Investec Switzerland. Just a month ago, Credit Suisse CEO Tidjane Thiam and Deutsche Bank CEO John Cryan risked, as one hedge fund manager put it, becoming the dead men walking of European banking as they struggled to shore up their firms’ profitability. © Simon Zenger | Dreamstime.com Thursday’s results from Credit Suisse suggest Thiam may escape that fate while Cryan’s effort to revamp the German lender stalls. After a first-quarter loss, the Swiss bank posted a...

Read More »Credit Suisse’s turnaround is working, but vulnerable

Just a month ago, Credit Suisse CEO Tidjane Thiam and Deutsche Bank CEO John Cryan risked, as one hedge fund manager put it, becoming the dead men walking of European banking as they struggled to shore up their firms’ profitability. © Simon Zenger | Dreamstime.com Thursday’s results from Credit Suisse suggest Thiam may escape that fate while Cryan’s effort to revamp the German lender stalls. After a first-quarter...

Read More »Schwarze Zahlen bei der CS: Asset Management mit 3,5 Mrd. Nettozufluss

Die Credit Suisse ist wieder in der Gewinnzone. Im Vergleich mit dem Vorjahr verbuchte man allerdings einen Gewinneinbruch von 84 Prozent. Sind das die ersten Erfolge der angestrebten Restrukturierung der Grossbank? Auf jedenfall überascht die Credit Suisse zur Jahresmitte mit einem Quartalsgewinn von CHF 170 Millionen. Analysten hatten mit einem erneuten Verlust gerechnet, und...

Read More »Return is “not really a function of yield”

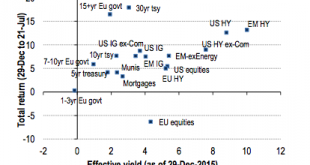

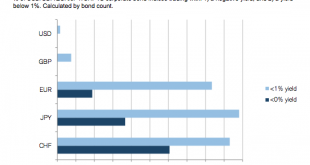

When x happens, yields fall — Rule 1? It’s not a search for yield, it’s a search for safety — Potential Rule 2? Two charts to make the point for us once again from the good folks at BofAML’s relative value department: Click to enlarge. You could also pop in here and have a look at Credit Suisse’s roughly similar argument (and the state of the negatively rate inspired corporate bond market). CS’s point has to do with...

Read More »It’s a negative yielding world, we just get to scramble in it

Here’s a rough piece of calculation based on the last few years of news: When x happens, yields fall. An example of this post-GFC rule-of-thumb was Brexit and its fallout. The potential lesson from said rule is that yield hunting isn’t fun anymore, say Credit Suisse’s William Porter and team, with our emphasis: Negative (or very low) 10-year Bund yields have not been a boon for European credit markets, based on our...

Read More »Credit Suisse setzt auf Robotik-Fonds

Das Credit Suisse Asset Management lanciert den Credit Suisse (Lux) Global Robotics Equity Fund. Der Fonds bietet Anlegern die Möglichkeit, vom langfristigen Wachstumstrend für Robotik und Automatisierung zu profitieren. Wir befinden uns mitten in der vierten industriellen Revolution, die von Automatisierung und künstlicher Intelligenz geprägt ist. Mit der Lancierung des Credit...

Read More »The Brexit Effect: What’s Next for Markets

To say that the Brexit vote on June 23 took financial markets by surprise would be an understatement. The pound, British stocks, and Gilt yields had all risen sharply in the week leading up to the vote, only to crash once the results started coming in. Broadly speaking, strategists on Credit Suisse’s Global Markets and Investment Solutions and Products (IS&P) teams expect markets to remain volatile in the coming days and for investors to prefer safe assets to risky ones. Below, we...

Read More »To IPO or Not to IPO: That Is the Question

Investing in companies such as Facebook before they went public has proven very lucrative for many well-connected investors – and Facebook’s decision to stay private for eight years before going public certainly worked out well for the social media giant. Bill Gurley, a general partner at venture capital firm Benchmark Capital, believes that early success stories such as Facebook and many other high-flying technology companies have made it fashionable for CEOs to resist public offerings....

Read More »What Being Wrong Can Teach Us About Being Right

No one is right all the time, but one can learn to be wrong less often. Watch Michael Mauboussin, Credit Suisse’s Head of Global Financial Strategies, explain how overcoming naïve realism and questioning the status quo can help leaders of all kinds make better choices. He discussed the above and more at the 2016 Thought Leader Forum.

Read More »Einheitlicher Standard zur Fondsdatenübermittlung

Nach zweijähriger Zusammenarbeit haben sich zwei Dutzend Finanzinstitute, angeführt von UBS, Credit Suisse und Julius Bär mit fundinfo auf die Veröffentlichung des openfunds-Standards auf www.openfunds.org geeinigt. Mit dem openfunds-Standard profitieren alle Stakeholder, da Fondsstammdaten effizienter, schneller und genauer übertragen werden. Die Non-Profit-Initiative definiert...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org