brussels for high-level Brexit negotiations with EC President von der Leyen; there are no signs of progress in the EU budget and recovery fund negotiations;...

Read More »Dollar Stabilizes but Weakness to Resume

There are new efforts to pass another round of stimulus sooner rather than later; we warn against getting too optimistic; US bond yields rose in anticipation of stimulus; Fed Chair Powell and Treasury Secretary Mnuchin gave somewhat conflicting outlooks for the US The Fed releases its Beige Book report for the December FOMC meeting; ADP releases its private sector jobs estimate, with consensus at 430k; Brazil outperformed yesterday on positive fiscal comments from...

Read More »Dollar Plumbs New Depths With No Relief In Sight

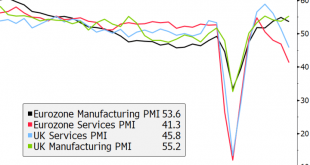

Stimulus talks continue but the goalposts have indeed been moved; the good news is that a package before year-end is looking more likely; optimism regarding stimulus continues to buoy US yields ISM services PMI is expected at 55.8 vs. 56.6 in October; weekly jobless claims data will be reported; Fed Beige Book report was suitably downbeat The noise level around Brexit continues to rise are we approach the finish line; eurozone and UK data came in firmer than...

Read More »Dollar Consolidates Ahead of Thanksgiving Holiday

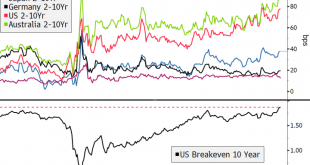

The divergence in developed markets yield curves continues; the dollar is consolidating ahead of the US holiday FOMC minutes will be released; weekly jobless claims data will be released a day early; October personal income and spending will be reported; Banco de Mexico releases its quarterly inflation report UK Chancellor Sunak’s spending review will lay out his plans for next year; South Africa reported higher than expected October CPI Japan’s Cabinet Office...

Read More »Dollar Weakness Resumes as Short-Covering Fades

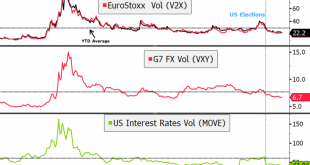

Sentiment is being buoyed by two incrementally positive stories; cross-markets implied volatility measures continue to trend lower; dollar weakness has resumed President-elect Biden will reportedly officially name his first cabinet picks today; Fed manufacturing surveys for November will continue to roll out; Brazil and Mexico both reports mid-November inflation readings German IFO Business Climate survey for November was mixed; UK national lockdown will end next...

Read More »Dollar Weakness Resumes as Markets Start Another Week in Risk-On Mode

Covid vaccine results from AstraZeneca and Oxford University brought another wave of optimism; dollar weakness has resumed; that said, we will refrain from making any longer-term calls for the demise of the dollar Reports suggest President-elect Biden is pushing House Democrats to reduce the size of their fiscal package demands to unlock negotiations; Republicans have an interest in compromising President-elect Biden has reportedly picked his diplomatic team; it’s a...

Read More »Dollar Bounce Likely to Fade

The negative virus news stream is taking a toll on market sentiment; the dollar is benefiting from the risk-off price action but is likely to fade Weekly jobless claims data will be of interest; Fed manufacturing surveys for November will continue to roll out; Judy Shelton’s Fed confirmation is looking less and less likely The row about EU funding takes center stage today as leaders hold a conference call to iron out their differences; UK CBI November industrial...

Read More »Dollar Weakness Continues Ahead of US Retail Sales Data

The dollar continues to soften October retail sales will be the US data highlight; Fed manufacturing surveys for November have started to roll out; Republican Senator Alexander opposes Judy Shelton’s nomination to the Fed Newswires reported (again) that a Brexit deal is at hand; Hungary and Poland will veto the EU budget and recovery fund; ECB signaled that they are focused on asset purchases and long-term funding for the next round of stimulus; Hungary is expected...

Read More »Dollar Soft as Markets Start the Week in Risk-On Mode

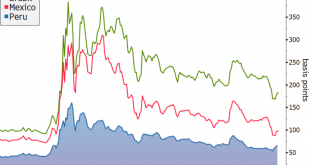

The odds of national-level action in the US against the second wave virus outbreak remains small, even after Biden takes over; the dollar continues to soften There is growing speculation about former Fed Chair Yellen becoming Biden’s Treasury Secretary; Fed manufacturing surveys for November will start to roll out; Peru’s interim President Merino resigned under pressure from more demonstrations Several UK MPs and Prime Minister Johnson were forced to isolate due to a...

Read More »Dollar Softens Ahead of CPI Data

Pressure on the dollar has resumed; October CPI data will be the US highlight; US bond market was closed yesterday but yields have eased a bit today Weekly jobless claims data will be reported; monthly budget statement for October will hold some interest; Mexico is expected to cut rates 25 bp to 4.0%; Peru is expected to keep rates steady at 0.25% UK Q3 GDP rebounded strongly but September data show a loss of momentum; Brexit talks remain unresolved; the domestic...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org